United Kingdom Popcorn Market Size, Share, and COVID-19 Impact Analysis, By Type (Ready-to-Eat Popcorn and Microwave Popcorn), By Distribution Channel (B2B and B2C), and United Kingdom Popcorn Market Insights, Industry Trend, Forecasts to 2035.

Industry: Food & BeveragesUnited Kingdom Popcorn Market Insights Forecasts to 2035

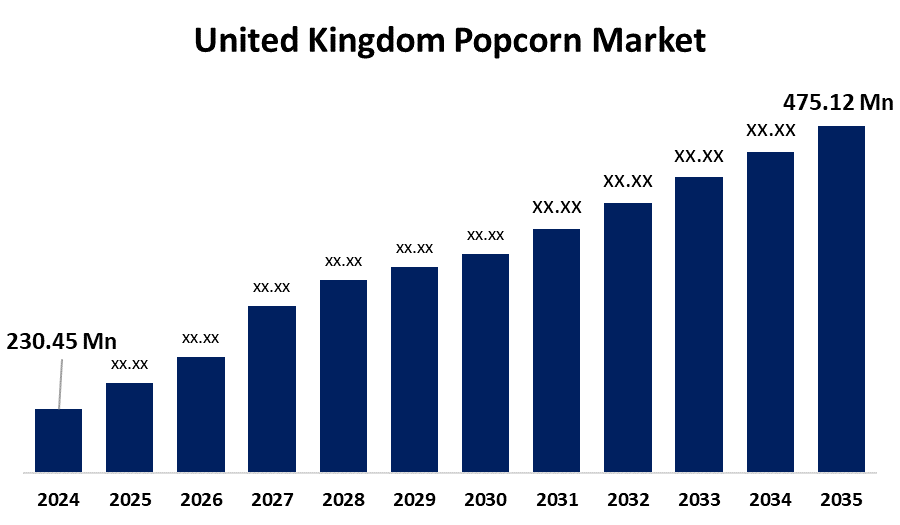

- The United Kingdom Popcorn Market Size was estimated at USD 230.45 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.80% from 2025 to 2035

- The United Kingdom Popcorn Market Size is Expected to Reach USD 475.12 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Popcorn Market Size is anticipated to reach USD 475.12 Million by 2035, growing at a CAGR of 6.80% from 2025 to 2035. The increasing demand from consumers for quick and healthier snack options, particularly from younger and health-conscious groups, is boosting the popcorn business in the UK.

Market Overview

The distribution and consumption of popcorn by microwaveable and ready-to-eat kinds are all encompassed in the popcorn market. Popcorn is a food derived from corn kernels or maize. It's made by cooking corn kernels in a saucepan, stove, kettle, or microwave with butter or vegetable oil. Both ready-to-eat (RTE) and microwave popcorn are popular snack foods worldwide due to their excellent nutritional value. Popcorn is becoming more popular among consumers since it's a healthy snack that's low in calories, gluten, and fiber, especially for those who enjoy working out. The most popular snacks at home, at movie theaters, sporting events, fairs, and other public locations are microwave popcorn and RTE popcorn. Popcorns are rich and concentrated sources of fiber, polyphenolic compounds, vitamin B complex, antioxidants, and various proteins. Increase in health consciousness among consumers, coupled with the health benefits of eating popcorn, is contributing to the growth of the popcorn market. A significant rise in theatres and multiplexes in developed countries has led to the growth of the popcorn market. Moreover, the increasing number of microwaves has raised the demand for microwavable popcorn, further driving the popcorn market growth.

Report Coverage

This research report categorizes the market for the United Kingdom popcorn market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom popcorn market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom popcorn market.

United Kingdom Popcorn Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 230.45 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.80% |

| 2035 Value Projection: | USD 475.12 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 215 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type (Ready-to-Eat Popcorn and Microwave Popcorn), By Distribution Channel (B2B and B2C) |

| Companies covered:: | Propercorn, Popcorn Shed, Jimmy Products UK, Popcorn Factory NI, Joe & Seph’s Gourmet Popcorn, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom popcorn is driven by more concern with sustainable development and personal health than it is with food purchases. The market for quick, healthful, and sustainably produced meals is expanding, and plant-based proteins are becoming more and more popular. Additionally, the industry is expanding due to consumer demand for popcorn in a variety of flavors. The popcorn market has grown significantly, mostly as a result of consumers' increasing need for quick and healthful food options. A healthy substitute for conventional snacks like chips or sugary delights is popcorn, especially air-popped or mildly seasoned types. Additionally, a lot of European manufacturers are marketing popcorn as a whole-grain, gluten-free snack, which appeals to those who are on particular diets or lifestyles, and the UK is centered on all kinds of sectors, revenue boosted the market expansion.

Restraining Factors

The popcorn market share is severely restricted by fierce competition from cutting-edge snack substitutes, including gourmet chips, spiced almonds, and high-protein bars, which frequently better suit changing consumer tastes for strong flavors and extra nutritional value.

Market Segmentation

The United Kingdom popcorn market share is classified into type and distribution channel.

- The ready-to-eat popcorn segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom popcorn market is segmented by type into ready-to-eat popcorn and microwave popcorn. Among these, the ready-to-eat popcorn segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. A growing number of brands are providing low-calorie, organic, and gluten-free choices, which is driving the market. Furthermore, the development of gourmet and inventive flavors has increased its appeal to a wider range of age groups.

- The B2C segment held the highest share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom popcorn market is segmented by distribution channel into B2B and B2C. Among these, the B2C segment held the highest share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is because of The growing availability of popcorn products at retail establishments such supermarkets, hypermarkets, convenience stores, and e-commerce platforms is what is driving this industry. The B2C channel has been further reinforced by the growing popularity of ready-to-eat choices and the growing trend of at-home snacking, particularly among younger groups.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom popcorn market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Propercorn

- Popcorn Shed

- Jimmy Products UK

- Popcorn Factory NI

- Joe & Seph’s Gourmet Popcorn

- Others

Recent Developments:

- In February 2025, Popcorn Shed launched its Easter range for 2025, featuring new gourmet flavors alongside seasonal favorites. The collection included the returning Popcorn Easter Egg and Chocolate Trio Gourmet Popcorn, plus two new additions: Carrot Cake and Cinnamon Roll.

- In January 2025, Butterkist, the UK’s leading popcorn brand, teamed up with Universal Pictures’ Wicked in its biggest entertainment partnership yet. Butterkist launched a limited edition 180g Sweet popcorn sharing pack featuring Wicked-themed designs. This partnership aimed to strengthen the connection between popcorn and movies, driving engagement and excitement among consumers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom popcorn market based on the below-mentioned segments:

United Kingdom Popcorn Market, By Type

- Ready-to-Eat Popcorn

- Microwave Popcorn

United Kingdom Popcorn Market, By Distribution Channel

- B2B

- B2C

Need help to buy this report?