United Kingdom Polyphthalamide Market Size, Share, and COVID-19 Impact Analysis, By Product (Unfilled, Mineral Filled, Glass Fiber Filled, and Carbon Fiber Filled), By Application (Automotive, Electronics & Electrical, Industrial Equipment & Apparatus, Consumer & Personal Care, and Others), and UK Polyphthalamide Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Kingdom Polyphthalamide Market Forecasts to 2035

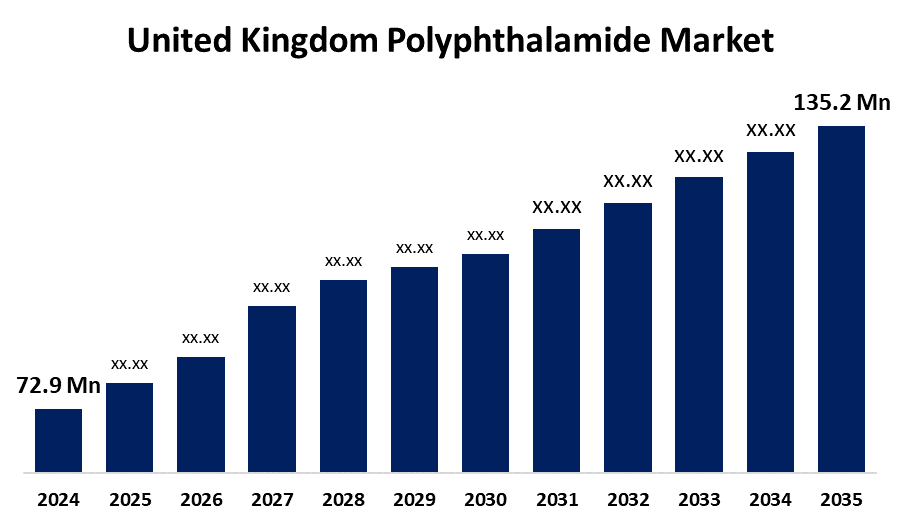

- The United Kingdom Polyphthalamide Market Size Was Estimated at USD 72.9 Million in 2024

- The UK Polyphthalamide Market Size is Expected to Grow at a CAGR of around 5.78% from 2025 to 2035

- The UK Polyphthalamide Market Size is Expected to Reach USD 135.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The UK Polyphthalamide Market Size is anticipated to reach USD 135.2 Million by 2035, growing at a CAGR of 5.78% from 2025 to 2035. The market is expanding significantly due to increased demand from the automotive sector, which values polyphthalamide (PPA) for its exceptional mechanical strength, chemical resistance, and thermal stability.

Market Overview

The UK polyphthalamide market refers to a heat-resistant, semi-crystalline polyamide that exhibits exceptional strength, dimensional stability, and resistance to moisture at elevated temperatures. Because of its strength and resilience to chemicals, it is utilised in industrial and automotive components such as pumps, valves, and connectors. The market for polyphthalamide (PPA) is influenced by the expanding electrical and electronics industry since small consumer electronics need materials with strong heat resistance and dimensional stability. PPA is frequently found in circuit breakers, LED housings, and connections. The need for insulation and thermal management materials is further increased by the development of 5G and IoT. Due to its resilience in harsh environments and chemical resistance, PPA is appreciated in industrial and oil and gas applications in addition to electronics and automobiles. It is used in tubing, gaskets, and seals. The advancement in material science and the production of eco-friendly, bio-based PPA by companies such as Arkema and Syensqo also support market demand and growth. Reinforced, PPA grades add strength and meet the urgent requirement that is high-performance, eco-friendly materials.

PPA is utilized by leading automobile manufacturers such as Bentley and Jaguar Land Rover to reduce vehicle weight and help comply with environmental pollution regulations. In the same manner, PPA composites are being adopted by giants in the aerospace industry, including Rolls-Royce and BAE Systems, to make lightweight, highly efficient aircraft parts that can withstand difficult environments. The demand for strong, heat-resistant materials is driving PPA's growing role in developing high-efficiency and environmentally friendly transport solutions in the UK.

Report Coverage

This research report categorizes the market for the UK polyphthalamide market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom polyphthalamide market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom polyphthalamide market.

United Kingdom Polyphthalamide Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 72.9 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.78% |

| 2035 Value Projection: | USD 135.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 158 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | By Product and By Application |

| Companies covered:: | Solvay S.A., Ems-Chemie, Arkema, DuPont de Nemours Inc., BASF SE, Evonik Industries AG, Royal DSM and Akro-Plastic GmbH., and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing demand for high-performance polymers in the automotive, electronics, and industrial markets is driving the growth rate within the UK polyphthalamide (PPA) industry. PPA is an ideal alternative to metal in lightweight car components and plays a critical role in electric vehicle systems because of its superior mechanical strength, chemical inertness, and thermal stability. PPA provides superior insulation and heat resistance in electronics, as well as longer-lasting consumer and industrial products. The PPA formulations are also constantly evolving, which further increases the applications and expands markets.

Restraining Factors

PPA's high production costs limit its application in markets based on cost-consciousness in the UK. There are also issues of concern to manufacturers related to processing, such as high moulding temperatures and a general lack of appropriate technologies to process PPA. Manufacturers were also concerned about having limited options for recycling based on environmental concerns and regulations. These factors hamper the polyphthalamide market during the forecast period.

Market Segmentation

The United Kingdom polyphthalamide market share is classified into product and application.

- The unfilled segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom polyphthalamide market is segmented by product into unfilled, mineral-filled, glass fiber-filled, and carbon fiber-filled. Among these, the unfilled segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Unfilled polyphthalamide is PPA resin in its pure, unreinforced form. This type has outstanding chemical resistance, minimal moisture absorption resistance, and high thermal resistance, all while having a lightweight construction. It is used in applications where precision and dimensional stability are important, like in electrical connectors, medical devices, and vehicles. Given its inherent mechanical properties, it is perfect for complicated pieces that need to work at high temperatures without requiring any additional reinforcement.

- The automotive segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom polyphthalamide market is segmented by application into automotive, electronics & electrical, industrial equipment & apparatus, consumer & personal care, and others. Among these, the automotive segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Polyphthalamide's strong mechanical strength, chemical resistance, and thermal performance make it an important material in the automotive market. Some of the many applications for PPA in automotive include under-the-hood applications such as electrical connectors, sensors, cooling systems, and fuel line connectors. The growing demand for PPA in automotive applications is primarily driven by the growing use of electric vehicles (EVs) and the greater use of lightweight materials for fuel economy.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom polyphthalamide market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Solvay S.A.

- Ems-Chemie

- Arkema

- DuPont de Nemours Inc.

- BASF SE

- Evonik Industries AG

- Royal DSM and Akro-Plastic GmbH.

- Others

Recent Developments:

- In February 2022, BASF launched its Ultramid One J PPA grade in Europe following the acquisition of Solvay’s polyamide business, expanding its PPA portfolio for electronics and under-the-hood automotive parts

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom polyphthalamide market based on the below-mentioned segments:

United Kingdom Polyphthalamide Market, By Product

- Unfilled

- Mineral Filled

- Glass Fiber Filled

- Carbon Fiber Filled

United Kingdom Polyphthalamide Market, By Application

- Automotive

- Electronics & Electrical

- Industrial Equipment & Apparatus

- Consumer & Personal Care

- Others

Need help to buy this report?