United Kingdom Polyolefin Market Size, Share, and COVID-19 Impact Analysis, By Product (Polyethylene (PE), Polypropylene (PP), Ethylene-Vinyl Acetate (EVA), Thermoplastic Polyolefins (TPO), Polyoxymethylene (POM), Polycarbonate (PC), Polymethyl Methacrylate (PMMA), and Others), By Application (Film & Sheet, Injection Molding, Blow Molding, Profile Extrusion, and Others), and UK Polyolefin Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Kingdom Polyolefin Market Forecasts to 2035

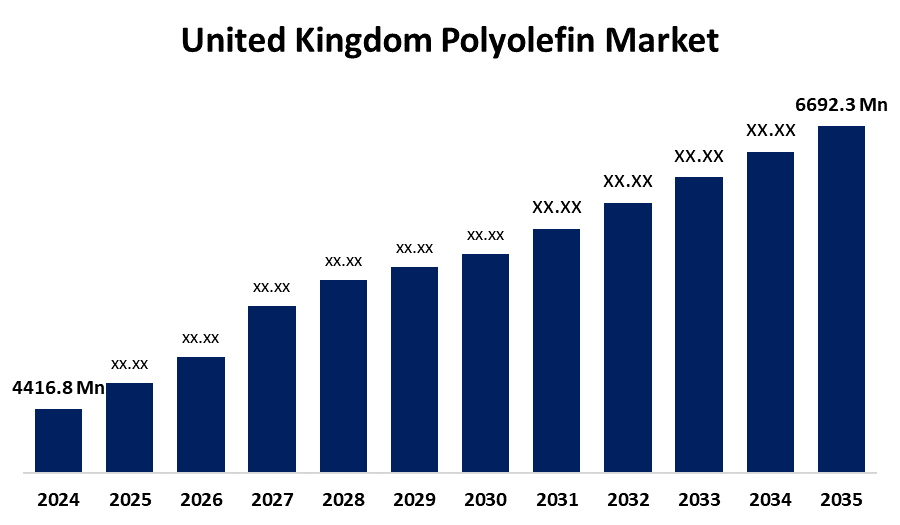

- The United Kingdom Polyolefin Market Size Was Estimated at USD 4416.8 Million in 2024

- The UK Polyolefin Market Size is Expected to Grow at a CAGR of around 3.85% from 2025 to 2035

- The UK Polyolefin Market Size is Expected to Reach USD 6692.3 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The UK Polyolefin Market Size is anticipated to reach USD 6692.3 Million by 2035, growing at a CAGR of 3.85% from 2025 to 2035. The UK polyolefin market includes escalating demand for lightweight, recyclable packaging materials, increased automotive applications in fuel-efficient and EV components, and sustainability/regulatory pulls for bio-based alternatives.

Market Overview

The UK polyolefin market typically refers to products produced from olefin monomers and includes familiar polymers like polyethylene (PE) and polypropylene (PP). Due to their strength, flexibility, and chemical resistance, polyolefin is used in textiles, car parts, and packaging. Demand is increasing in the textile, solar energy, and packaging industries, assisting in market growth. Polyolefins can be easily converted into yarns, knitted fabrics, and non-woven fabrics. Polyolefins are becoming more common in the automotive industry because of their lightweight attributes. This will reduce vehicle weight and consequently fuel consumption, particularly compared to traditional metals and rubber. This is a part of the steadily growing demand for fuel-efficient and environmentally conscious vehicles. Moreover, rising concerns about health and safety across sectors, including electronics, healthcare, construction, and automotive, are causing an upward trend in the demand for polyolefins. Polyolefins are well established to be used for under-the-hood automotive components; their application is expanding to the exterior and interior components. The growing demand for polyethylene, polypropylene, ethylene-vinyl acetate, and thermoplastics is also driven by increased usage of personal protective equipment (PPE) such as masks, gloves, and gowns, reflecting heightened public focus on hygiene and infection prevention. Furthermore, innovations in material science, including advanced catalyst systems, metallocene-based polyolefins, and bio-based alternatives, are enhancing performance, broadening applications, and supporting sustainability, thereby contributing to the ongoing growth of the UK polyolefin market.

Report Coverage

This research report categorizes the market for the UK polyolefin market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom polyolefin market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom polyolefin market.

United Kingdom Polyolefin Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4416.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.85% |

| 2035 Value Projection: | USD 6692.3 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 169 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product and By Application |

| Companies covered:: | INEOS, SABIC, LyondellBasell, ExxonMobil, Arkema, Axion Polymers Ltd, Elite Plastics, SJA Film Technologies Ltd, Fast Forward Recycling Ltd, Borealis AG, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The packaging segment is experiencing heightened demand for polyolefins due to their low cost, resistance to damage, and lightweight capabilities. Polyethylene and polypropylene are already meeting the growing specifications of e-commerce for strong, flexible packaging in items such as films, bags, and containers. As e-commerce growth continues, the need for sustainable and recyclable materials and the acceptance of flexible packaging drives the reaffirmation of polyolefins to support the growth of the UK marketplace. Their environmentally favorable and flexible characteristics make them ideal for new-age packaging alternatives.

Restraining Factors

There is growing awareness regarding the environmental challenges posed by polyolefins since they are derived from non-renewable resources and take a long time to degrade before they become pollution. In light of recent regulatory changes, the industry is encouraged to rethink its use of materials, including using biodegradable, bio-based, or recycled plastics. Utilizing materials with an emphasis on eco-friendliness provides long-term benefits for the environment and the polyolefin industry. These factors hamper the polyolefin market during the forecast period.

Market Segmentation

The United Kingdom polyolefin market share is classified into product and application.

- The polyethylene (PE) segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom polyolefin market is segmented by product into polyethylene (PE), polypropylene (PP), ethylene-vinyl acetate (EVA), thermoplastic polyolefins (TPO), polyoxymethylene (POM), polycarbonate (pc), polymethyl methacrylate (PMMA), and others. Among these, the polyethylene (PE) segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. It's growing use in prototype development for 3D printers and CNC machines. Moreover, the UK's polyethylene industry is enabled by growth in the construction and furniture industries, the presence of large automotive manufacturing industries, and a growing need for sophisticated infrastructure because of increased industrialisation.

- The film & sheet segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom polyolefin market is segmented by application into film & sheet, injection molding, blow molding, profile extrusion, and others. Among these, the film & sheet segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The applications for films and sheets are vast, including food and beverage, agricultural, cosmetics, and industrial packaging. The films and sheets come in a variety of gauges depending on the thickness. Films and sheets are often used for beverage bottles, food packaging, and cosmetic product packaging. Newer advancements in films and sheets include NIR blocking films, fluorescent films, and UV protection from the sun.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom polyolefin market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- INEOS

- SABIC

- LyondellBasell

- ExxonMobil

- Arkema

- Axion Polymers Ltd

- Elite Plastics

- SJA Film Technologies Ltd

- Fast Forward Recycling Ltd

- Borealis AG

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom polyolefin market based on the below-mentioned segments:

United Kingdom Polyolefin Market, By Product

- Polyethylene (PE)

- Polypropylene (PP)

- Ethylene-Vinyl Acetate (EVA)

- Thermoplastic Polyolefins (TPO)

- Polyoxymethylene (POM)

- Polycarbonate (PC)

- Polymethyl Methacrylate (PMMA)

- Others

United Kingdom Polyolefin Market, By Application

- Film & Sheet

- Injection Molding

- Blow Molding

- Profile Extrusion

- Others

Need help to buy this report?