United Kingdom Pet Food Market Size, Share, and COVID-19 Impact Analysis, By Product (Wet Pet Food, Dry Pet Food, and Snacks/ Treats), By Pet Type (Cats and Dogs), and United Kingdom Pet Food Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Pet Food Market Insights Forecasts to 2035

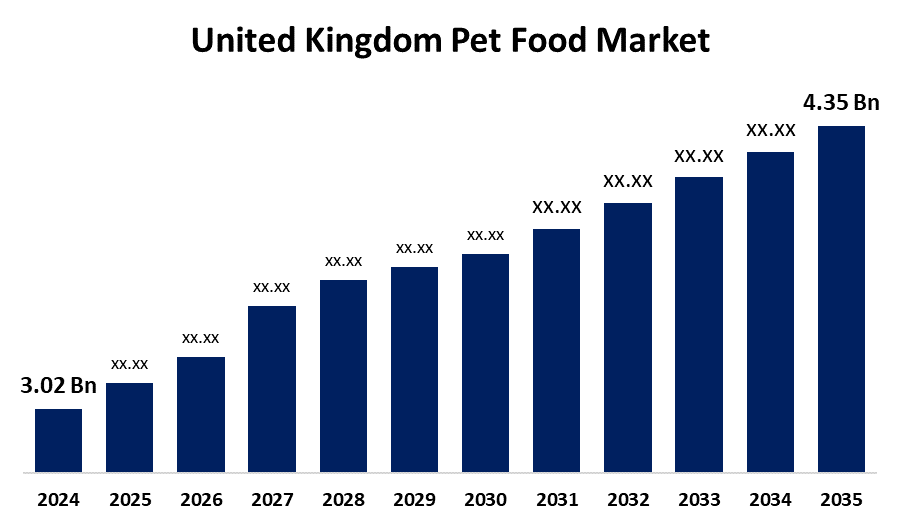

- The United Kingdom Pet Food Market Size was estimated at USD 3.02 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.37% from 2025 to 2035

- The United Kingdom Pet Food Market Size is Expected to Reach USD 4.35 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Pet Food Market is anticipated to reach USD 4.35 Billion by 2035, growing at a CAGR of 3.37% from 2025 to 2035. The increasing demand for preventative treatment, rising prevalence of chronic diseases, and growing health awareness. The market's growth is also primarily attributed to developments in telemedicine, medical technology, and customized medical evaluations.

Market Overview

The UK pet food market refers to the industry involved with the manufacturing, marketing, and distribution of pet food designed especially for household pets such dogs, cats, birds, and small mammals. It includes an extensive variety of goods, such as dietary supplements, meals, wet and dry food, and others. The market places a strong emphasis on nutrition, convenience, and premium ingredients in order to satisfy changing customer demands, which have been influenced by an increase in pet ownership and a growing awareness of pet health. Increased demand for premium, organic, and health-conscious items; rising pet ownership; and growing humanization of pets. The industry is experiencing new opportunities for growth and consumer interaction as the consequence of innovations like plant-based and sustainable pet foods and growing e-commerce platforms. As a consequence of shifting customer preferences and legislative backing for environmentally friendly pet nutrition, government support for sustainable innovation such as the legalization of lab-grown meat for pet food further encourages industry expansion.

Report Coverage

This research report categorizes the market for the UK pet food market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK pet food market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK pet food market.

United Kingdom Pet Food Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.02 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 3.37% |

| 2035 Value Projection: | USD 4.35 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 261 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product and By Pet Type |

| Companies covered:: | Mars Incorporated, LUPUS Alimento, Total Alimentos, Hill’s Pet Nutrition, Inc., General Mills Inc., WellPet LLC, The Hartz Mountain Corporation, Diamond Pet Foods, The J.M. Smucker Company, Nestlé Purina, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing awareness of pet nutrition and health, in addition to the humanization of pets, where owners view their animals as part of the family. High-quality, organic, and personalized pet nourishment are in high demand from consumers. Pet owners who are concerned regarding their health are also drawn to new developments in pet food formulas, including customized diets and functional ingredients. The development of subscription-based business models and e-commerce platforms additionally increased accessibility and convenience, which has accelerated the market's growth across a range of pet categories and demographics.

Restraining Factors

The higher retail costs. There are additional difficulties because of the strict government laws governing pet food safety, labeling, and nutritional requirements. Consumer shopping behavior may also be impacted by increased environmental concerns regarding packaging waste and carbon footprint.

Market Segmentation

The UK pet food market share is classified into product and pet type

- The dry pet food segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK pet food market is segmented by product into wet pet food, dry pet food, and snacks/ treats. Among these, the dry pet food segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by its longer shelf life, cost, ease of use, and improvements for tooth health. Grain-free, high-protein, breed-specific, and other specialized dry formulations with customized nutrition are becoming growing more popular within health-conscious consumers.

- The dogs segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK pet food market is segmented by pet type into cats and dogs. Among these, the dogs segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the increasing amount of dog owners. Demand for high-end, natural, and functional products is increasing as consumers place a higher priority on health and customized nutrition. Increased accessibility via online and physical stores boosts sales among a variety of customer segments.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK pet food market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Mars Incorporated

- LUPUS Alimento

- Total Alimentos

- Hill’s Pet Nutrition, Inc.

- General Mills Inc.

- WellPet LLC

- The Hartz Mountain Corporation

- Diamond Pet Foods

- The J.M. Smucker Company

- Nestlé Purina

- Others

Recent Developments:

- In February 2025, Meatly launched "Chick Bites," the world's first lab-grown meat dog treats, in collaboration with vegan dog food company The Pack. These treats combine plant-based ingredients with cultivated chicken meat, offering a sustainable alternative to traditional pet treats. The UK became the first European country to approve the sale of lab-grown meat for pet food, marking a significant step towards eco-friendly pet nutrition.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the UK pet food market based on the below-mentioned segments:

UK Pet Food Market, By Product

- Wet Pet Food

- Dry Pet Food

- Snacks/ Treats

UK Pet Food Market, By Pet Type

- Cats

- Dogs

Need help to buy this report?