United Kingdom Pension Administration Software System Market Size, Share, and COVID-19 Impact Analysis, By Deployment Type (Cloud-based and On-premise), By End User (Public Pension Funds, Corporate Pension Plans, Insurance Companies, and Third-party Administrators), and UK Pension Administration Software System Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited Kingdom Pension Administration Software System Market Insights Forecasts to 2035

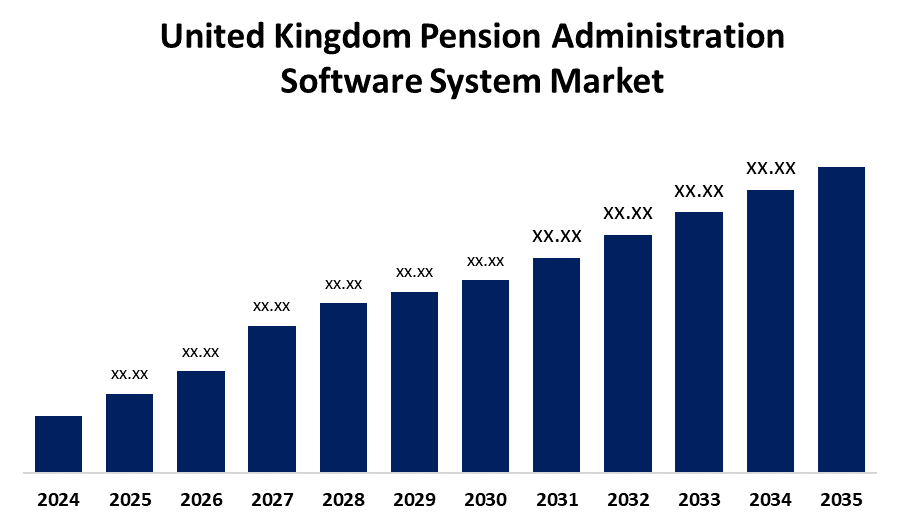

- The United Kingdom Pension Administration Software System Market Size is Expected to Grow at a CAGR of around 5.3% from 2025 to 2035

- The United Kingdom Pension Administration Software System Market Size is Expected to hold a significant share By 2035

Get more details on this report -

The United Kingdom Pension Administration Software System Market Size is Anticipated to hold a significant share by 2035, Growing at a CAGR of 5,3% from 2025 to 2035. The growing expectations for regulatory compliance, the complexity of pensions, the growing use of cloud-based solutions, and the requirement for effective, automated pension administration. Market expansion in financial services has been further accelerated by the digital revolution.

Market Overview

The UK pension administration software system market refers to the industry focused on creating and providing digital solutions that assist businesses and pension providers in managing and expediting pension-related procedures. Contribution management, benefit computations, compliance reporting, and member record-keeping are all handled by these systems. They guarantee regulatory compliance, lower administrative expenses, and increase operational efficiency. These software programs are becoming indispensable resources in the UK's financial and retirement planning environment due to the complexity of pension plans and a growing demand for automation and transparency. Growing need for regulatory compliance, automation, and real-time data availability. Opportunities for innovation are presented by the move to cloud-based solutions, the growing uptake by small and medium businesses, and the combination of analytics and artificial intelligence. The need for advanced, approachable pension management solutions is further increased by rising retirement planning awareness.

Report Coverage

This research report categorizes the market for the UK pension administration software system market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK pension administration software system market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK pension administration software system market.

United Kingdom Pension Administration Software System Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.3% |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 187 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Deployment Type, By End User and COVID-19 Impact Analysis |

| Companies covered:: | Aquila Heywood, Sagitec Solutions, Vitech Systems Group, Morneau Shepell, Oracle, SAP, Capita, TCS, FIS, SS&C Technologies, Congruent Solutions, Levi, Ray & Shoup and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing regulatory requirements, the complexity of pension plans, and the demand for precise, accessible, and effective pension administration. To maintain compliance with evolving laws, minimize manual errors, and streamline processes, organizations are implementing digital solutions. Adoption is further accelerated by the move to cloud-based platforms and integration with cutting-edge technology like artificial intelligence and data analytics. Pension companies are also being encouraged to modernize their administrative procedures by increased consumer interaction and growing awareness of retirement planning.

Restraining Factors

The substantial setup costs and initial investment, which may put off small and medium-sized businesses. Furthermore, opposition to digital transformation, issues with legacy system integration, and worries about data security could prevent broad adoption in the industry.

Market Segmentation

The UK pension administration software system market share is classified into deployment type and end user.

- The cloud-based segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK pension administration software system market is segmented by deployment type into cloud-based and On-premise. Among these, the cloud-based segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by its adaptability, affordability, and simplicity of implementation. Cloud solutions are preferred by organizations due to their improved security, rapid upgrades, and real-time data access. The industry's adoption is further accelerated by growing trends in remote work and digital transformation.

- The third-party administrators segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK pension administration software system market is segmented by end user into public pension funds, corporate pension plans, insurance companies, and third-party administrators. Among these, the third-party administrators segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of growing demand for pension management that is effective, accessible, and compliant. To handle the growing number of retirees and the increasing administrative duties, governments are updating outdated systems, enhancing data accuracy, and guaranteeing regulatory compliance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK pension administration software system market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aquila Heywood

- Sagitec Solutions

- Vitech Systems Group

- Morneau Shepell

- Oracle

- SAP

- Capita

- TCS

- FIS

- SS&C Technologies

- Congruent Solutions

- Levi, Ray & Shoup

- Others

Recent Developments:

- In April 2025, Vitech Systems Group launched V3locity Express: Supplemental Health, an advanced cloud-native pension and insurance administration solution designed to streamline operations and enhance customer experience in the pension administration software market across the , United Kingdom.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the UK Pension Administration Software System Market based on the below-mentioned segments:

UK Pension Administration Software System Market, By Deployment Type

- Cloud-based

- On-premise

UK Pension Administration Software System Market, By End User

- Public Pension Funds

- Corporate Pension Plans

- Insurance Companies

- Third-party Administrators

Need help to buy this report?