United Kingdom Peanut Butter Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Crunchy Peanut Butter, Smooth Peanut Butter, and Others), By Distribution Channel (Supermarkets and Hypermarkets, Convenience Stores, Online Stores, and Others), and UK Peanut Butter Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Peanut Butter Market Forecasts to 2035

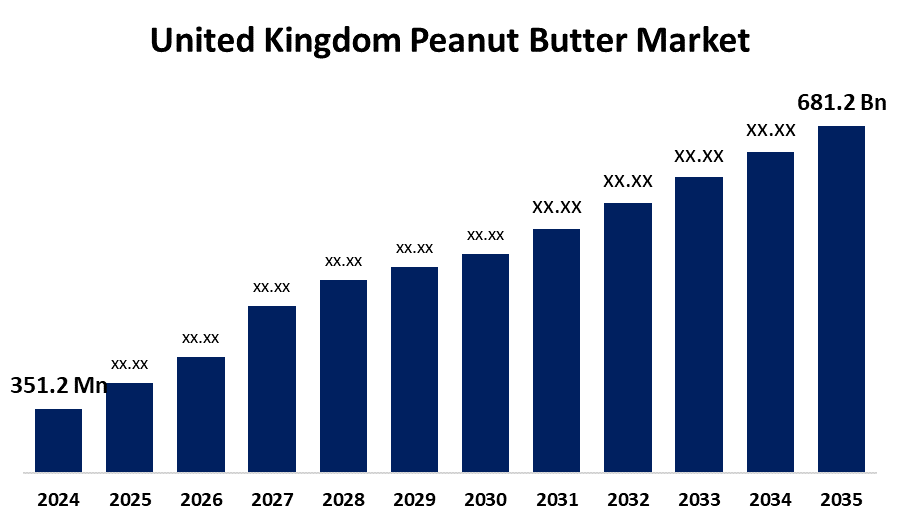

- The United Kingdom Peanut Butter Market Size Was Estimated at USD 351.2 Million 2024

- The UK Peanut Butter Market Size is Expected to Grow at a CAGR of around 6.21% from 2025 to 2035

- The UK Peanut Butter Market Size is Expected to Reach USD 681.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Peanut Butter Market is anticipated to reach USD 681.2 million by 2035, growing at a CAGR of 6.21% from 2025 to 2035. The growing trend of health consciousness and the growing desire for high-protein food products among young people and millennials. Some of the major factors propelling the market include the development of flavoured peanut butter, organic alternatives, and reduced-sugar or no-sugar-added variants, as well as shifting consumer preferences and habits desire for convenient food.

Market Overview

Peanut butter is a well-liked spread that is made by grinding dry-roasted peanuts. Known for its rich, nutty flavour and smooth or chunky consistency, it often includes added ingredients like salt, sugar, and vegetable oils to improve its taste and texture. Peanut butter is well known for its nutritional advantages such as a good source of protein, healthy fats, vitamins like E and B, minerals like potassium and magnesium, and dietary fibre. Peanut butter's market expansion is aided by the health-conscious customer base that looks for it as a component of a balanced diet. It is also a popular choice for people looking for a nutrient-dense meal option because it is a high source of protein, healthy fats, vitamins, and minerals. Consumer choice and taste preferences are the main factors driving the steady demand for peanut butter. Because of its rich, nutty flavour, peanut butter has long been a popular staple in the UKs people diet. A broad spectrum of consumers, including both adults and children, find this food product appealing due to its versatility. In addition, the demand for peanut butter has been positively affected by the growing popularity of vegetarian and vegetarian lifestyle as well as plants-based diet.

Report Coverage

This research report categorizes the market for the UK peanut butter market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK peanut butter market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom peanut butter market.

United Kingdom Peanut Butter Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 20241 |

| Market Size in 20241: | USD 351.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.21% |

| 2035 Value Projection: | USD 681.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Product Type, By Distribution Channel and COVID-19 Impact Analysis |

| Companies covered:: | Whole Earth, Pip and Nut, Schwartz, Almond Breeze, Nutworks, Kraft Heinz, Zara Food, Bramley and Gage, Little Nut Tree, Meridian Foods, Unilever, SunPat, Peanut Hottie, Associated British Foods plc, Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

Peanut butter remains a staple in the UK, rising obesity rates are encouraging consumers to choose healthier snack and breakfast options, boosting demand for nutritious products like peanut butter. Its popularity as a go-to choice for breakfast and snacks continues to thrive. Growing health consciousness among consumers are increasingly seeking options with reduced sugar, higher protein content, and natural ingredients, which has propelled the rise of health-conscious peanut butter brands. The growing trend of veganism and plant-based diets has further expanded the market, as peanut butter is viewed as a key source of plant-based protein. Additionally, innovative flavour varieties and convenient packaging have helped boost its appeal across different age groups. Increasing urbanization, higher disposable incomes, and greater awareness of health issues such as heart disease and high blood pressure are supporting market expansion. Awareness of the health benefits of peanut oil is another factor positively influencing market growth.

Restraining Factors

Peanut allergies pose a significant obstacle to the growth of the peanut butter market. A considerable number of individuals, both children and adults, are affected by these allergies, which represent a major share of all food-related allergies. Reactions can range from mild skin irritations to severe, potentially life-threatening systemic responses such as anaphylaxis, due to this factors market is expected to hamper over the forecast period.

Market Segmentation

The UK peanut butter market share is classified into by product type and distribution channel

- The crunchy peanut butter segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK peanut butter market is segmented by product type into crunchy peanut butter, smooth peanut butter, and others. Among these, the crunchy peanut butter segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The crunchy peanut butter spreads, with a piece of peanuts and is preferred by consumers who seek a satisfactory crunch in their spread. This particular product is suitable for health-conscious consumers who appreciate the product more naturally because it contains less pairs of oil and sugars. It can be used when baking and used as grains, curd or salad toppers. This section will benefit from increasing interest in premium and artisan variants that often include additional ingredients such as honey or seeds that enhance taste and nutritional appeal.

- The supermarkets and hypermarkets segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK peanut butter market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, online stores, and others. Among these, the supermarkets and hypermarkets segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. It is responsible for the broader variety and access of peanut butter brands that provide large retail format, appealing to a comprehensive consumer base in search of convenience and value. Additionally, supermarkets and hypermarkets benefit from high foot traffic, which increases the product visibility and increases sales. They also provide the benefit of immediate satisfaction for consumers who prefer to assess the quality of the product directly before purchase.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK peanut butter market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Whole Earth

- Pip and Nut

- Schwartz

- Almond Breeze

- Nutworks

- Kraft Heinz

- Zara Food

- Bramley and Gage

- Little Nut Tree

- Meridian Foods

- Unilever

- SunPat

- Peanut Hottie

- Associated British Foods plc

- Others

Recent Developments:

- In November 2024, KP Snacks acquired Whole Earth Foods Limited from the Ecotone group as part of its strategy to broaden its range of healthier products and enhance its lineup of well-established snack brands. The Whole Earth brand which includes nut butters and soft drinks has seen a fivefold increase in sales and now holds the top position in the UK peanut butter market, while also experiencing strong growth in organic peanut butter sales across major European markets

- In November 2024, ManiLife announced a £1 million investment in a new production facility, reflecting its rapid growth as the fastest-expanding peanut butter brand in the UK. Located in Shirebrook, Derbyshire, the new plant will have the capacity to store up to six billion peanuts, supporting efficient distribution and enabling continued small-batch manufacturing

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the UK peanut butter market based on the below-mentioned segments:

United Kingdom Peanut Butter Market, By Product Type

- Crunchy Peanut Butter

- Smooth Peanut Butter

- Others

United Kingdom Peanut Butter Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience Stores

- Online Stores

- Others

Need help to buy this report?