United Kingdom Payday Loans Market Size, Share, and COVID-19 Impact Analysis, By Type (Storefront Payday, Online Payday), By Marital Status (Married, Single), and United Kingdom Payday Loans Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialUnited Kingdom Payday Loans Market Insights Forecasts to 2035

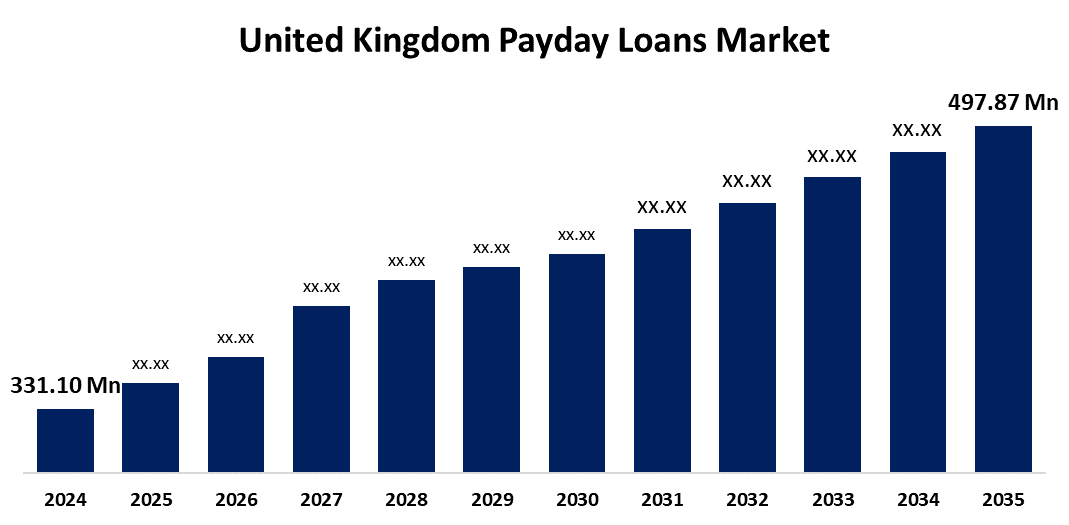

- The United Kingdom Payday Loans Market Size was estimated at USD 331.10 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.78% from 2025 to 2035

- The United Kingdom Payday Loans Market Size is Expected to Reach USD 497.87 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United Kingdom Payday Loans Market Size is anticipated to Reach USD 497.87 Million by 2035, Growing at a CAGR of 3.78% from 2025 to 2035. The Banking, Financial Services, and Insurance (BFSI) industry is rapidly digitizing, which is driving an increase in online loan applications.

Market Overview

The market for payday loans is the area of financial services that provides expensive, short-term loans, typically for $500 or less. Typically, these loans are paid back within two to four weeks or on the borrower's subsequent payday. Payday loans are unsecured, short-term loans that frequently have exorbitant interest rates. As a result, the borrower can submit a postdated check to the lender for their payday wage, but they can get some of that money in cash. Opportunities in certain markets include rising economies, greater financial instability for the lower classes, and the growing acceptability of online lending. The focus of market expansion potential is on new lending methods, technology applications to help customers with their products and reduce loan time, and access to new, untapped geographic areas. Payday loans are short-term loans that are taken out when extra money is needed. They are rising consumer debt, the rise in financial emergencies, and inadequate banking infrastructure, the market for payday loans has experienced a significant expansion. The high interest rates associated with the loan make it dangerous for the borrowers. Online and in-store loans are offered by payday lenders.

Report Coverage

This research report categorizes the market for the United Kingdom payday loans market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom payday loans market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom payday loans market.

United Kingdom Payday Loans Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 331.10 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 3.78% |

| 2035 Value Projection: | USD 497.87 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Marital Status |

| Companies covered:: | Western Circle (Cashfloat), SGE Group (SGE Payday), Swift Money Ltd, Fund Ourselves Ltd., and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom payday loans is influenced by the youth, with increased awareness of payday loans for financial freedom or purpose. Further, student loans and growing living expenses are many variables that cause financial insecurity. Furthermore, the market is expanding due to the growing use of payday loans by younger populations. Additionally, the market is growing as more payday lenders enter the market. The major players are implementing cutting-edge technologies to provide their clients with better options. In addition, market participants are utilizing technologies like analytics, machine learning (ML), and artificial intelligence (AI) to lower compliance costs and endure in a fiercely competitive market.

Restraining Factors

However, the growth of the payday loan business will be hampered by elements like high interest rates and the detrimental effect on credit scores.

Market Segmentation

The United Kingdom payday loans market share is classified into type, and marital status.

- The storefront payday segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom payday loans market is differentiated by type into storefront payday, and online payday. Among these, the storefront payday segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The existence of multiple payday loan stores is responsible for the segment's expansion. Additionally, a borrower who applies for a payday loan in person is more likely to have it approved faster than one who applies online.

- The single segment held the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period.

The United Kingdom payday loans market is segmented by marital status into married, and single. Among these, the single segment held the largest share in 2024 and is predicted to grow at a significant CAGR during the forecast period. This is because of comparing to married couples, who are more likely to have multiple sources of income if both spouses are employed, single individuals only have one source of income, which accounts for the segment's increase. Most of them are students who might be living abroad or in single-parent situations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom payday loans market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Western Circle (Cashfloat)

- SGE Group (SGE Payday)

- Swift Money Ltd

- Fund Ourselves Ltd.

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom payday loans market based on the below-mentioned segments:

United Kingdom Payday Loans Market, By Type

- Storefront Payday

- Online Payday

United Kingdom Payday Loans Market, By Marital Status

- Married

- Single

Need help to buy this report?