United Kingdom Paracetamol Market Size, Share, and COVID-19 Impact Analysis, By Type (Tablets, Powder, Granules), By Medicine Formulation (Tablet Drug, Granules Drug, Oral Solution, Injectables, and Suppositories), and United Kingdom Paracetamol Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited Kingdom Paracetamol Market Insights Forecasts to 2035

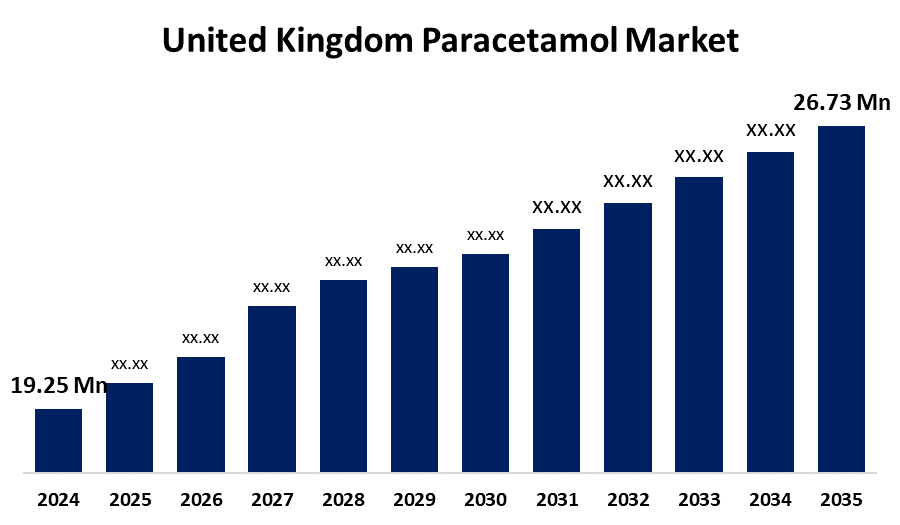

- The United Kingdom Paracetamol Market Size was estimated at USD 19.25 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.03% from 2025 to 2035

- The United Kingdom Paracetamol Market Size is Expected to Reach USD 26.73 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Paracetamol Market Size is anticipated to reach USD 26.73 Million by 2035, growing at a CAGR of 3.03% from 2025 to 2035. The market is rising due to the increasing prevalence of paracetamol as a secure and effective over-the-counter analgesic and antipyretic medication. Moreover, growing mild fever and minor pain, as well as an increase in self-medication, are driving market growth.

Market Overview

The United Kingdom paracetamol market refers to the business that is a subsegment of the healthcare industry that focuses on the production and application of paracetamol, which is a widely used analgesic (pain reliever) and antipyretic (fever reducer). This market includes raw material suppliers, pharmaceutical manufacturers, distributors, and retailers who produce and sell paracetamol-based products in various forms, such as tablets, capsules, syrups, and intravenous solutions. Also, the government support for development in the healthcare industry fuels the market expansions. For instance, in April 2020, the trade of paracetamol between the UK and India highlighted the strong economic ties between the two nations. India was a major supplier of generic pharmaceuticals, including paracetamol, to the UK, ensuring a steady supply of essential medicines. This relationship was particularly evident during the COVID-19 pandemic when India lifted export restrictions on paracetamol to support the UK's healthcare needs. Further, pharmaceutical companies are developing combination drug compositions containing acetaminophen (paracetamol) and more analgesics in response to the increasing demand for effective treatment of pain alternatives that lack opioids.

Report Coverage

This research report categorizes the market for the United Kingdom paracetamol market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom paracetamol market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom paracetamol market.

United Kingdom Paracetamol Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 19.25 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.03% |

| 2035 Value Projection: | USD 26.73 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 204 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type (Tablets, Powder, Granules), By Medicine Formulation (Tablet Drug, Granules Drug, Oral Solution, Injectables, and Suppositories) |

| Companies covered:: | Aspar Pharmaceuticals Ltd., M & A Pharmachem, GlaxoSmithKline (GSK), Sanofi, Mallinckrodt Pharmaceuticals, Teva Pharmaceutical Industries, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom paracetamol is influenced by rapid transformation in the healthcare industry, especially development in the pharmaceutical production industry sector. Moreover, the need for drugs containing acetaminophen is being significantly stimulated by the rising prevalence of chronic illnesses such as musculoskeletal disorders, migraines, and arthritis. The demand for analgesics that are effective, secure, and easily tolerated has increased because millions of individuals suffer from chronic pain disorders. Besides, patients who are susceptible to stomach ulcers or who have gastric sensitivity should use acetaminophen (paracetamol) instead of NSAIDs, which also contributes to the paracetamol market expansion. Further, key companies decided to team up with local major industry players for novel drug formulation and delivery, which could boost the country's market revenue for paracetamol.

Restraining Factors

Acetaminophen's ability to cause liver damage and an overdose, which can result in serious health consequences, is one of this marketplace's major obstacles to wide market expansion. Further, the big efforts by the UK government, such as in September 2023, the UK government considered restricting the sale of over-the-counter paracetamol as part of its National Suicide Prevention Strategy. The move aimed to reduce suicide rates, which had stalled in decline since 2018. Previously, individuals could purchase up to two packets of paracetamol-containing medicine (16 tablets of 500mg each), but the government had asked the Medicines and Healthcare Products Regulatory Agency (MHRA) to explore further restrictions.

Market Segmentation

The United Kingdom paracetamol market share is classified into type and medicine formulation.

- The tablets segment held the highest share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom paracetamol market is segmented by type into tablets, powder, and granules. Among these, the tablets segment held the highest share in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This segment growth is driven by their ease of use, affordability, and convenience to the pharmaceutical industry. They provide a reliable and accurate way to deliver active chemicals in a regulated way, which makes them perfect for patients and medical professionals. Tablets can now be made with immediate, delayed, or extended release to meet a variety of therapeutic demands thanks to developments in formulation technologies.

- The injectables segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom paracetamol market is segmented by medicine formulation into tablet drug, granules drug, oral solution, injectables, and suppositories. Among these, the injectables segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This is because an effective treatment alternative for pain alleviation is the intravenous infusion of paracetamol. Additionally, the segment has grown since intravenous paracetamol mixed with NSAIDs and opioids has become widely accepted. The well-rounded approach to post-operative pain management provided by this combination therapy is in line with the growing need in clinical settings for all-encompassing pain reduction solutions.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom paracetamol market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aspar Pharmaceuticals Ltd.

- M & A Pharmachem

- GlaxoSmithKline (GSK)

- Sanofi

- Mallinckrodt Pharmaceuticals

- Teva Pharmaceutical Industries

- Others

Recent Developments:

- In December 2024, A research team led by the University of Liverpool developed a new saliva-based test that can rapidly identify paracetamol overdose. The technique, called paper-arrow mass spectrometry (PA-MS), allows clinicians to assess paracetamol levels using a tiny drop of saliva on paper, offering a faster and more efficient alternative to current clinical tests. This innovative test, developed in collaboration with Alder Hey Children’s Hospital and Royal Liverpool University Hospital, could improve emergency diagnosis and patient outcomes.

- In August 2024, Perrigo UK launched SolpaOne, a new high-strength 1000mg paracetamol effervescent tablet as part of its Solpadeine pain relief portfolio. This product is designed to provide fast pain relief, working up to two times faster than regular paracetamol tablets.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom paracetamol market based on the below-mentioned segments:

United Kingdom Paracetamol Market, By Type

- Tablets

- Powder

- Granules

United Kingdom Paracetamol Market, By Medicine Formulation

- Tablet Drug

- Granules Drug

- Oral Solution

- Injectables

- Suppositories

Need help to buy this report?