United Kingdom Paints and Coatings Market Size, Share, and COVID-19 Impact Analysis, By Product (Powdered, Solvent-borne), By Resin (Acrylic, Alkyd, Epoxy, Polyester, Polyurethane, Fluoropolymer, Vinyl, Others), By Technology (UV-cured Coating, Waterborne, Solvent Borne, Powder, and Additive Manufacturing), and United Kingdom Paints and Coatings Market Insights, Industry Trend, Forecasts to 2035.

Industry: Specialty & Fine ChemicalsUnited Kingdom Paints and Coatings Market Insights Forecasts to 2035

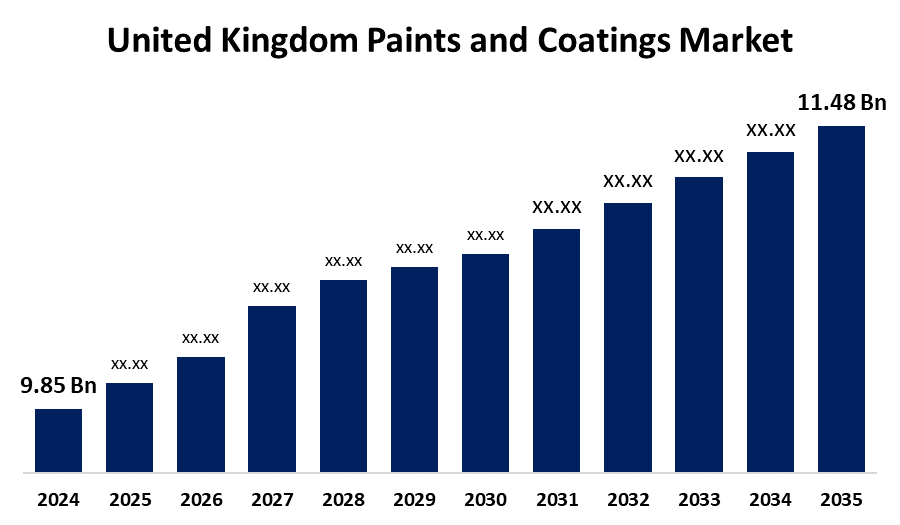

- The United Kingdom Paints and Coatings Market Size was estimated at USD 9.85 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 1.40% from 2025 to 2035

- The United Kingdom Paints and Coatings Market Size is Expected to Reach USD 11.48 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Paints and Coatings Market Size is Anticipated to reach USD 11.48 Billion By 2035, Growing at a CAGR of 1.40% from 2025 to 2035. The market development is influenced by rising product consumption in the general, automotive, and construction industries. Further, the need for paints and coatings in building applications is expected to be driven by factors such as fast industrialization and urbanization.

Market Overview

The United Kingdom paints and coatings market refers to the business focused on the production and application of paints and coatings materials in the form of liquid or powder-based substances used to protect, decorate, and enhance surfaces. These products are applied to buildings, automobile machinery, furniture, and other materials to provide aesthetic appeal, durability, and resistance to environmental factors. Additionally, the product's anti-friction, hardness, reflection-absorption, thermal protection, and rust-resistance qualities make them pivotal for daily purposes. In addition, the rise of the paints and coatings business is due to the culture of DIY (do-it-yourself) and the expansion of paint suppliers, rising demand propelling the market expansion. In the paints & coatings industry, artificial intelligence and machine learning are reinventing research, development, and production processes. Machine learning techniques can be used to model data so that paint formulae can be precisely modified based on chemical composition. Furthermore, AI and ML assess factors such as paint toxicity, market-driven pricing fluctuations, environmental impacts, and the viability of alternative materials, providing information that aids in improving product composition.

Report Coverage

This research report categorizes the market for the United Kingdom paints and coatings market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom paints and coatings market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom paints and coatings market.

United Kingdom Paints and Coatings Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.85 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 1.40% |

| 2035 Value Projection: | USD 11.48 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product, By Resin, By Technology and COVID-19 Impact Analysis |

| Companies covered:: | HMG Paints Ltd, Akzo Nobel Industrial Coatings, Elite Coatings International Ltd., Neals Coatings Ltd., PPG Industries, Euro Quality Coatings, Benjamin Moore, Hycrome Europe Ltd, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market growth is influenced by the massive product penetration in the industrial wood sector and the shipping and maritime industries, whereas the paints and coatings are being applied as resistance layers from external environmental factors. Additionally, the paint and coating industry will be bombarding the market with profitable growth opportunities due to the increased digitization and development in the chemical industry, which will also add value for consumers. Further, the rising need for sustainable coating and painting materials drives the market growth at a rapid pace. Moreover, key market companies' partnership with the local firms excels in the growing opportunities for the market inclination.

Restraining Factors

The price volatility of raw materials and creating thick and smooth coatings make the production procedure challenging. Also, controlling the quantity and pace of substrate is equally challenging. Further, the paints and coatings market could be slowed down by strict regulatory guidelines and delayed quality inception progress.

Market Segmentation

The United Kingdom paints and coatings market share is classified into product, resin, and technology.

- The solvent-borne segment held the highest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period.

The United Kingdom paints and coatings market is divided by product into powdered and solvent-borne. Among these, the solvent-borne segment held the highest share in 2024 and is anticipated to grow at a substantial CAGR during the forecast period. This is because water evaporation from the coating layer occurs quickly, and these coatings dry more quickly without developing surface skin than paints and coatings based on solvents. They have outstanding resistance to heat and corrosion, making them perfect primers. They also have low toxicity and are resistant to flames because of their low volatile organic compound (VOC) content and low emissions of harmful air pollutants.

- The acrylic segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United Kingdom paints and coatings market is segmented by resin into acrylic, alkyd, epoxy, polyester, polyurethane, fluoropolymer, vinyl, and others. Among these, the acrylic segment dominated the market in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This is because of its qualities of adhesion, drying speed, relative resistance, and flexibility. Acrylic resin is the most widely used of these in terms of volume and is appropriate for use in paints and coatings. The primary driver of acrylic's demand is its expanding application in architectural coatings for windows, panels, and walls both inside and outside.

- The powder segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom paints and coatings market is segmented by technology into UV-cured coating, waterborne, solvent borne, powder, and additive manufacturing. Among these, the powder segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This is due to powder-based coatings classified into thermosets and thermoplastics. Besides, powder coatings offer an enticing opportunity to prevent pollution because no petroleum-based solvents are used in the coating formulation process. These don't produce any harmful waste and have a high transfer efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom paints and coatings market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- HMG Paints Ltd

- Akzo Nobel Industrial Coatings

- Elite Coatings International Ltd.

- Neals Coatings Ltd.

- PPG Industries

- Euro Quality Coatings

- Benjamin Moore

- Hycrome Europe Ltd

- Others

Recent Developments:

- In April 2024, Kraton and Nordmann expanded their partnership, strengthening their collaboration in pine-based resin products. Nordmann now distributes Kraton’s portfolio of pine chemicals and specialty resins for applications in paints, coatings, and adhesives across multiple European countries, including the United Kingdom. These bio-based alternatives offer better performance and a lower carbon footprint compared to fossil-based materials.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom paints and coatings market based on the below-mentioned segments

United Kingdom Paints and Coatings Market, By Product

- Powdered

- Solvent-borne

United Kingdom Paints and Coatings Market, By Resin

- Acrylic

- Alkyd

- Epoxy

- Polyester

- Polyurethane

- Fluoropolymer

- Vinyl

- Others

United Kingdom Paints and Coatings Market, By Technology

- UV-cured Coating

- Waterborne

- Solvent Borne

- Powder

- Additive Manufacturing

Need help to buy this report?