United Kingdom Pain Relief Medication Market Size, Share, and COVID-19 Impact Analysis, By Medication Type (Non-Steroidal Anti-Inflammatory Drugs, Acetaminophen, Opioids, and Adjuvant Analgesics), By Therapeutic Area (Chronic Pain, Acute Pain, Postoperative Pain, and Cancer Pain), and UK Pain Relief Medication Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Pain Relief Medication Market Forecasts to 2035

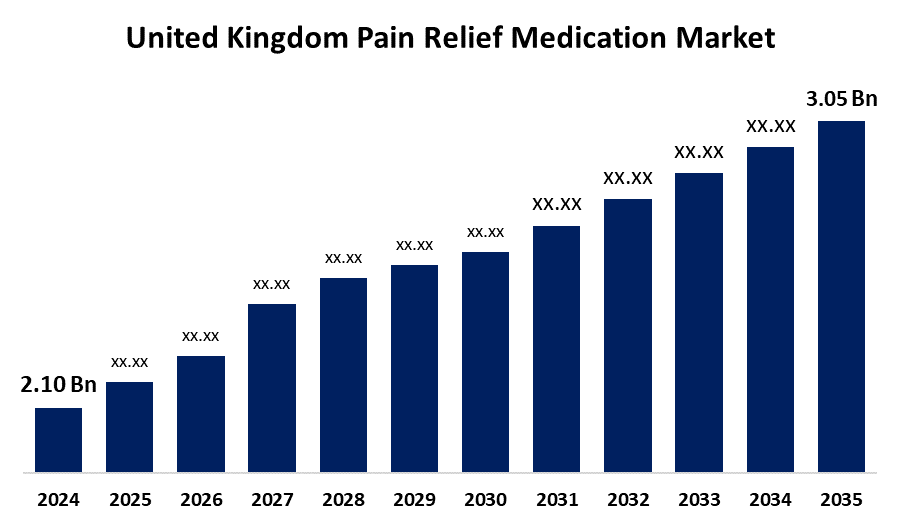

- The United Kingdom Pain Relief Medication Market Size Was Estimated at USD 2.10 Billion in 2024

- The UK Pain Relief Medication Market Size is Expected to Grow at a CAGR of around 3.45% from 2025 to 2035

- The UK Pain Relief Medication Market Size is Expected to Reach USD 3.05 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the UK Pain Relief Medication Market Size is Anticipated to Reach USD 3.05 Billion by 2035, Growing at a CAGR of 3.45% from 2025 to 2035. An ageing population with chronic pain, a greater preference for over-the-counter and non-opioid choices, and the emergence of digital health solutions like online pharmacies and customised pain management technology are all contributing factors to the growth of the UK market for pain relief medication

Market Overview

The UK pain relief medication market refers to a crucial area of the pharmaceutical industry. The market treats a wide range of pain problems, from minor headaches to excruciating pain following surgery and cancer. A number of significant themes are driving innovation and growth in the UK market for pain management medications. Patients are being encouraged to investigate a range of over-the-counter (OTC) medications for efficient pain management as a result of growing consumer awareness of pain management choices. The need for effective treatment options is being fuelled by the increasing frequency of chronic pain diseases like back pain and arthritis. Additionally, more people are self-medicating with reasonably priced over-the-counter medications as a result of rising healthcare prices. The growing popularity of natural products and alternative therapies, which combine holistic and herbal pain management with conventional treatments, is also providing prospects for the industry. Pharmaceutical companies are being encouraged by the growing interest in personalised medicine to create painkillers that are specifically suited to the needs of each patient.

Patient access to pain management is being improved by healthcare digitisation, which includes telehealth and online consultations. OTC painkiller purchases in the UK are becoming easier due to e-commerce sites. Pharmaceutical R&D investment is being stimulated by government assistance for creative healthcare solutions, which is resulting in the creation of more powerful and inventive painkillers. All of these factors point to a vibrant and changing market for painkillers in the UK that is influenced by customer preferences, technological advancements, and government support.

Report Coverage

This research report categorizes the market for the UK pain relief medication market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom pain relief medication market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom pain relief medication market.

United Kingdom Pain Relief Medication Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.10 Billion |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 3.45% |

| 2035 Value Projection: | USD 3.05 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 130 |

| Segments covered: | By Medication Type, By Therapeutic Area and COVID-19 Impact Analysis |

| Companies covered:: | Aurobindo Pharma, Pfizer, Boehringer Ingelheim, Teva Pharmaceutical Industries, Lundbeck, Mylan, Hikma Pharmaceuticals, GlaxoSmithKline, Bristol-Myers Squibb, AstraZeneca, Roche, Johnson & Johnson, AbbVie, Sanofi, Novartis and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

As chronic conditions such as diabetes and arthritis become more common in the UK, the demand for pain relief medications is growing. The NHS and the Department of Health and Social Care are prioritizing pain management and improving the management of medical pain, adding relevance to the market. Pharmaceutical companies such as GlaxoSmithKline and AstraZeneca are investing heavily in research and development, which is supported by the UK Government’s funding programs, indicating that more pain relief drugs are becoming available in the UK market. Moreover, the recently increasing public awareness of the importance of pain management, supported by local charities, interest groups, and commissions like Pain UK, is raising awareness, acceptability, and demands for pain management views. This has encouraged consumers to increasingly self-medicate and engage in medical consultations, consequently heightening growth in the market.

Restraining Factors

The possible adverse effects and dependency hazards of some opioids pose difficulties for the UK market for pain treatment medications. Market expansion is also constrained by pricing constraints and stringent regulatory approvals. Furthermore, the need for traditional painkillers may decline as people's preference for alternative remedies grows. These factors hamper the pain relief medication market during the forecast period.

Market Segmentation

The United Kingdom pain relief medication market share is classified into medication type and therapeutic area.

- The non-steroidal anti-inflammatory drugs segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom pain relief medication market is segmented by medication type into non-steroidal anti-inflammatory drugs, acetaminophen, opioids, and adjuvant analgesics. Among these, the non-steroidal anti-inflammatory drugs segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. NSAIDs are essential due to their anti-inflammatory effects and their widespread use to help with minor injuries and arthritis; they are a popular option for medical professionals to manage pain.

- The chronic pain segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom pain relief medication market is segmented by therapeutic area into chronic pain, acute pain, postoperative pain, and cancer pain. Among these, the chronic pain segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the ageing population and rising incidence of chronic illnesses, chronic pain accounts for a sizeable share of the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom pain relief medication market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Aurobindo Pharma

- Pfizer

- Boehringer Ingelheim

- Teva Pharmaceutical Industries

- Lundbeck

- Mylan

- Hikma Pharmaceuticals

- GlaxoSmithKline

- Bristol-Myers Squibb

- AstraZeneca

- Roche

- Johnson & Johnson

- AbbVie

- Sanofi

- Novartis

- Others

Recent Developments:

- In March 2024, PP353, a new medication from Persica Pharmaceuticals, targets infections that result in persistent lower back discomfort. 60% of patients in early trials report considerable gains, which could revolutionise how this ailment is treated.

- In Dec 2024, GlaxoSmithKline (GSK) entered a USD300 million collaboration with London-based biotech firm Relation Therapeutics. This partnership focuses on developing treatments for osteoarthritis and fibrotic diseases using machine learning to generate data from human tissue.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom pain relief medication market based on the below-mentioned segments:

United Kingdom Pain Relief Medication Market, By Medication Type

- Non-Steroidal Anti-Inflammatory Drugs

- Acetaminophen, Opioids

- Adjuvant Analgesics

United Kingdom Pain Relief Medication Market, By Therapeutic Area

- Chronic Pain

- Acute Pain

- Postoperative Pain

- Cancer Pain

Need help to buy this report?