United Kingdom OTC Drugs Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Cough, Cold, Flu Products, Analgesics, Dermatology Products, and Gastrointestinal Products), By Distribution Channel (Retail Pharmacy, Hospital Pharmacy, and E-Pharmacy), and United Kingdom OTC Drugs Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom OTC Drugs Market Insights Forecasts to 2035

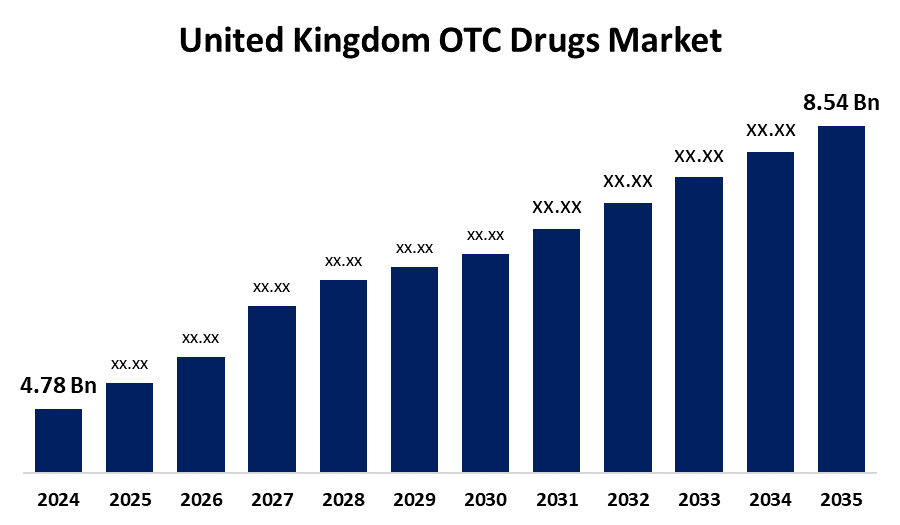

- The United Kingdom OTC Drugs Market Size Was Estimated at USD 4.78 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.42% from 2025 to 2035

- The United Kingdom OTC Drugs Market Size is Expected to Reach USD 8.54 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom OTC Drugs Market Size is anticipated to reach USD 8.54 Billion by 2035, growing at a CAGR of 5.42% from 2025 to 2035. The growing higher population, easy access to over-the-counter (OTC) medications, growing healthcare awareness, growing self-medication tendencies, and supportive government policies encouraging responsible drug usage without prescriptions for minor medical ailments.

Market Overview

The United Kingdom OTC drugs market refers to the common medical conditions including colds, discomfort, allergies, and digestive disorders are treated with these medications. The market is driven by customer demand for affordable, easily accessible, and convenient healthcare solutions, and it comprises a wide range of items marketed through pharmacies, supermarkets, and online platforms. Growing demand for accessible treatment choices due to rising healthcare expenses, growing consumer preference for self-care, and growing networks of online and physical pharmacies. The availability of a large variety of over-the-counter products and rising awareness of preventative healthcare also aid in market expansion. The market's growth potential is further increased by innovations in product composition and packaging in addition to encouraging regulatory measures. Innovations like AI-driven health kiosks like HERMES, which offer multilingual, safe, and customized over-the-counter advice in public areas. Furthermore, user convenience and compliance are improved by the creation of discrete formulations, including transdermal patches from businesses like Medherant and the dissolvable Viagra ODF from Viatris.

Report Coverage

This research report categorizes the market for the United Kingdom OTC drugs market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom OTC drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom OTC drugs market.

United Kingdom OTC Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4.78 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.42% |

| 2035 Value Projection: | USD 8.54 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 115 |

| Segments covered: | By Product Type and By Distribution Channel |

| Companies covered:: | Bayer AG, Haleon Group of Companies, Johnson & Johnson, Perrigo Company plc, Pfizer, Inc, Reckitt Benckiser Group PLC, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The consumption of over-the-counter remedies for minor medical illnesses is being encouraged by growing consumer awareness of self-medication and preventative healthcare. Accessible and affordable over-the-counter (OTC) alternatives are becoming more popular as a result of growing healthcare expenses and lengthy wait periods for doctor's appointments. Convenience and product availability are improved by the growth of retail and internet pharmacy chains. The aging population, rising rates of lifestyle-related illnesses, and supportive laws encouraging self-care behaviors are further factors driving market expansion. Product formulation innovations and easy to use packaging are also essential for drawing in and keeping consumers.

Restraining Factors

The potential misuse or overuse of drugs without the appropriate medical supervision. Safety issues include medication interactions, adverse effect risk, and a lack of consumer understanding. The introduction of new over-the-counter products can be additionally hampered by stringent regulatory requirements and product approval procedures.

Market Segmentation

The United Kingdom OTC drugs market share is classified into product type and distribution channel.

- The flu products segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom OTC drugs market is segmented by product type into cough, cold, flu products, analgesics, dermatology products, and gastrointestinal products. Among these, the flu products segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed increased customer awareness of early symptom treatment requiring prescription intervention, aggressive marketing by pharmaceutical manufacturers, increased shelf space in retail establishments, and the growing availability of combination medications.

- The flu products segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period

The United Kingdom OTC drugs market is segmented by distribution channel into retail pharmacy, hospital pharmacy, and E-pharmacy. Among these, the flu products segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of increased product availability and convenience in rural as well as urban locations, strong brand loyalty, the expansion of pharmacy services like health screenings, and a growing desire among consumers for personal consultations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom OTC drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bayer AG

- Haleon Group of Companies

- Johnson & Johnson

- Perrigo Company plc

- Pfizer, Inc

- Reckitt Benckiser Group PLC

- Others

Recent Developments:

- In April 2022, Théa Pharmaceuticals introduced Zaspray, a preservative-free 3-in-1 eye spray designed to hydrate, lubricate, and soothe dry and itchy eyes. The product utilizes hyaluronic acid and liposomal technology to improve tear film stability and alleviate discomfort.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom OTC drugs market based on the below-mentioned segments:

United Kingdom OTC Drugs Market, By Product Type

- Cough

- Cold

- Flu Products

- Analgesic

- Dermatology Products

- Gastrointestinal Products

United Kingdom OTC Drugs Market, By Distribution Channel

- Retail Pharmacy

- Hospital Pharmacy

- E-Pharmacy

Need help to buy this report?