United Kingdom Osteosynthesis Devices Market Size, Share, and COVID-19 Impact Analysis, By Type (Internal, and External), By Material (Bio Degradable, and Non Bio Degradable), and United Kingdom Osteosynthesis Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Osteosynthesis Devices Market Insights Forecasts to 2035

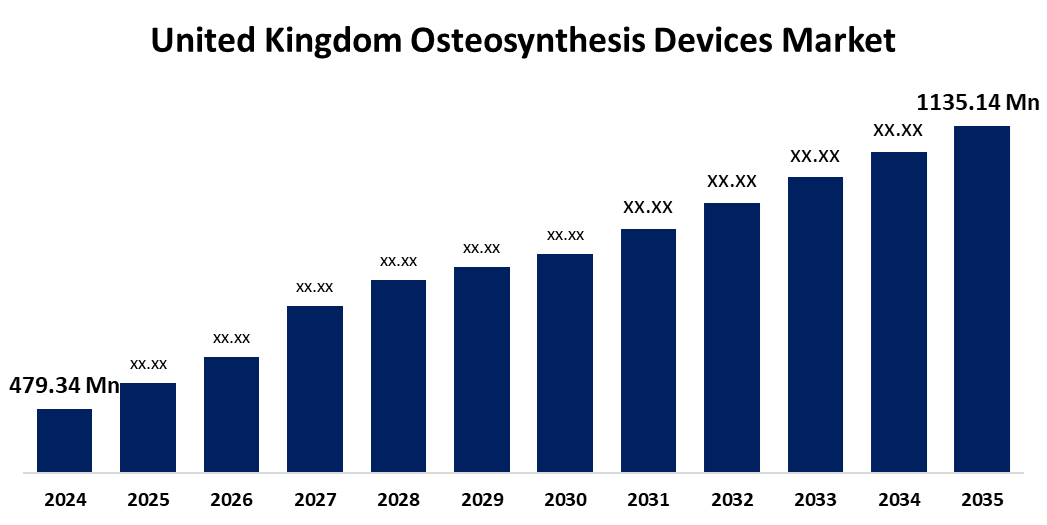

- The United Kingdom Osteosynthesis Devices Market Size was Estimated at USD 479.34 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.15% from 2025 to 2035

- The United Kingdom Osteosynthesis Devices Market Size is Expected to Reach USD 1135.14 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United Kingdom Osteosynthesis Devices Market Size is anticipated to Reach USD 1135.14 Million by 2035, Growing at a CAGR of 8.15% from 2025 to 2035. Among the major drivers propelling the market are the rising rates of traffic accidents and the increasing prevalence of osteoarthritis and bone fractures, particularly in the elderly population.

Market Overview

The United Kingdom Osteosynthesis Devices Market Size is segmented into the segment of healthcare industry, by provides devices for orthopaedic surgery to stabilize joints. Osteosynthesis is a reconstructive orthopedic surgery technique that uses intramedullary rods, screws, plates, spinal fixations, and several implanted devices to unite and stabilize different shattered and fractured bone pieces. It includes such common internal and exterior medical implants as Kirschner wires (K-wires), washers, bone lengthening and Ilizarov devices, and fracture fixation treatments. These parts are made from a variety of materials, both biodegradable and non-biodegradable, such as metal alloys, polymers, glasses, ceramics, magnesium, titanium, zinc, and iron. In addition to offering maximum stability and improved clinical results, osteosynthesis devices help to rebuild damaged bone, increase the contact area between implants and osteoporotic bone, and correct bone position. Osteosynthesis devices are therefore used to repair fractures of the hip, femur, hand, wrist, clavicle, scapula, patella, and fibula.

Report Coverage

This research report categorizes the market for the United Kingdom osteosynthesis devices market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom osteosynthesis devices market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom osteosynthesis devices market.

United Kingdom Osteosynthesis Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 479.34 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 8.15% |

| 2035 Value Projection: | USD 1135.14 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 185 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Material |

| Companies covered:: | Osteotec Ltd, Surgalign UK (part of Surgalign Holdings), In2Bones Europe Ltd, Smith & Nephew plc, Corin Group, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom osteosynthesis devices is influenced by the rising number of traffic accidents and adventurous sporting activities. Additionally, the market is propelling due to the increased incidence of osteoarthritis and bone fractures, particularly in the elderly population. Another reason driving growth is the increasing demand for bone surgeries and consumers preference for minimally invasive procedures over full-fledged surgeries because of their many advantages. The market expansion is also being aided by the advantageous policies that several nations are putting in place to encourage investment in biomedical firms that provide a variety of osteosynthesis devices for various body sections. The osteosynthesis device market is gaining traction as it adjusts to shifting healthcare environments owing to this partnership and increased awareness of orthopedic health.

Restraining Factors

Despite growing revenue across the country, the profitable share could be hampered due to innovation and product launches being slowed down by regulatory barriers and onerous approval. The market also faces issues with post-operative consequences such as implant failures and infections, which undermine patient and physician confidence.

Market Segmentation

The United Kingdom osteosynthesis devices market share is classified into type, and material.

- The internal segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom osteosynthesis devices market is divided by material into internal, and external. Among these, the internal segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This segment growth is driven by the broken bone is held together by these pieces of equipment, which also help to stabilize and support it. For repairing fractures, the most commonly used internal fixation methods are screws, metal plates, and nails.

- The bio degradable segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom osteosynthesis devices market is segmented by type into bio degradable, and non bio degradable. Among these, the bio degradable segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. Osteosynthesis systems might not have to be removed if biodegradable systems made of degradable polymers are used. The segment is rising as a result of factors like continuing clinical trials and studies, and an increasing number of product approvals.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom osteosynthesis devices market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Osteotec Ltd

- Surgalign UK (part of Surgalign Holdings)

- In2Bones Europe Ltd

- Smith & Nephew plc

- Corin Group

- Others

Recent Developments:

- In April 2025, London-based MedTech startup OSSTEC raised £2.5 million to commercialize its 3D-printed, cementless partial knee implant, designed to improve outcomes for younger, more active patients. OSSTEC, a MedTech business based in London, is adopting a different strategy. The business created a partial knee implant that promotes natural bone growth using 3D printing and no cement. This is particularly crucial for younger patients who need a more robust treatment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom osteosynthesis devices market based on the below-mentioned segments:

United Kingdom Osteosynthesis Devices Market, By Type

- Internal

- External

United Kingdom Osteosynthesis Devices Market, By Material

- Bio Degradable

- Non Bio Degradable

Need help to buy this report?