United Kingdom Orthopedic Implant Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Metallic, Ceramic, and Others), By Application (Spinal Implants, Reconstructive Joint Implants, Orthobiologics, and Others), and UK Orthopedic Implant Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Orthopedic Implant Market Forecasts to 2035

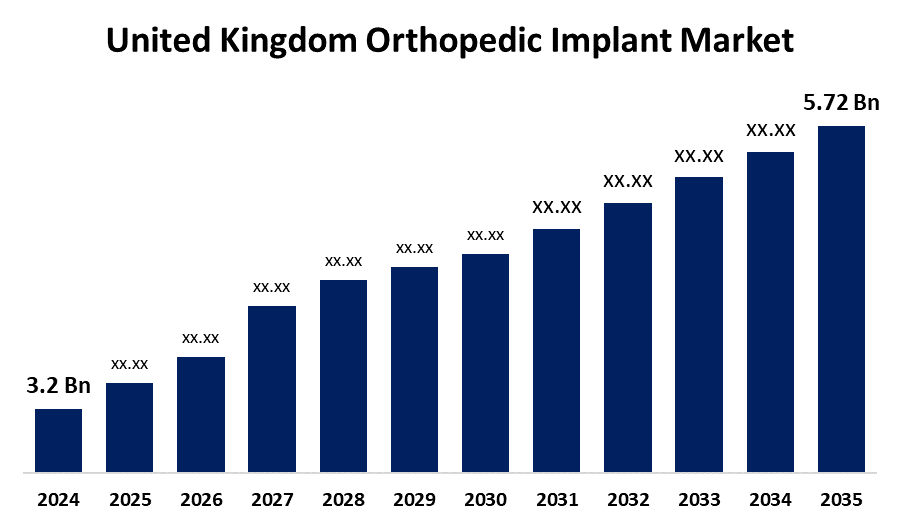

- The United Kingdom Orthopedic Implant Market Size Was Estimated at USD 3.2 Billion in 2024

- The UK Orthopedic Implant Market Size is Expected to Grow at a CAGR of around 5.42% from 2025 to 2035

- The UK Orthopedic Implant Market Size is Expected to Reach USD 5.72 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The UK Orthopedic Implant Market Size is anticipated to reach USD 5.72 Billion by 2035, growing at a CAGR of 5.42% from 2025 to 2035. The UK orthopedic implant market is influenced by several factors, including an aging population, a rise in sports-related injuries, technological development in the industry as indicated by the advent of 3D printing, government healthcare investments, as well as increased need for minimally invasive, customized implant solutions.

Market Overview

The UK orthopedic implant market refers to a range of medical devices used in surgeries to repair or replace damaged bones and joints, aiding conditions like arthritis or fractures. They include items like screws, plates, and joint prostheses, and are designed to replicate natural bone function, improving mobility, reducing pain, and enhancing patients' quality of life. The orthopedic implant market in the UK is evolving due to an aging population and increased life expectancy, driving higher demand for orthopedic surgeries. The NHS is adopting advanced implant technologies to improve surgical outcomes and accommodate demographic changes. Market trends are shifting toward minimally invasive procedures, which reduce recovery times and hospital stays. The rise in orthopedic conditions from sports and physical activities is also expanding the market. Government investment in healthcare infrastructure supports the adoption of advanced solutions, including telemedicine and robotic-assisted surgery, enhancing patient care and operational efficiency. There is a growing focus on personalized implants tailored to individual needs, improving fit and functionality. Manufacturers are collaborating with healthcare providers and research institutions to develop innovative, next-generation implants. Additionally, sustainability is becoming a priority, with the UK promoting environmentally conscious practices among implant manufacturers. These trends point to a future of more efficient, customized, and eco-friendly orthopedic care in the UK.

Report Coverage

This research report categorizes the market for the UK orthopedic implant market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom orthopedic implant market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom orthopedic implant market.

United Kingdom Orthopedic Implant Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 3.2 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.42% |

| 2035 Value Projection: | USD 5.72 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 190 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product Type and By Application |

| Companies covered:: | Arthrex, JohnsonandJohnson, Aesculap, Exactech, Orthofix, Stryker, RTI Surgical, B. Braun, Zimmer Biomet, Conmed, Smith and Nephew, Medtronic, Livanova, NuVasive, DePuy Synthes, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing UK orthopaedic implant market is influenced by rapid technological advancements, an aging population, and rising sports-related injuries. The NHS is increasing its surgical capacity to meet the growing demand for implants owing to the overall increase in joint problems in the elderly. The high-specification manufacturers are investing heavily in technologically advanced innovations, such as 3D-printed custom-made implants, which will also improve patient outcomes in some cases. The growth of the market will now also be aided by the increase in sports injuries and thus necessitating the need for orthopaedic procedures and implants, mainly among younger individuals.

Restraining Factors

The high cost of advanced implant procedures is a barrier to access, especially in publicly funded health care systems, such as the NHS. Post-operative complications, failure of implants, and regulatory approvals could possibly cause barriers to the market growth. Manufacturers and providers are facing more barriers from the lengthy approval processes and limited reimbursement policies. These factors hamper the orthopedic implant market during the forecast period.

Market Segmentation

The United Kingdom orthopedic implant market share is classified into product type and application.

- The metallic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom orthopedic implant market is segmented by product type into metallic, ceramic, and others. Among these, the metallic segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Metallic implants are well-suited for many orthopaedic procedures due to their strength and durability. Metallic implants' inherent strength and durability are a large reason for their great use in the UK, and for many medical professionals, they are a preferred choice.

- The spinal implants segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom orthopedic implant market is segmented by application into spinal implants, reconstructive joint implants, orthobiologics, and others. Among these, the spinal implants segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increasing number of surgical procedures on elderly patients and the increasing number of spinal diseases have led to increased interest in spinal implants.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom orthopedic implant market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arthrex

- JohnsonandJohnson

- Aesculap

- Exactech

- Orthofix

- Stryker

- RTI Surgical

- B. Braun

- Zimmer Biomet

- Conmed

- Smith and Nephew

- Medtronic

- Livanova

- NuVasive

- DePuy Synthes

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom orthopedic implant market based on the below-mentioned segments:

United Kingdom Orthopedic Implant Market, By Product Type

- Metallic

- Ceramic

- Others

United Kingdom Orthopedic Implant Market, By Application

- Spinal Implants

- Reconstructive Joint Implants

- Orthobiologics

- Others

Need help to buy this report?