United Kingdom Orthopedic Devices Market Size, Share, and COVID-19 Impact Analysis, By Product (Joint Replacement/ Orthopedic Implants, Trauma, Sports Medicine, Orthobiologics, and Others), By End Use (Hospitals, and Outpatient Facilities), and UK Orthopedic Devices Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Orthopedic Devices Market Forecasts to 2035

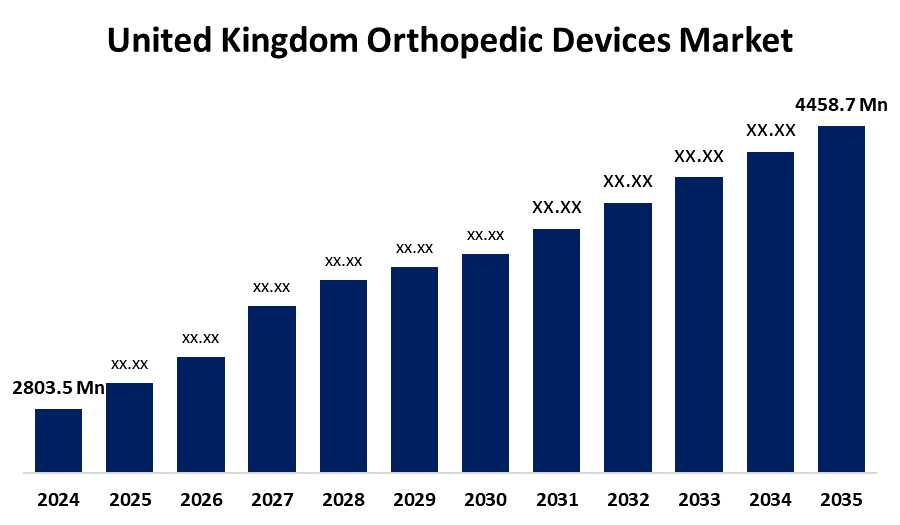

- The United Kingdom Orthopedic Devices Market Size Was Estimated at USD 2803.5 Million in 2024

- The UK Orthopedic Devices Market Size is Expected to Grow at a CAGR of around 4.31% from 2025 to 2035

- The UK Orthopedic Devices Market Size is Expected to Reach USD 4458.7 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The UK Orthopedic Devices Market Size is anticipated to reach USD 4458.7 Million by 2035, growing at a CAGR of 4.31% from 2025 to 2035. A high prevalence of orthopaedic conditions, an ageing population, an increase in degenerative bone disease, and an increase in traffic accidents are the main factors propelling the market.

Market Overview

The UK orthopedic devices market refers to devices that treat musculoskeletal issues affecting the bones or joints. such as rods, pins, and plates, are used to treat joint and bone issues by stabilizing fractures. Recent advancements include 3D printing, robotics, and AI integration, enhancing surgical precision, customization, and treatment planning in orthopedic procedures for improved patient outcomes and recovery. The market for orthopedic devices is growing rapidly. Robots help enhance recovery and outcomes by providing accuracy, limiting trauma-damaging soft tissue, and creating individualised treatment plans. In the UK, market growth is supported by an ageing population, changing diagnostic trends regarding orthopedic conditions such as osteoporosis and arthritis, and ongoing NHS funding. The trend is also towards efficient recovery and patient experience, with a trend towards minimally invasive surgery and customized orthopedic devices. In addition, digital healthcare technologies such as telemedicine and remote monitoring solutions to enhance pre- and post-operative care. The focus on value-based healthcare is shifting the emphasis from cost to patient outcomes, influencing device selection and surgical methods. Sustainability efforts are also shaping product development through green design technologies. In the UK, increasing sports participation and improved healthcare infrastructure further support the demand for advanced orthopedic solutions, highlighting strong business potential in innovative, personalized, and minimally invasive orthopedic care.

Report Coverage

This research report categorizes the market for the UK orthopedic devices market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom orthopedic devices market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom orthopedic devices market.

United Kingdom Orthopedic Devices Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2803.5 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.31% |

| 2035 Value Projection: | USD 4458.7 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 157 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Product and By End Use |

| Companies covered:: | Smith and Nephew, DePuy Synthes, Orthofix, Stryker Corporation, NuVasive, Braun Melsungen, Hozelock, Conmed Corporation, DJO Global, Aesculap, MicroPort Scientific, Osseon, RTI Surgical, Zimmer Biomet, Medtronic, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing incidence of musculoskeletal disorders due to an ageing population, increasing obesity, and changing lifestyles is driving growth in the UK orthopaedic devices market. Advances in technology, such as 3D printing, robotics, and minimally invasive procedures, enhance treatment efficiency and outcomes. Demand is driven by an ageing population and the cost of healthcare. Government support and NHS investments in innovation, which provide access to innovative orthopaedic solutions, are creating strong market growth opportunities.

Restraining Factors

Adoption of orthopaedic devices is hindered by product recalls that are a result of either defects or manufacturing errors; both affect patient trust and the bottom line for manufacturers. The increase in adverse events, including defective knee implants and defects in the packaging, has created a threat to patient safety. Therefore, orthopaedic device manufacturers must adequately market their products and appropriately anticipate and communicate risk. These factors hamper the orthopedic devices market during the forecast period.

Market Segmentation

The United Kingdom orthopedic devices market share is classified into product and end use.

- The joint replacement/ orthopedic implants segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom orthopedic devices market is segmented by product into joint replacement/ orthopedic implants, trauma, sports medicine, orthobiologics, and others. Among these, the joint replacement/ orthopedic implants segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increasing prevalence of osteoarthritis and other degenerative joint conditions, particularly among aging populations. Advancements in implant technology, minimally invasive procedures, and rising patient awareness drive demand. Additionally, the growing desire for improved mobility and quality of life supports market dominance.

- The hospitals segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom orthopedic devices market is segmented by end use into hospitals, and outpatient facilities. Among these, the hospitals segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is partly due to the existence of many therapeutic possibilities and the large infrastructure in place. In addition, it is expected that the increasing number of hospitalizations for bone fractures and injuries from car accidents will drive the market growth. The high demand for hospital services may be attributed to fair reimbursement policies for patients seeking to be treated in facility-based settings, hospitals instead of outpatient facilities, and the longstanding presence of many hospitals and primary care centers.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom orthopedic devices market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Smith and Nephew

- DePuy Synthes

- Orthofix

- Stryker Corporation

- NuVasive

- Braun Melsungen

- Hozelock

- Conmed Corporation

- DJO Global

- Aesculap

- MicroPort Scientific

- Osseon

- RTI Surgical

- Zimmer Biomet

- Medtronic

- Others

Recent Developments:

- In July 2025, UK-based Osteotec secured an exclusive distribution agreement with German spine-implant maker Ulrich Medical. This expands Osteotec’s spine portfolio for NHS and private healthcare, offering advanced vertebral body replacement and fusion systems

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom orthopedic devices market based on the below-mentioned segments:

United Kingdom Orthopedic Devices Market, By Product

- Joint Replacement/ Orthopedic Implants

- Trauma

- Sports Medicine

- Orthobiologics

- Others

United Kingdom Orthopedic Devices Market, By End Use

- Hospitals

- Outpatient Facilities

Need help to buy this report?