United Kingdom Orthodontic Supplies Market Size, Share, and COVID-19 Impact Analysis, By Product (Fixed Braces, Removable Braces, Adhesives, Accessories), By Patient (Children, Teenagers, Adults) and By End User (Hospitals, Clinics, Others) and United Kingdom Orthodontic Supplies Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Orthodontic Supplies Market Forecasts to 2035

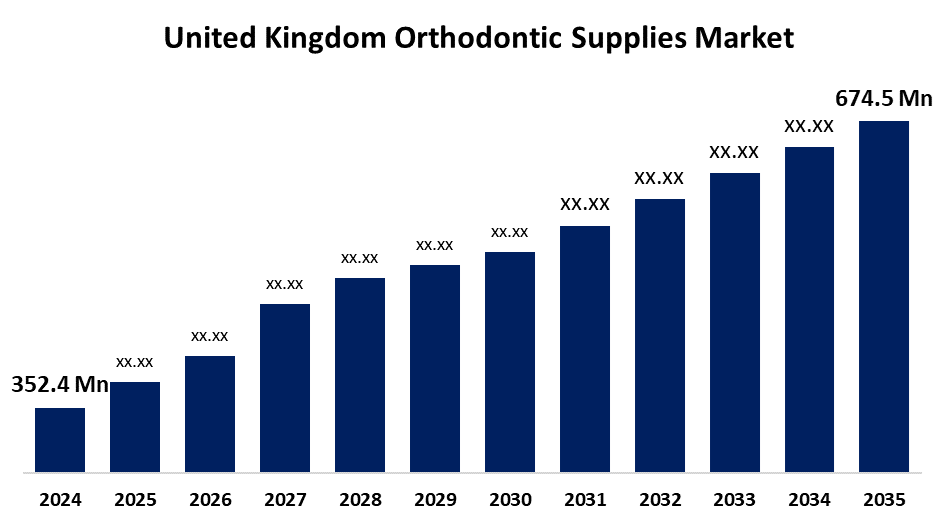

- The United Kingdom Orthodontic Supplies Market Size Was Estimated at USD 352.4 Million 2024

- The United Kingdom Orthodontic Supplies Market Size is Expected to Grow at a CAGR of around 6.08% from 2025 to 2035

- The United Kingdom Orthodontic Supplies Market Size is Expected to Reach USD 674.5 million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Orthodontic Supplies Market Size is anticipated to reach USD 674.5 Million by 2035, Growing at a CAGR of 6.08% from 2025 to 2035. The rising demand for orthodontic treatment choices, especially among adults who are increasingly looking for aesthetic solutions like clear aligners, is one of the major factors propelling the market.

Market Overview

The United Kingdom Orthodontic Supplies Market refers to dentistry field known as orthodontics tackles malocclusion, a condition in which a person's teeth are misaligned, leading to an incorrect bite and other associated issues. Some of the reasons supporting the market's growth during the forecast period include the rising prevalence of dental misalignment among young peoples in the United Kingdom and the growing patient preference for invisible aligners. Increasing awareness of oral health has led to higher expectations regarding the quality and performance of orthodontic products, emphasizing the need for suppliers to maintain exceptional standards. Additionally, the adoption of digital technologies such as 3D printing, CAD/CAM technology and tele orthodontics is transforming the industry by streamlining workflows and enhancing patient experiences. These digital tools are increasingly being used for diagnostics and treatment planning, helping orthodontic practices to improve efficiency.

The United Kingdom market presents promising opportunities, particularly through stronger collaborations between orthodontic suppliers and dental professionals, which can drive innovation in product development and service delivery. Moreover, as public understanding of the advantages of orthodontic care increases, there is potential for further market expansion.

A notable change in recent years is the growing reliance on digital distribution channels, with online sales of orthodontic supplies on the rise. This shift toward e-commerce allows suppliers to refine their marketing strategies to better reach both dental practitioners and end consumers. Support from the United Kingdom government in enhancing oral health and improving access to dental services is also expected to contribute positively to the ongoing growth of the orthodontic supplies sector.

Report Coverage

This research report categorizes the market for the United Kingdom orthodontic supplies market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom orthodontic supplies market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom orthodontic supplies market.

United Kingdom Orthodontic Supplies Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 352.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.08% |

| 2035 Value Projection: | USD 674.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 180 |

| Tables, Charts & Figures: | 105 |

| Segments covered: | By Product, By Patient, By End User and COVID-19 Impact Analysis |

| Companies covered:: | A-Z Orthodontics, Ashford Orthodontics,, United Kingdom Ortho LTD, Ortho-Care United Kingdom, Henry Schein, Dentaurum, GAC International, Adec, Ultradent Products, GC Orthodontics, Ortho Organizers, Align Technology, American Orthodontics, Dentsply Sirona and others key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The United Kingdom orthodontic supplies market is expanding rapidly, fueled by growing public awareness of oral health and the desire for aesthetic improvements. Increasing the incidence of malocclusion among patients as more people experiencing irregular teeth, misalignment of jaws. An 18% rise in orthodontic treatments has been linked to both health campaigns and the influence of social media promoting perfect smiles. Technological innovations such as 3D printing and digital scanning have enhanced treatment speed and accuracy, while companies like Align Technology are producing more advanced, better-fitting aligners. Additionally, increased government funding for paediatric dental care and ongoing public health investments are improving access to orthodontic services, further driving demand for supplies.

Restraining Factors

The increasing incidence of dental malocclusions and the introduction of advanced treatment technologies. However, the industry's expansion is being constrained by the high cost of malocclusion therapy and its limited side effects, which include tooth discolouration or breaking from continuous use. Therefore, the primary reasons why people in the United Kingdom choose not to receive treatment are the high cost of the products, the possibility of undesirable outcomes, social embarrassment, and side effects related to the treatment. The market is suffering as a result, and the demand for orthodontic products in the United Kingdom is being hampered.

Market Segmentation

The United Kingdom orthodontic supplies market share is classified into product, patient, and end user.

- The fixed braces segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom orthodontic supplies market is segmented by product into fixed braces, removable braces, adhesives, accessories. Among these, the fixed braces segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The industry is dominated by fixed braces because they work well to cure intricate tooth abnormalities. They have many benefits, like applying steady pressure on teeth throughout time, which improves treatment results. Their effectiveness, affordable cost in comparison to alternative solutions like clear aligners, and their efficacy in treating severe malocclusions. Fixed braces are a popular option for both adults and children because they provide consistent and dependable outcomes.

- The children segment held a significant market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom orthodontic supplies market is segmented by patient into children, teenagers, adults. Among these, the children segment held a significant market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Greater prevalence of malocclusion and other orthodontic disorders in young children, growing parental understanding of the value of early treatments, and government programs supporting dental health. The domination of the industry is also attributed to the availability of comfortable and kid-friendly equipment, as well as early diagnosis and treatment.

- The hospitals segment held a highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom orthodontic supplies market is segmented by end user into hospitals, clinics, others. Among these, the hospital segment held a highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Due to the large amount of patient, they treat and their ability to offer interdisciplinary care. Hospitals, especially in urban areas, or serving broad areas, require a large amount of patients, which requires high demand for supply. In addition, hospitals often integrate orthodontics with other dental specifics, such as periodontics and prosthodontics, further increase the requirement of special orthodontic materials.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom orthodontic supplies market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market

List of Key Companies

- A-Z Orthodontics

- Ashford Orthodontics,

- United Kingdom Ortho LTD

- Ortho-Care United Kingdom

- Henry Schein

- Dentaurum

- GAC International

- Adec

- Ultradent Products

- GC Orthodontics

- Ortho Organizers

- Align Technology

- American Orthodontics

- Dentsply Sirona

- Others

Recent Developments:

- In August 2023: Dentsply Sirona has acquired a prominent technology company to strengthen its digital workflow solutions, highlighting the ongoing trend of consolidation among leading suppliers in the industry.

- In October 2022: Align Technology introduced the Invisalign Go Express system in the United Kingdom, designed for mild to moderate dental issues. This addition enhances treatment efficiency and caters to the growing demand for personalized and discreet orthodontic solutions.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom orthodontic supplies market based on the below-mentioned segments:

United Kingdom Orthodontic Supplies Market, By Product

- Fixed Braces

- Removable Braces

- Adhesives

- Accessories

United Kingdom Orthodontic Supplies Market, By Patient

- Children

- Teenagers

- Adults

United Kingdom Orthodontic Supplies Market, By End User

- Hospitals

- Clinics

- Others

Need help to buy this report?