United Kingdom Orthobiologics Market Size, Share, and COVID-19 Impact Analysis, By Product (Demineralized Bone Matrix (DBM), Allograft, Bone Morphogenetic Protein (BMP), Viscosupplementation, Synthetic Bone Substitutes, and Stem Cell Therapy), By Application (Spinal Fusion, Trauma Repair, and Reconstructive Surgery), and UK Orthobiologics Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Orthobiologics Market Forecasts to 2035

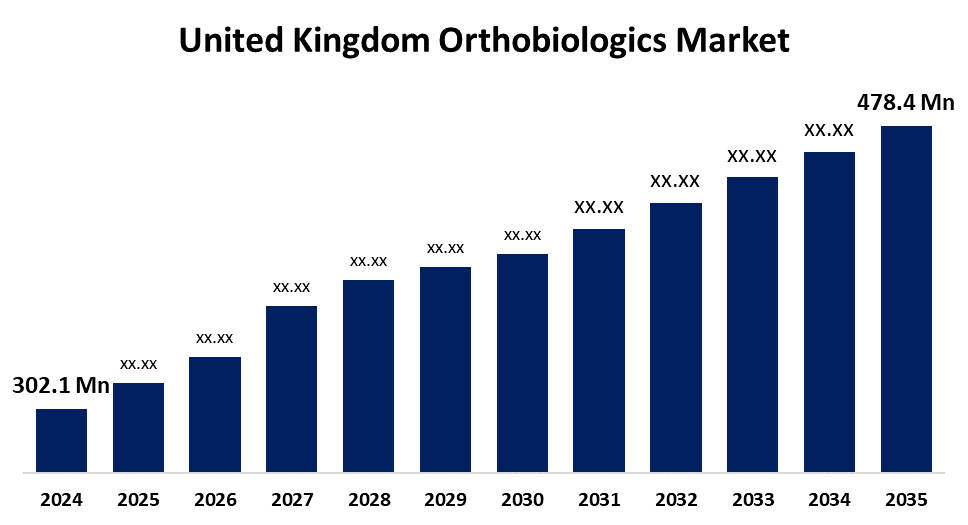

- The United Kingdom Orthobiologics Market Size Was Estimated at USD 302.1 Million in 2024

- The UK Orthobiologics Market Size is Expected to Grow at a CAGR of around 4.27% from 2025 to 2035

- The UK Orthobiologics Market Size is Expected to Reach USD 478.4 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The UK Orthobiologics Market Size is anticipated to reach USD 478.4 Million by 2035, growing at a CAGR of 4.27% from 2025 to 2035. Key factors contributing to market growth are the increased incidence of sports injuries and road traffic accidents, the adoption of minimally invasive surgeries, the growing incidence of orthopedic surgeries, and an aging population.

Market Overview

The UK orthobiologics market refers to regenerative cellular therapies, use growth factors that can help enhance tissue repair, reduce pain, and restore function. Orthobiologics are often made from the patient's cells and can be applied to a variety of conditions, such as recovery from fractures and spinal fusions, as well as assisting with faster injury healing of joints such as the hips, knees, ankles, and wrists. The orthopedics industry is being driven by an increase in sports participation and an aging population, leading to increased injuries such as hip, knee, and shoulder fractures, which are creating opportunities for surgeries. The orthobiologics market is growing with significant R&D investments and funding from leading medical device and biotechnology companies. Recent innovations are enhancing the value of orthopedic care, including bone graft substitutes, platelet-rich plasma (PRP) therapy, stem cell treatments, advanced imaging technologies (MRI, CT), and 3D printing for custom implants. Innovations in biotechnology and genetic engineering are also improving regenerative capacity, enabling faster healing and better patient outcomes. There is also a very active mergers and acquisitions market to consolidate leading orthopedics companies in a competitive landscape, with improved options and outcomes for patients.

The market is developing an increasing awareness of orthobiologics as effective therapeutic options. An additional factor driving the demand for orthobiologics can be attributed to the increasing trend of joint replacement surgeries occurring within the nation. The number of knee replacement surgeries is significant. According to NHS data, there are over 70,000 knee replacements performed each year in England and Wales, and the numbers are increasing. The majority of patients receiving total knee replacements will be 65 years of age and older.

Report Coverage

This research report categorizes the market for the UK orthobiologics market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom orthobiologics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom orthobiologics market.

United Kingdom Orthobiologics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 302.1 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.27% |

| 2035 Value Projection: | USD 478.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 1,578 |

| Tables, Charts & Figures: | 99 |

| Segments covered: | By Product and By Application |

| Companies covered:: | Smith & Nephew, Locate Bio, Apatech, Medtronic, Stryker, Zimmer Biomet, Arthrex, NuVasive, DePuy Synthes (Johnson & Johnson), Bioventus, and Others |

| Pitfalls & Challenges: | COVID-19 Impact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for orthobiologics is primarily driven by the aging population and the rising rates of osteoarthritis of the knee. These therapies deliver natural, regenerative solutions for musculoskeletal ailments such as osteoarthritis, fractures, tendon and ligament injuries, and other conditions. Orthobiologics can also expedite rehabilitation, enhance recovery, and reduce pain medication dependence. Furthermore, there is increasing demand for minimally invasive surgery alternatives driven by increased rates of injuries related to athletics and the geriatric community, and the level of interest in sports and physical activity.

Restraining Factors

The orthobiologics market faces challenges, including high treatment costs that restrict accessibility, limited reimbursement policies, inconsistent clinical outcomes, and tough regulatory approval processes. Each factor limits the market further and hinders the growth and entry of new companies into the market. These factors hamper the orthobiologics market during the forecast period.

Market Segmentation

The United Kingdom orthobiologics market share is classified into product and application.

- The viscosupplementation segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom orthobiologics market is segmented by product into demineralized bone matrix (DBM), allograft, bone morphogenetic protein (BMP), viscosupplementation, synthetic bone substitutes, and stem cell therapy. Among these, the viscosupplementation segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Increased product launches along with a growing osteoarthritis patient population are projected to drive market growth. Viscosupplementation with hyaluronic acid injections is commonly used to treat osteoarthritis due to its convenience and higher tolerance, which is contributing to market growth.

- The spinal fusion segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom orthobiologics market is segmented by application into spinal fusion, trauma repair, and reconstructive surgery. Among these, the spinal fusion segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The spinal fusion segment leads the UK orthobiologics market on the back of the prevalence of spinal disorders in this country, especially in the elderly population. Biologics helped to improve bone healing, strong reimbursement schemes, and superior surgical facilities have enabled spinal fusion procedures to increase in frequency, driving demand and revenue in this segment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom orthobiologics market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Smith & Nephew

- Locate Bio

- Apatech

- Medtronic

- Stryker

- Zimmer Biomet

- Arthrex

- NuVasive

- DePuy Synthes (Johnson & Johnson)

- Bioventus

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom orthobiologics market based on the below-mentioned segments:

United Kingdom Orthobiologics Market, By Product

- Demineralized Bone Matrix (DBM)

- Allograft

- Bone Morphogenetic Protein (BMP)

- Viscosupplementation

- Synthetic Bone Substitutes

- Stem Cell Therapy

United Kingdom Orthobiologics Market, By Application

- Spinal Fusion

- Trauma Repair

- Reconstructive Surgery

Need help to buy this report?