United Kingdom Ophthalmic Drugs Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Gels, Eye Solutions & Suspensions, Capsules and Tablets, Eye Drops, and Ointments), By Drug Class (Anti-allergy, Anti-inflammatory, Non-steroidal drugs, Steroidal drugs, Anti-VEGF Agents, Anti-glaucoma, and Others), By Route of Administration (Topical, Local Ocular, Subconjunctival, [Intravitreal, Retrobulbar, Intracameral], and Systemic), and United Kingdom Ophthalmic Drugs Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited Kingdom Ophthalmic Drugs Market Insights Forecasts to 2035

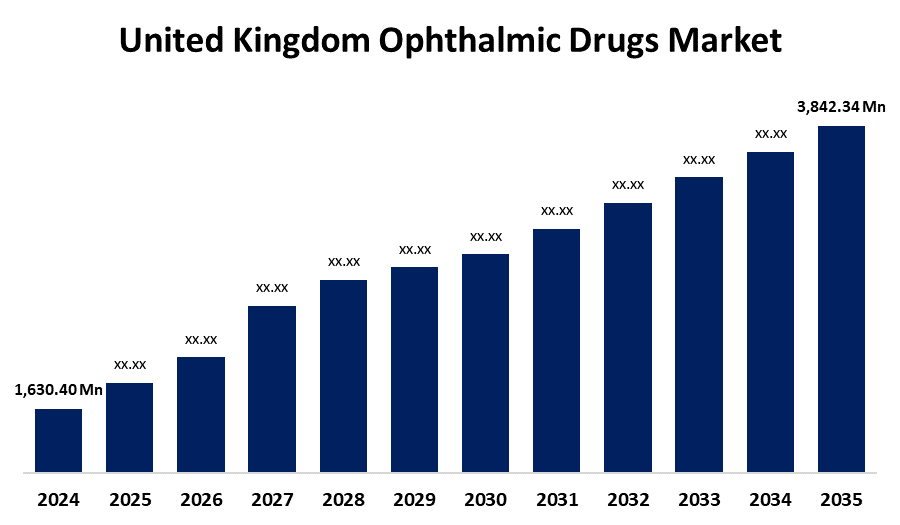

- The United Kingdom Ophthalmic Drugs Market Size was estimated at USD 1,630.40 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.10% from 2025 to 2035

- The United Kingdom Ophthalmic Drugs Market Size is Expected to Reach USD 3,842.34 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Ophthalmic Drugs Market Size is Anticipated to reach USD 3,842.34 Million By 2035, Growing at a CAGR of 8.10% from 2025 to 2035. The development of novel medications and treatment approaches is also being aided by cooperation between pharmaceutical corporations, educational institutions, and research groups propels the market expansion.

Market Overview

The United Kingdom ophthalmic drugs market refers to the business related to the healthcare sector that focuses on the production and distribution of medicine, which can diagnose and support pre-determined prevention for the eye and its supportive functional parts from any eye health-related illnesses. Ophthalmic drug administration is when a medication is administered directly to the eyes; this usually takes the form of eye drops. Mostly, topical medicines are used to treat a variety of eye diseases such as bacterial infections, dry eye, glaucoma, and eye damage. The main features of ophthalmic preparations are stability, particle limits, sterility, preservation, pH, and eye comfort. The first requirement is cleanliness; it is crucial to make sure that any medications are administered to the eyes. The nation's gradually increasing aging population and the growing incidence of eye-related disorders in both adults and children are expected to have a substantial influence on the need for ophthalmic pharmaceuticals going forward. Particularly for diabetes-oriented patients, such drugs are in growing need because, in some cases, there is an incidence of high adverse reactions on the eye and its related vision system. Besides, recent development addressing the influence of this drugs market expansion across the UK, for instance, in May 2025, the Medicines and Healthcare products Regulatory Agency (MHRA) approved teprotumumab (Tepezza) as the first licensed treatment in the UK for moderate to severe Thyroid Eye Disease (TED). TED was an autoimmune condition where the immune system attacked the muscles and fat around the eyes, leading to inflammation, swelling, and vision impairment.

Report Coverage

This research report categorizes the market for the United Kingdom ophthalmic drugs market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom ophthalmic drugs market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom ophthalmic drugs market.

United Kingdom Ophthalmic Drugs Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,630.40 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.10% |

| 2035 Value Projection: | USD 3,842.34 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 188 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Product Type, By Drug Class, By Route of Administration and COVID-19 Impact Analysis |

| Companies covered:: | Rayner, GlaxoSmithKline (GSK), AstraZeneca, Novartis Pharmaceuticals, Bausch & Lomb UK Ltd, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom ophthalmic drugs is driven by the growing prevalence of eye-related conditions, more research and development efforts for the manufacture of ophthalmic medications, and heightened focus on the creation of combination treatments. Further, there is a high demand as a result of the increased risk of diabetic retinopathy (DR) brought on by the general public's growing prevalence of diabetes and sedentary lifestyle habits. The rising incidence of allergies and eye infections is also expected to present this market with significant growth prospects. Furthermore, growing awareness of ocular illnesses and pre-detection symptoms is expected to drive the market growth. Moreover, the growing population of elder individuals might be driving this market expansion. Furthermore, the market for ophthalmic medications has seen technical breakthroughs that have stimulated the development of novel formulations and drug delivery systems, including sustained-release compositions.

Restraining Factors

The delay procedure for permission to use from the regulatory authorities with rigid laws and a shortage of precise adherence to medication are some barriers that restrain the wide market adoption.

Market Segmentation

The United Kingdom ophthalmic drugs market share is classified into product type, drug class, and route of administration.

- The eye drops segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom ophthalmic drugs market is divided by product type into gels, eye solutions & suspensions, capsules and tablets, eye drops, and ointments. Among these, the eye drops segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the treatment of ocular conditions such as glaucoma, corneal ulcers, and acute allergies, eye drops are the most used drug delivery method. By addressing particular eye structures, such as the cornea, conjunctiva, or intraocular tissues, where this treatment is required and enable localized drug delivery to the ocular surface. The growth of the eye drop sector market is influenced by the prevalence of eye illnesses as well as the growing over-the-counter availability of eye drops.

- The anti-VEGF agents segment held the highest share in 2024 and is anticipated to grow at a notable CAGR over the forecast period.

The United Kingdom ophthalmic drugs market is segmented by drug class into anti-allergy, anti-inflammatory, non-steroidal drugs, steroidal drugs, anti-VEGF agents, anti-glaucoma, and others. Among these, the anti-VEGF agents segment held the highest share in 2024 and is anticipated to grow at a notable CAGR over the forecast period. This is because these substances help treat diseases of the eyes that result in the formation of new blood vessels or edema related to the retina. Furthermore, the entry of novel medicines to the market is being facilitated by an increase in research activity concerning anti-VEGF medications for various ocular illnesses.

- The local ocular segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The United Kingdom ophthalmic drugs market is differentiated by route of administration into topical, local ocular, subconjunctival, [intravitreal, retrobulbar, intracameral], and systemic. Among these, the local ocular segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period. This is due to the intraocular route makes it easier for medications to enter the blood-retinal barrier directly, and the largest possible peak in drug concentration can be reached. The posterior segment tissues of the eye, such as the macula or fovea, which contain cones, are where it reaches its highest intraocular bioavailability, which enables to segment to grow significantly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom ophthalmic drugs market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Rayner

- GlaxoSmithKline (GSK)

- AstraZeneca

- Novartis Pharmaceuticals

- Bausch & Lomb UK Ltd

- Others

Recent Developments:

- In December 2024, Tenpoint Therapeutics Ltd. and Visus Therapeutics, Inc. merged, creating a powerhouse in ophthalmic medicine innovation. This collaboration aimed to advance best- and first-in-class treatments for aging-related eye conditions, including presbyopia, cataracts, and geographic atrophy. One of their key developments has BRIMOCHOL™ PF, a presbyopia-correcting eye drop combining carbachol and brimonidine, which was expected to be filed for NDA approval in 2025 and planned for commercial launch in the U.S. by 2026.

- In July 2023, Santen launched Roclanda® in the UK, marking a significant milestone in glaucoma treatment—the first new class of medication for the condition in Europe in 25 years. Roclanda® was a fixed-dose combination of latanoprost and netarsudil, a Rho-kinase (ROCK) inhibitor, designed to lower intraocular pressure (IOP) by targeting trabecular meshwork (TM) dysfunction.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom ophthalmic drugs market based on the below-mentioned segments

United Kingdom Ophthalmic Drugs Market, By Product Type

- Gels

- Eye Solutions & Suspensions

- Capsules and Tablets

- Eye Drops

- Ointments

United Kingdom Ophthalmic Drugs Market, By Drug Class

- Anti-allergy

- Anti-inflammatory

- Non-steroidal drugs

- Steroidal drugs

- Anti-VEGF Agents

- Anti-glaucoma

- Others

United Kingdom Ophthalmic Drugs Market, By Route of Administration

- Topical

- Local Ocular

- Subconjunctival [Intravitreal, Retrobulbar, Intracameral]

- Systemic

Need help to buy this report?