United Kingdom Online Food Delivery Services Market Size, Share, and COVID-19 Impact Analysis, By Type (Restaurant-to-Consumer, Platform-to-Consumer), By Channel (Website/Desktop, Mobile Applications), and UK Online Food Delivery Services Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited Kingdom Online Food Delivery Services Market Size Forecasts to 2035

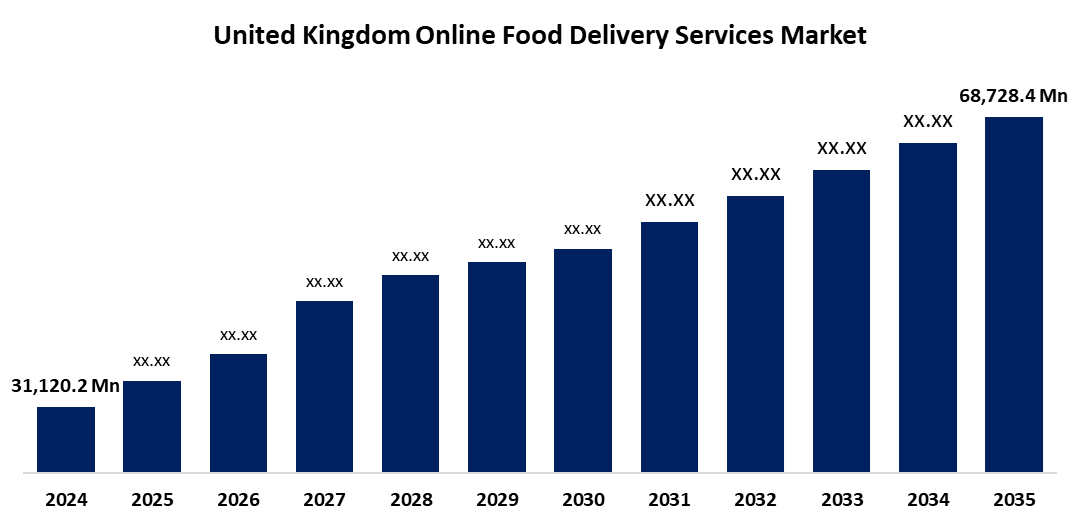

- The United Kingdom Online Food Delivery Services Market Size Was Estimated at USD 31,120.2 Million in 2024

- The UK Online Food Delivery Services Market Size is Expected to Grow at a CAGR of around 7.47% from 2025 to 2035

- The UK Online Food Delivery Services Market Size is Expected to Reach USD 68,728.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the UK Online Food Delivery Services Market Size is anticipated to reach USD 68,728.4 Million by 2035, growing at a CAGR of 7.47% from 2025 to 2035. The rising smartphone use, urbanization, busy lifestyles, cloud kitchens, AI-driven personalization, and consumer demand for convenience, speed, and contactless transactions post-COVID-19.

Market Overview

The UK Online Food Delivery Services Market Size refers to a customers may quickly choose restaurants, menu items, and delivery or pickup options through websites or apps when they purchase food online. Families, working professionals, and others who prefer easy, rapid access to their favourite meals at home are drawn to it because of its convenience. The widespread use of smartphones and high-speed internet has made online food ordering convenient and accessible, especially for urban consumers seeking quick meal solutions. The rise of cloud kitchens, delivery-only kitchens without dine-in spaces, has lowered operational costs, boosting market scalability. Strategic partnerships between delivery platforms and restaurants have expanded menu options, enhancing customer experience. Evolving payment methods like digital wallets and contactless payments have simplified transactions, encouraging adoption. The COVID-19 pandemic accelerated growth by increasing demand for contactless delivery. Changing lifestyles, dual-income families, and a desire for affordable, quick food access further drive market growth. Attractive discounts, rewards, and doorstep delivery incentivize users, while providers invest in warehouses to ensure fresh produce and quality food. Subscription models that include advantages like free delivery greatly improve customer retention factors. The emergence of dark kitchens is catching up with the demands of convenience and variety. AI-driven chatbots and voice assistants facilitate users to order food quickly, while gamification and personalized suggestions help to engage the user, creating an active and customer-centric online food delivery service market.

Report Coverage

This research report categorizes the market for the UK online food delivery services market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom online food delivery services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom online food delivery services market.

United Kingdom Online Food Delivery Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 31,120.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 7.47% |

| 2035 Value Projection: | USD 68,728.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 159 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Type, By Channel and COVID-19 Impact Analysis |

| Companies covered:: | Delivery Hero, Grab Holdings, Yum! Brands, DoorDash, Zomato, Hungryhouse, Just Eat, Deliveroo, Uber Eats, HungryPanda, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The convenience provided by these services, along with their deep technology integration, is the main factor propelling the online food delivery market. With only a few clicks, customers can easily order food, which is very convenient considering how busy many consumer's lives are these days. Furthermore, the incorporation of cutting-edge technologies like artificial intelligence (AI) and machine learning, which improve user experience through tailored recommendations and more effective service delivery mechanisms, has driven the industry.

Restraining Factors

Intense competition from the industry’s leading players has led to aggressive price practices, which have resulted in downward pressure on profit margins. When also factoring in delivery expenses, gasoline, and driver expenses. Consumers' concerns about food quality, the sustainability of food packaging, food safety, and data privacy may also be potential deterrents. Furthermore, reliance on third-party delivery drivers presents issues of reliability, which can have a negative effect on customer satisfaction. These factors hamper the online food delivery services market during the forecast period.

Market Segmentation

The United Kingdom online food delivery services market share is classified into type and channel.

- The platform-to-consumer segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom online food delivery services market is segmented by type into restaurant-to-consumer, platform-to-consumer. Among these, the platform-to-consumer segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. the expansion of the Platform-to-Consumer (P2C) market is expected as hassle-free meal options become more and more desirable due to hectic schedules and time constraints. P2C systems eliminate the necessity for cooking or eating out by enabling clients to order meals to be delivered right to their homes. The adoption rate is especially high in urban regions where fast-paced living is prevalent. These platforms accommodate a range of dietary requirements and interests by providing access to a large number of cuisines via a single app.

- The mobile applications segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom online food delivery services market is segmented by channel into website/desktop, mobile applications. Among these, the mobile applications segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increased use of smartphones has made mobile channels the main way that customers place orders. The ease of meal delivery apps is becoming more widely available as smartphone usage in the UK keeps rising. This tendency has been further pushed by reasonably priced internet connection, which allows consumers in both urban and rural regions to connect and consume content seamlessly. Mobile apps are used by users of all demographics because of their user-friendly layout, speed, and dependability.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom online food delivery services market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Delivery Hero

- Grab Holdings

- Yum! Brands

- DoorDash

- Zomato

- Hungryhouse

- Just Eat

- Deliveroo

- Uber Eats

- HungryPanda

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom online food delivery services market based on the below-mentioned segments:

United Kingdom Online Food Delivery Services Market, By Type

- Restaurant-to-Consumer

- Platform-to-Consumer

United Kingdom Online Food Delivery Services Market, By Channel

- Website/Desktop

- Mobile Applications

Need help to buy this report?