United Kingdom Office Real Estate Market Size, Share, and COVID-19 Impact Analysis, By Type (Grade A Buildings, Grade B Buildings, and Flexible Workspaces), By Occupancy Model (Single-tenant, Multi-tenant, and Serviced Offices), and United Kingdom Office Real Estate Market Insights, Industry Trend, Forecasts to 2035.

Industry: Banking & FinancialUnited Kingdom Office Real Estate Market Insights Forecasts to 2035

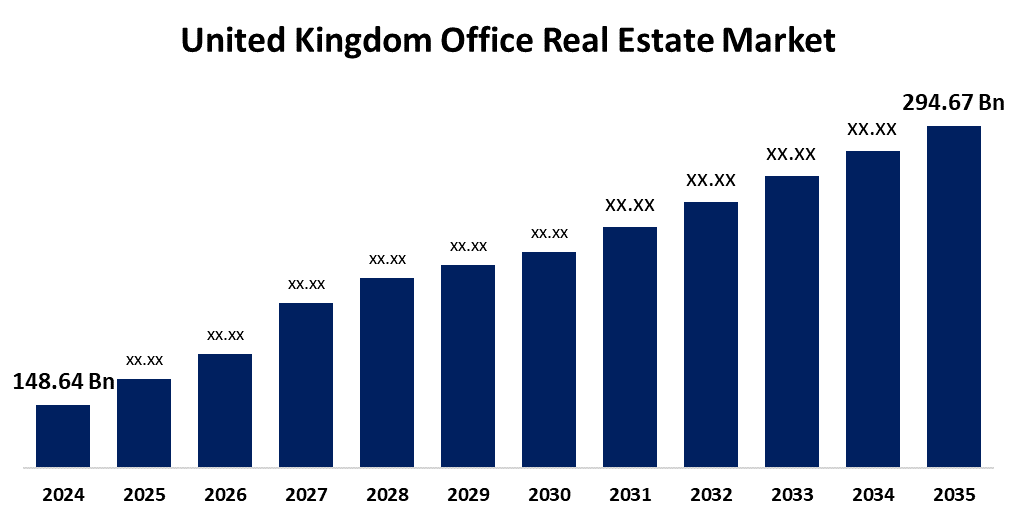

- The United Kingdom Office Real Estate Market Size Was Estimated at USD 148.64 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.42% from 2025 to 2035

- The United Kingdom Office Real Estate Market Size is Expected to Reach USD 294.67 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Office Real Estate Market Size is Anticipated to reach USD 294.67 Billion By 2035, Growing at a CAGR of 6.42% from 2025 to 2035. The increasing hybrid work trends, corporate expansions, urban redevelopment projects, growing demand for flexible workspaces, and technical developments in building management, all of which are bolstered by attractive government investment and infrastructure policies in major cities.

Market Overview

The United Kingdom office real estate market refers to the industry focused on office property development, leasing, purchasing, and selling in the United Kingdom. It encompasses a range of real estate kinds, including commercial buildings, coworking spaces, business parks, and huge office skyscrapers. Economic growth, employment rates, urbanization, technology, and evolving workplace trends including remote and hybrid work models all have an impact on this industry, which supports corporate operations and services a variety of industries. The growth of hybrid office formats and flexible workspaces. New investment opportunities are created by the growing demand for intelligent, energy-efficient buildings and sustainable building techniques. Older office buildings can be renovated into contemporary, tech-enabled hubs that draw in international corporations and startups. Furthermore, government funding for regional development and infrastructure improves chances in developing areas outside of London, encouraging balanced commercial and economic growth throughout the United Kingdom. Focusing on adaptive reuse, sustainable building practices, and smart building technologies. IoT is being integrated by developers for real-time monitoring, touchless access, and energy saving. Additionally popular are green certifications like BREEAM and modular construction techniques, which improve tenant appeal and the environment.

Report Coverage

This research report categorizes the market for the United Kingdom office real estate market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom office real estate market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom office real estate market.

United Kingdom Office Real Estate Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 148.64 Billion |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 6.42% |

| 2035 Value Projection: | USD 294.67 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 189 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Type, By Occupancy Model and COVID-19 Impact Analysis |

| Companies covered:: | British Land, Land Securities Group, Workspace Group, Great Portland Estates, Derwent London, Segro, Helical, CLS Holdings, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The changing nature of workspaces as an outcome of growing demand for flexible office solutions and hybrid work methods. Modern, tech-enabled offices that promote sustainability, employee well-being, and cooperation are what businesses are looking for. Energy-efficient buildings with green certifications are becoming more and more popular among developers as the consequence of the increased focus on ESG (Environmental, Social, and Governance) standards. Infrastructure development and urban renewal initiatives, especially in places like Manchester and London, increase demand. The office real estate industry is also expanding as a consequence of cheap loan rates and significant institutional investor interest in commercial assets.

Restraining Factors

The continuing complexity around advances in remote and mixed work. There is less demand as a result of many companies decreasing down on office space. Economic uncertainty, regulatory barriers, and high building costs further restrict investment and growth in the industry.

Market Segmentation

The United Kingdom office real estate market share is classified into type and occupancy model.

- The grade A buildings segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom office real estate market is segmented by type into grade A buildings, grade B buildings, and flexible workspaces. Among these, the grade A buildings segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing demand for upscale office buildings with modern amenities, sustainability certifications, and contemporary infrastructure. These qualities are given top priority by businesses for the efficiency, well-being, and improved reputation of their workforce.

- The multi-tenant segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom office real estate market is segmented by occupancy model into single-tenant, multi-tenant, and serviced offices. Among these, the multi-tenant segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of demand for cost-sharing benefits, tenant diversity, and flexible leasing. Long-term profitability and occupancy are increased when diverse firms are drawn to properties with improved facilities, effective space utilization, and customized property management.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom office real estate market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- British Land

- Land Securities Group

- Workspace Group

- Great Portland Estates

- Derwent London

- Segro

- Helical

- CLS Holdings

- Others.

Recent Developments:

- In May 2024, British Land announced a strategic shift focusing on retail parks due to rising operational costs. The company has introduced over £1.2 billion investment in retail parks since 2020, resulting in a 6% rental income growth in this segment.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom office real estate market based on the below-mentioned segments

United Kingdom Office Real Estate Market, By Material Type

- Grade A Buildings

- Grade B Buildings

- Flexible Workspaces

United Kingdom Office Real Estate Market, By Occupancy Model

- Single-tenant

- Multi-tenant

- Serviced Offices

Need help to buy this report?