United Kingdom Nuclear Imaging Market Size, Share, and COVID-19 Impact Analysis, By Product (Equipment and Diagnostic Radioisotope), By Application (SPECT Applications and PET Applications), and United Kingdom Nuclear Imaging Market Insights, Industry Trend, Forecasts to 2035.

Industry: HealthcareUnited Kingdom Nuclear Imaging Market Insights Forecasts to 2035

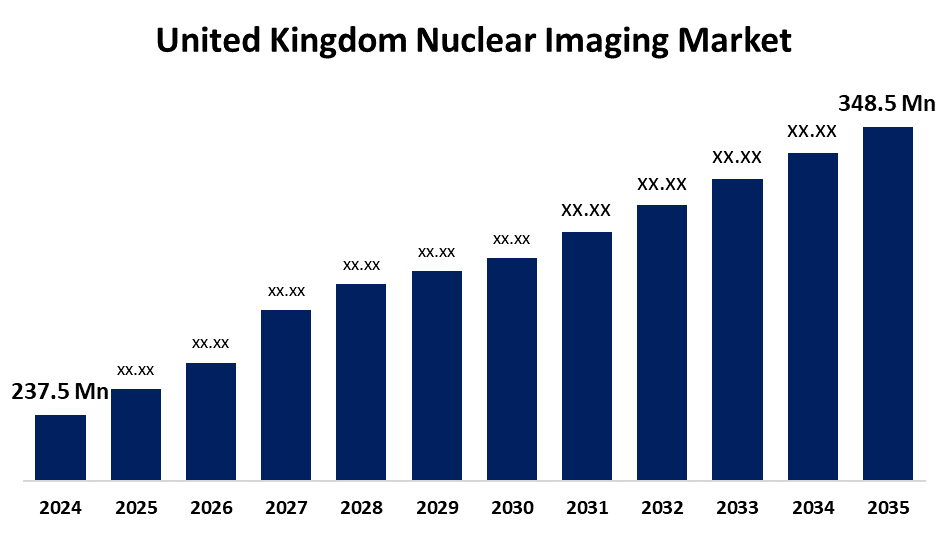

- The United Kingdom Nuclear Imaging Market Size was estimated at USD 237.5 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.55% from 2025 to 2035

- The United Kingdom Nuclear Imaging Market Size is Expected to Reach USD 348.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Nuclear Imaging Market Size is Anticipated to reach USD 348.5 Million By 2035, Growing at a CAGR of 3.55% from 2025 to 2035. The increasing number of cases of chronic illnesses, improved imaging techniques, increased healthcare costs, and faster access to innovative diagnostic services all encourage better early identification and treatment in healthcare facilities.

Market Overview

The United Kingdom nuclear imaging market refers to the industry involves identifying and tracking a range of medical diseases using sophisticated imaging techniques that make use of trace amounts of radioactive elements. These methods, which include PET and SPECT scans, offer comprehensive information about the composition and operation of tissues and organs. Growing healthcare needs and technology improvements in diagnostic imaging within the UK healthcare system are driving the market's support for early illness identification, treatment planning, and monitoring. The growing need for precise and early disease diagnosis, particularly in cardiology and cancer. Nuclear imaging services have become more widely available attributable to government healthcare investments and imaging technology advancements. The market potential is further fueled by rising healthcare provider awareness of customized treatment regimens, which promotes the creation of novel, effective, and secure nuclear imaging technologies. The improvements in radiotracers for improved disease targeting, the creation of hybrid imaging systems such as PET/CT and SPECT/CT, and the use of artificial intelligence for improved picture processing. These developments increase patient safety and treatment achievements, decrease scan times, and improve diagnostic accuracy.

Report Coverage

This research report categorizes the market for the United Kingdom nuclear imaging market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom nuclear imaging market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom nuclear imaging market.

United Kingdom Nuclear Imaging Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 237.5 Million |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 3.55% |

| 2035 Value Projection: | USD 348.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Canon Medical Systems Corporation, Fujifilm Holdings Corporation, GE Healthcare, Koninklijke Philips NV, Siemens Healthineers, Curium, BWX Technologies Inc., Bracco Group, Bayer AG, MR SOLUTION LTD, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing incidence of chronic illnesses that need accurate diagnosis, like cancer, heart disease, and neurological disorders. Improved radiotracers and hybrid systems are two examples of imaging technology advancements that promote early disease detection and diagnostic accuracy. Government programs to upgrade medical infrastructure and rising healthcare costs also contribute to industry expansion. Demand is also increased by patients and clinicians increased understanding of the advantages of nuclear imaging for individualized treatment planning. Adoption is accelerated by the incorporation of AI and machine learning into image analysis, leading to it possible for healthcare institutions to manage patients more effectively and produce faster, more accurate findings.

Restraining Factors

The high prices for sophisticated imaging devices and radiotracers, a shortage of qualified workers, and strict legal requirements for managing radioactive materials. Furthermore, worries regarding radiation exposure and rivalry from other imaging technologies could prevent market expansion and broad acceptance.

Market Segmentation

The United Kingdom nuclear imaging market share is classified into product and application.

- The equipment segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom nuclear imaging market is segmented by product into equipment and diagnostic radioisotope. Among these, the equipment segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing need for sophisticated diagnostic tools, AI integration, and hybrid imaging systems like PET/CT contribute to nuclear imaging equipment investments. Increased workflow efficiency, reduced scan times, and improved accuracy encourage broad adoption in medical facilities and imaging centers.

- The SPECT applications segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom nuclear imaging market is segmented by application into SPECT applications and PET applications. Among these, the SPECT applications segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven because it is essential for the diagnosis of neurological and cardiac conditions. The demand for precise, non-invasive, and reasonably priced imaging solutions is increased by its extensive use in the NHS in addition to the rise in dementia, epilepsy, and heart disease patients.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom nuclear imaging market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Canon Medical Systems Corporation

- Fujifilm Holdings Corporation

- GE Healthcare

- Koninklijke Philips NV

- Siemens Healthineers

- Curium

- BWX Technologies Inc.

- Bracco Group

- Bayer AG

- MR SOLUTION LTD

- Others.

Recent Developments:

- In June 2022, Siemens Healthineers launched the Symbia Pro.Specta, a SPECT/CT system combining advanced SPECT and CT imaging technologies. It offers features like 64-slice CT and automated motion correction, enhancing imaging functionalities and workflow efficiency.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom nuclear imaging market based on the below-mentioned segments

United Kingdom Nuclear Imaging Market, By Product

- Equipment

- Diagnostic Radioisotope

United Kingdom Nuclear Imaging Market, By Application

- SPECT Applications

- PET Applications

Need help to buy this report?