United Kingdom Network Equipment Market Size, Share, and COVID-19 Impact Analysis, By Component (Hardware, Software), By Network (Private Network, Public Network), and United Kingdom Network Equipment Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited Kingdom Network Equipment Market Size Insights Forecasts to 2035

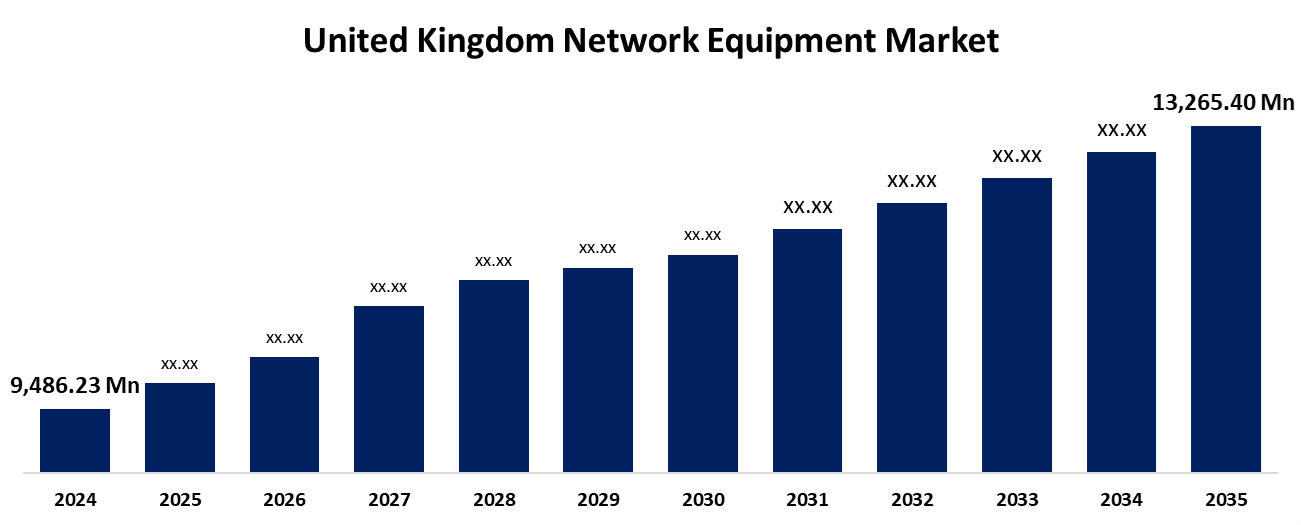

- The United Kingdom Network Equipment Market Size was estimated at USD 9,486.23 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 3.10% from 2025 to 2035

- The United Kingdom Network Equipment Market Size is Expected to Reach USD 13,265.40 Million by 2035

Get more details on this report -

The United Kingdom Network Equipment Market Size is anticipated to reach USD 13,265.40 million by 2035, growing at a CAGR of 3.10% from 2025 to 2035. It is anticipated that this sector will keep growing as technology advances and the need for worldwide communication increases.

Market Overview

The industry engaged in the development, integration, and distribution of hardware and software technologies that provide digital communication and data transmission across networks is referred to as the UK network equipment market. Network management tools, wireless access points, switches, routers, modems, fiber-optic transmission systems, and firewalls are just a few of the many devices that fall under this category. The market serves both consumer and business segments and provides essential infrastructure for cloud services, private enterprise networks, mobile networks (including 5G), and broadband internet. Growing data demand, digital transformation, and government-led connectivity efforts are driving the UK network equipment industry, which is essential to ensuring safe, fast communications across the nation's commercial, industrial, and residential sectors.

Report Coverage

This research report categorizes the market for the United Kingdom network equipment market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom network equipment market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom network equipment market.

United Kingdom Network Equipment Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9,486.23 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.10% |

| 2035 Value Projection: | USD 13,265.40 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 136 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Component, By Network and COVID-19 Impact Analysis |

| Companies covered:: | Filtronic plc, Adder Technology, Cambridge Broadband Networks (CBNL), BT Group plc, Softcat plc, RM plc, and Other key vendors |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis |

Get more details on this report -

Driving Factors

The market for network equipment in the UK is being propelled by some important factors that are quickening technology adoption and growth. One of the main motivators is the national push for 5G connection and full-fibre broadband, which is aided by regulatory incentives and government programs. The demand for sophisticated switches, routers, optical equipment, and wireless access points is being driven by the expansion of infrastructure. Furthermore, both the home and commercial sectors now require more high-capacity, low-latency networks due to the growth of remote working, digital services, and smart technologies like cloud computing and the Internet of Things.

Restraining Factors

The high cost of infrastructure upgrades, large capital expenditures are needed for these upgrades, which may discourage smaller providers and cause rollouts in low-density areas to be delayed.

Market Segmentation

The United Kingdom network equipment market share is classified into component, and network

- The software segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The United Kingdom network equipment market is segmented by component into hardware, and software. Among these, the software segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period. The total revenue from deploying on-premises and cloud-based software solutions for the RAN, core network, and fixed access is included in the software section. Operations support system (OSS)/business support system (BSS), infrastructure software (including network infrastructure management software), and other software (including application software) are covered in this section.

- The public network segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom network equipment market is divided by network into private network, and public network. Among these, the public network segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. A private network infrastructure's deployed network equipment also includes virtual and physical devices, including hubs, modems, routers, switches, bridges, access points, and gateways. The increasing use of network security makes it possible for businesses to purchase private network equipment.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom network equipment market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Filtronic plc

- Adder Technology

- Cambridge Broadband Networks (CBNL)

- BT Group plc

- Softcat plc

- RM plc

- Others

Recent Developments:

- In June 2025, CityFibre made waves in the UK broadband scene with its rollout of 5.5Gbps symmetrical broadband, more than doubling its previous top speed. This leap was powered by XGS-PON technology, which supported speeds up to 10Gbps and had already been deployed across 85% of CityFibre’s network.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom network equipment market based on the below-mentioned segments:

United Kingdom Network Equipment Market, By Component

- Hardware

- Software

United Kingdom Network Equipment Market, By Network

- Private Network

- Public Network

Need help to buy this report?