United Kingdom Needle Coke Market Size, Share, and COVID-19 Impact Analysis, By Type (Petroleum-based, and Coal-based), By Application (Graphite Electrodes, Lithium-ion Batteries, Specialty Carbon, and Others), and United Kingdom Needle Coke Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Needle Coke Market Insights Forecasts to 2035

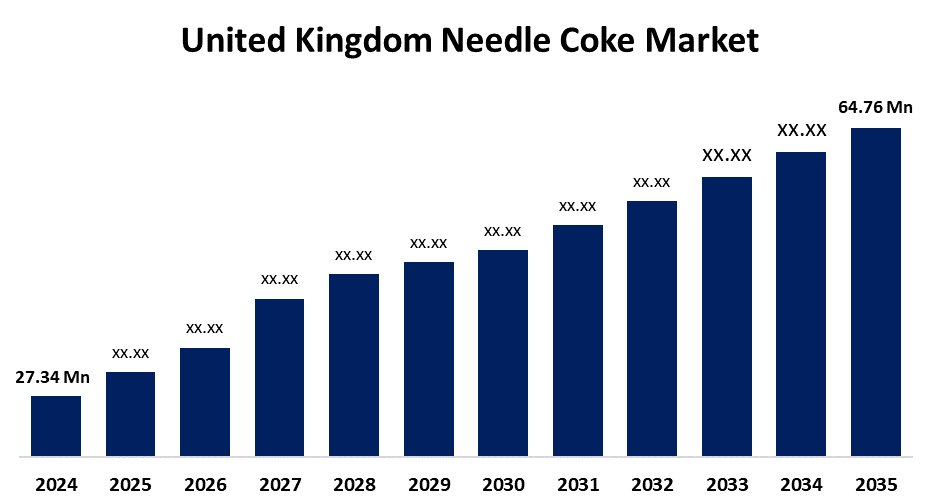

- The United Kingdom Needle Coke Market Size was estimated at USD 27.34 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.15% from 2025 to 2035

- The United Kingdom Needle Coke Market Size is Expected to Reach USD 64.76 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Needle Coke Market is anticipated to reach USD 64.76 million by 2035, growing at a CAGR of 8.15% from 2025 to 2035. Rising electric vehicle (EV) adoption, development in steel infrastructure, and the need for high-performance materials in lithium-ion batteries are some of the major factors driving market expansion.

Market Overview

The United Kingdom needle coke market refers to the industry focused on the production and application of A petroleum-based substance of superior quality and high value. Needle coke has a characteristic needle-like form when it fractures. Steel recycling and energy storage devices like lithium-ion batteries are among the high-temperature industrial applications that choose needle coke because of its low coefficient of thermal expansion, high electrical conductivity, and exceptional structural integrity. In various electric furnaces, needle coke is primarily used as a raw material for the creation of graphite electrodes. Petroleum or coal tar are the two sources of needle coke. During the manufacturing of coke, coal tar is converted into coal-based needle coke. Coal-based needle coke offers remarkable physical characteristics, such as a low coefficient of thermal expansion and electric resistance, as well as less breaking and spalling. The growing technological breakthroughs are further impacting the dynamics of the industry. Additionally, in order to increase the efficiency of needle coke production and lessen its negative effects on the environment, refineries and producers of carbon materials are investing in innovation. Advanced feedstock treatment and process optimization are being combined with sustainable production techniques to increase output and quality while adhering to increasingly stringent regulatory regimes.

Report Coverage

This research report categorizes the market for the United Kingdom needle coke market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom needle coke market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom needle coke market.

United Kingdom Needle Coke Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 27.34 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.15% |

| 2035 Value Projection: | USD 64.76 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 225 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Philips 66 Company, Graf Tech UK Limited, Royal Dutch Shell Plc,Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom needle coke is driven by its crucial function in creating graphite electrodes for steelmaking's electric arc furnaces (EAFs) is driving the market's expansion. The market for needle coke is expected to develop as a result of the increasing use of electric arc furnaces for steel production, which are more energy efficient and emit fewer carbon emissions than blast furnaces. This has increased demand for high-quality graphite electrodes. The growth of the steel and aluminum industries, which is mostly being driven by growing demand for consumer goods, automobile manufacturing, and infrastructure construction, is fueling this need. Furthermore, the market benefits from the increase in strategic partnerships and the emergence of new markets, which serve as market catalysts and enhance advantageous prospects for market expansion.

Restraining Factors

Despite the significant growth industry may be restricted by economic and political instability around petroleum-based goods.

Market Segmentation

The United Kingdom needle coke market share is classified into type, and application

- The petroleum-based segment held the largest share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The United Kingdom needle coke market is divided by type into petroleum-based, and coal-based. Among these, the petroleum-based segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to compared to other forms, it has reduced sulfur content, higher carbon purity, and superior structural consistency. The manufacturing of ultra-high-power graphite electrodes for use in electric arc furnace (EAF) steelmaking is typically done using petroleum-based needle coke.

- The graphite electrodes segment dominated the market in 2024 and is expected to grow at a notable CAGR during the forecast period.

The United Kingdom needle coke market is segmented by application into graphite electrodes, lithium-ion batteries, specialty carbon, and others. Among these, the graphite electrodes segment dominated the market in 2024 and is expected to grow at a notable CAGR during the forecast period. This is mostly due to the growing demand for energy-efficient steelmaking and the expanding usage of electric arc furnaces (EAF) in steel production. Furthermore, needle coke is essential for graphite electrodes, which are essential for EAFs, because of its low impurity levels and high electrical and thermal conductivity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom needle coke market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of key companies

- Philips 66 Company

- Graf Tech UK Limited

- Royal Dutch Shell Plc

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom needle coke market based on the below-mentioned segments:

United Kingdom Needle Coke Market, By Type

- Petroleum-based

- Coal-based

United Kingdom Needle Coke Market, By Application

- Graphite Electrodes

- Lithium-ion Batteries

- Specialty Carbon

- Others

Need help to buy this report?