United Kingdom Motor Insurance Market Size, Share, and COVID-19 Impact Analysis, By Premium Type (Personal Insurance Premium and Commercial Insurance Premium), By Policy Type (Liability Insurance, Comprehensive Coverage, Collision Coverage, and Personal Injury Protection), and United Kingdom Motor Insurance Market Insights, Industry Trend, Forecasts to 2035

Industry: Banking & FinancialUnited Kingdom Motor Insurance Market Insights Forecasts to 2035

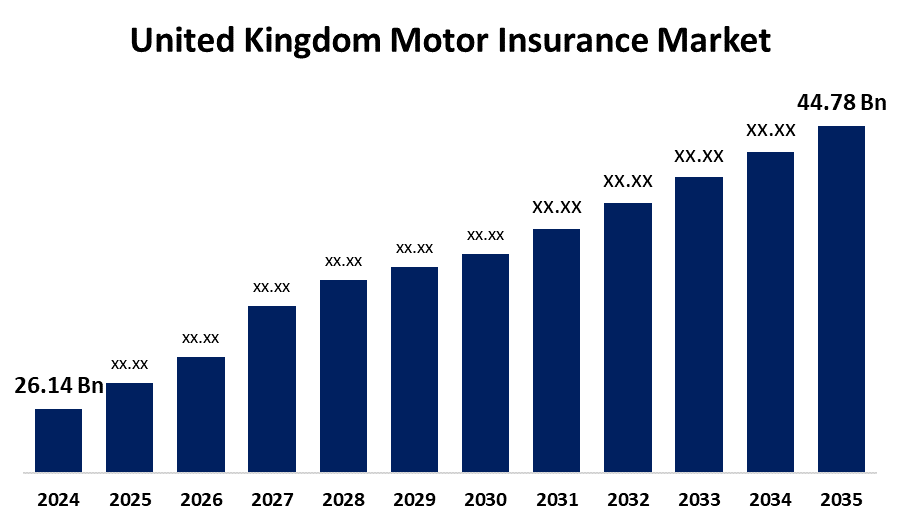

- The United Kingdom Motor Insurance Market Size was estimated at USD 26.14 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.02% from 2025 to 2035

- The United Kingdom Motor Insurance Market Size is Expected to Reach USD 44.78 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Motor Insurance Market Size is anticipated to reach USD 44.78 Billion by 2035, growing at a CAGR of 5.02% from 2025 to 2035. The increasing car ownership, worsening traffic, more stringent insurance coverage regulations, increased financial protection awareness, and the use of AI and sophisticated telematics for risk assessment and customized premium pricing.

Market Overview

The United Kingdom motor insurance market refers to the industry providing car owners financial security against losses brought on by theft, accidents, or other problems. It covers motorcycles, commercial vehicles, and private automobiles. With services from insurers, brokers, and online insurance platforms, this sector is essential for maintaining legal compliance, encouraging traffic safety, and providing coverage for personal losses and third-party liabilities. Increasing demand for usage-based insurance and an increase in car ownership. Insurers may now provide individualized rates and enhanced consumer experiences through the use of telematics and AI-powered underwriting. Additionally, a new market for specialty auto insurance products is created by the expanding electric vehicle (EV) market. Growth and innovation in the changing automobile insurance market are further encouraged by alliances with automakers, developments in data analytics, and the growing acceptance of direct-to-consumer channels. Personalization is improved by usage-based insurance models and smartphone apps that provide real-time driving feedback. Throughout the insurance lifecycle, these technologies enhance client interaction and satisfaction, expedite operations, and improve risk assessment.

Report Coverage

This research report categorizes the market for the United Kingdom motor insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom motor insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom motor insurance market.

United Kingdom Motor Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 26.14 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 5.02% |

| 2035 Value Projection: | USD 44.78 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 274 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Premium Type and By Policy Type |

| Companies covered:: | Admiral Group, Direct Line Group, Aviva, Hastings Direct, AXA Insurance UK PLC, Royal & Sun Alliance Insurance PLC, Ageas Insurance Limited, NFU Mutual, Allianz Insurance PLC, Zurich Assurance Ltd, DL Insurance Services Limited, Co-op Insurance, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing number of automobiles on the road, increasing awareness of the advantages of insurance, and stringent laws requiring auto insurance coverage. The industry has grown as because of the increasing use of digital platforms for policy comparison, purchase, and renewal, which have greatly improved client convenience. Furthermore, the need for comprehensive auto insurance has increased due to an increase in accidents and auto thefts. By improving risk profiling and pricing accuracy, technological advancements like telematics and AI-based underwriting draw in more customers.

Restraining Factors

The high incidence of claim fraud and rising repair expenses. Furthermore, growing premiums may put off consumers, and the sector's overall growth is constrained because economic uncertainty and fierce insurer competition, which limit profitability and market expansion.

Market Segmentation

The United Kingdom motor insurance market share is classified into premium type and policy type.

- The personal insurance premium accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom motor insurance market is segmented by premium type into personal insurance premium and commercial insurance premium. Among these, the personal insurance premium accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing urban population, rising car ownership, and the requirement for comprehensive coverage. As individuals search for financial protection against theft, accidents, and damages, these factors increase the section of personal insurance premiums.

- The comprehensive coverage accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom motor insurance market is segmented by policy type into liability insurance, comprehensive coverage, collision coverage, and personal injury protection. Among these, the comprehensive coverage accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven because of its extensive defense against liability, damage, and theft. In light of rising car ownership and legal insurance commitments, consumers decide on it over basic plans more and more in search of financial stability and peace of mind.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom motor insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Admiral Group

- Direct Line Group

- Aviva

- Hastings Direct

- AXA Insurance UK PLC

- Royal & Sun Alliance Insurance PLC

- Ageas Insurance Limited

- NFU Mutual

- Allianz Insurance PLC

- Zurich Assurance Ltd

- DL Insurance Services Limited

- Co-op Insurance

- Others.

Recent Developments:

- In October 2024, Lotus introduced tailored insurance solutions for UK customers, offering specialized coverage that includes access to Lotus Approved Bodyshop Network, Lotus Trained Technicians, and guaranteed genuine Lotus parts. This initiative enhances the buying and ownership experience for Lotus owners.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom motor insurance market based on the below-mentioned segments:

United Kingdom Motor Insurance Market, By Premium Type

- Personal Insurance Premium

- Commercial Insurance Premium

United Kingdom Motor Insurance Market, By Policy Type

- Liability Insurance

- Comprehensive Coverage

- Collision Coverage

- Personal Injury Protection

Need help to buy this report?