United Kingdom Mobile Substation Market Size, Share, and COVID-19 Impact Analysis, By Type (Power Transformer, Distribution Transformer), By Application (Industrial, Infrastructure, Utilities), and United Kingdom Mobile Substation Market Insights, Industry Trend, Forecasts to 2035

Industry: Energy & PowerUnited Kingdom mobile substation Market Insights Forecasts to 2035

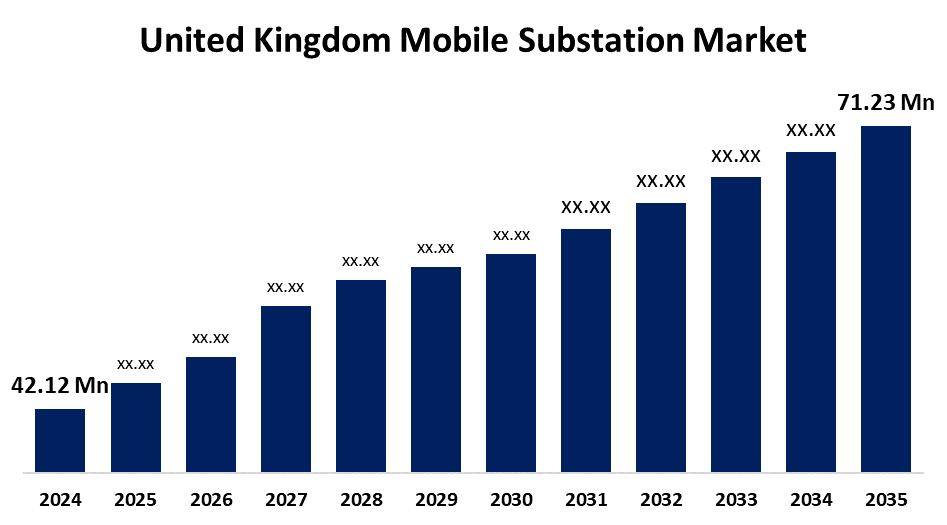

- The United Kingdom Mobile Substation Market Size was estimated at USD 42.12 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.89% from 2025 to 2035

- The United Kingdom Mobile Substation Market Size is Expected to Reach USD 71.23 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The United Kingdom Mobile Substation Market Size is anticipated to Reach USD 71.23 Million by 2035, Growing at a CAGR of 4.89% from 2025 to 2035. The market is influenced by the growing need for versatile and reliable electrical solutions in situations of emergency, network growth, and immediate power supply needs. The rapid urbanization, industrialization, and growing expenditures in the integration of renewable energy sources are all contributing to market expansion.

Market Overview

The market for mobile substations in the UK is the area of the power distribution sector devoted to emergency or temporary use of portable, self-contained electrical substations. These devices, which are usually installed on trucks or containers, can be quickly moved to areas that are experiencing outages or lack permanent infrastructure. A mobile substation is a standalone, transportable device that provides electrical power distribution to areas without permanent substations or that are temporarily without power. After distributing power to end users and ensuring operational safety, these substations reduce high voltage. At the chosen location, they can then be connected to a local power source. They can manage a variety of voltage levels and, by integrating sophisticated protective mechanisms, offer a broad range of power distribution capabilities. Mobile substations may be quickly deployed and moved when needed. They are used in emergencies, on building sites, and as a temporary power source while repairs or maintenance are being done.

Report Coverage

This research report categorizes the market for the United Kingdom mobile substation market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom mobile substation market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom mobile substation market.

United Kingdom Mobile Substation Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 42.12 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 4.89% |

| 2035 Value Projection: | USD 71.23 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 205 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Type, By Application |

| Companies covered:: | Hitachi Energy, SES Ltd, INDSS Ltd, GSS Ltd, Powersystems UK Ltd, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom mobile substation is flourishing due to the rising need for dependable and adaptable power solutions. The market is growing as a result of growing investments in modernizing power infrastructure and increased electricity demand in the commercial and industrial sectors. The market adoption is further enhanced by technological improvements in smart grid integration and small, modular designs. Further, government policies that support electrification projects and grid resilience in developing nations also help the industry grow. The market for mobile substations is being driven by a number of significant factors, including a significant increase in the need for a steady supply of electricity for an increasing number of old infrastructures that need to be upgraded, and supportive programs that support mobile power generation solutions.

Restraining Factors

The market expansion could be slowed down by several obstacles the high initial cost and continuing maintenance costs of mobile substations, the cost of transportation and deployment of mobile substations, and disruption of infrastructure and logistics chain.

Market Segmentation

The United Kingdom mobile substation market share is classified into type and application.

- The power transformer segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United Kingdom mobile substation market is segmented by type into power transformer, distribution transformer. Among these, the power transformer segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period. This is due to rapid and adaptable power restoration becoming more and more necessary in the event of emergency maintenance, natural disasters, and grid failure. Moreover, mobile substations with power transformers are necessary to temporarily support solar and wind farms on the grid as a result of growing investments in renewable energy integration.

- The infrastructure segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The United Kingdom mobile substation market is segmented by application into industrial, infrastructure, and utilities. Among these, the infrastructure segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period. This is because of its fast industrialization, urbanization, and extensive infrastructure development, especially in developing nations. Airports, highway electrification, metro rail networks, and growing smart cities all need mobile substations for backup or temporary power. Furthermore, the growing electrification of remote mining activities and construction sites calls for mobile substations for effective power supply.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom mobile substation market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Hitachi Energy

- SES Ltd

- INDSS Ltd

- GSS Ltd

- Powersystems UK Ltd

- Others

Recent Developments:

- In June 2025, National Grid officially began construction of the Uxbridge Moor substation in Buckinghamshire to support the explosive growth of data centres in West London. It had been designed to connect over a dozen new data centres, addressing surging electricity demand.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom mobile substation market based on the below-mentioned segments:

United Kingdom Mobile Substation Market, By Type

- Power Transformer

- Distribution Transformer

United Kingdom Mobile Substation Market, By Application

- Industrial

- Infrastructure

- Utilities

Need help to buy this report?