United Kingdom Mobile Payments Market Size, Share, and COVID-19 Impact Analysis, By Technology (Near Field Communication, Direct Mobile Billing, Mobile Web Payment, SMS, Interactive Voice Response System, Mobile App, and Others), By Payment Type (B2B, B2C, B2G, Others), and United Kingdom Mobile Payments Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited Kingdom Mobile Payments Market Insights Forecasts to 2035

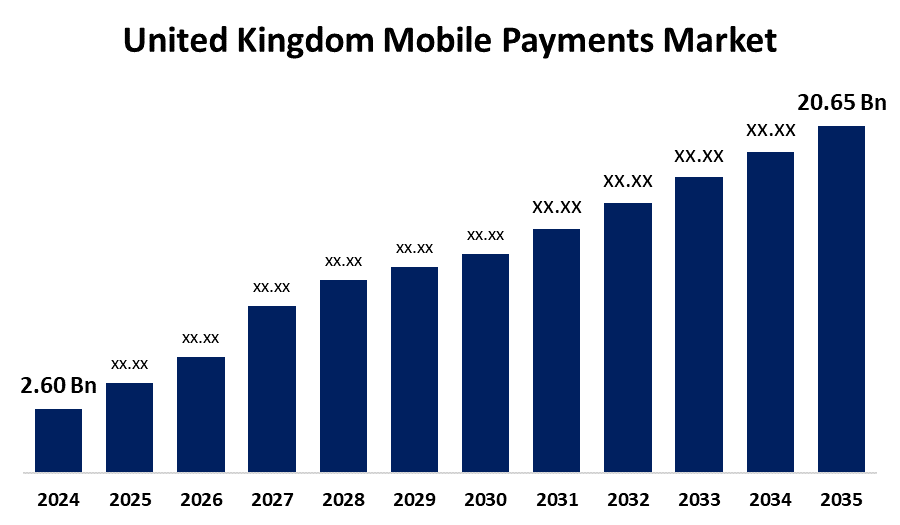

- The United Kingdom Mobile Payments Market Size was Estimated at USD 2.60 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 20.73% from 2025 to 2035

- The United Kingdom Mobile Payments Market Size is Expected to Reach USD 20.65 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom mobile payments market Size is anticipated to reach USD 20.65 Billion by 2035, growing at a CAGR of 20.73% from 2025 to 2035. The market is growing quickly due to a number of factors, including the increasing percentage of consumers utilizing smartphones, the adoption of laws that encourage them, the quick development of novel forms of payment, and an ongoing shift in customer tastes toward wireless and online transactions.

Market Overview

The United Kingdom mobile payments market refers to the business firm focused on the development and application of a platform where consumers operate and conclude easy transactions without any difficulty. For consumers, mobile payments offer a safe alternative to cash-based transactions by facilitating fast money transfers. The expanding market trends are being influenced by the digital generation, or generation Z, which is anticipated to generate several growth prospects for the payment industry. Reward points, loyalty points, and other incentives are also being offered by market participants to entice consumers to pay with mobile devices and attract a wider market audience. Moreover, some development news related to the UK and its territories might exceed the market growth opportunities. For instance, in August 2021, Boku launched M1ST (Mobile First), the world’s largest mobile payments network, designed to simplify mobile payment acceptance for local merchants.

Report Coverage

This research report categorizes the market for the United Kingdom mobile payments market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom mobile payments market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom mobile payments market.

United Kingdom Mobile Payments Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.60 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 20.73% |

| 2035 Value Projection: | USD 20.65 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 256 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Technology and By Payment Type |

| Companies covered:: | Worldpay, SumUp, GoCardless, Form3, Glint Pay, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for United Kingdom mobile payments is promoted by the growing use of mobile banking apps, the acceptance of contactless payments due to their efficiency and convenience, and the growing user-friendly platforms that meet the changing needs of both individuals and businesses. Further, the incorporation of budgeting tools, real-time transaction tracking, and simplified payment methods has made mobile banking apps provide seamless daily financial operations. Furthermore, e-commerce growth, integration with digital wallets, and government initiatives for cashless economies are driving mobile payment market growth.

Restraining Factors

The challenge to slowing down the market adoption is the security risks of using online-based transactions.

Market Segmentation

The United Kingdom Mobile Payments Market share is classified into technology and payment type.

- The mobile web payment segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period.

The United Kingdom mobile payments market is segmented by technology into near field communication, direct mobile billing, mobile web payment, SMS, interactive voice response system, mobile app, and others. Among these, the mobile web payment segment dominated the market in 2024 and is anticipated to grow at a substantial CAGR over the forecast period. This is because mobile web payment solutions offer flexibility and security. Additionally, encouraging the segment's growth is e-commerce's increasing popularity, the increase in transactions prompted by social media platforms, the simplicity of use, and the improved network and infrastructure capabilities of BFSI organizations and quick commerce enterprises.

- The B2B segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom mobile payments market is segmented by payment type into B2B, B2C, B2G, and others. Among these, the B2B segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This is because of the growing use of mobile applications by businesses, the adoption of cutting-edge technology, their user-friendliness, the availability of highly functional smartphone devices, and the expanding accessibility of high-performance internet services. Businesses have also been prompted to create and favor safe and legal payment methods by the constantly changing regulatory landscape surrounding financial transactions and customer data protection.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom mobile payments market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Worldpay

- SumUp

- GoCardless

- Form3

- Glint Pay

- Others

Recent Developments:

- In June 2025, MO Car Wash launched Quick Pay, a new digital payment solution designed to make car washing faster and more convenient. Customers in the UK can already use Quick Pay. Quick Pay allows users to scan, wash, and go without needing physical payment terminals, reducing queue times and enhancing the customer experience.

- In June 2025, Visa launched Visa A2A, a pay-by-bank solution in the UK, aimed at making bank transfer payments safer and smarter. This service introduced consumer protection guidelines for bank transfer transactions, ensuring users could reclaim funds in case of errors.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom mobile payments market based on the below-mentioned segments:

United Kingdom Mobile Payments Market, By Technology

- Near Field Communication

- Direct Mobile Billing

- Mobile Web Payment

- SMS

- Interactive Voice Response System

- Mobile App

- Others

United Kingdom mobile Payments Market, By Payment Type

- B2B

- B2C

- B2G

- Others

Need help to buy this report?