United Kingdom Milk Protein Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Whey Protein and Casein & Caseinates), By Application (Food & Beverages, Pharmaceuticals & Nutraceuticals, and Sports & Clinical Nutrition), and United Kingdom Milk Protein Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Milk Protein Market Insights Forecasts to 2035

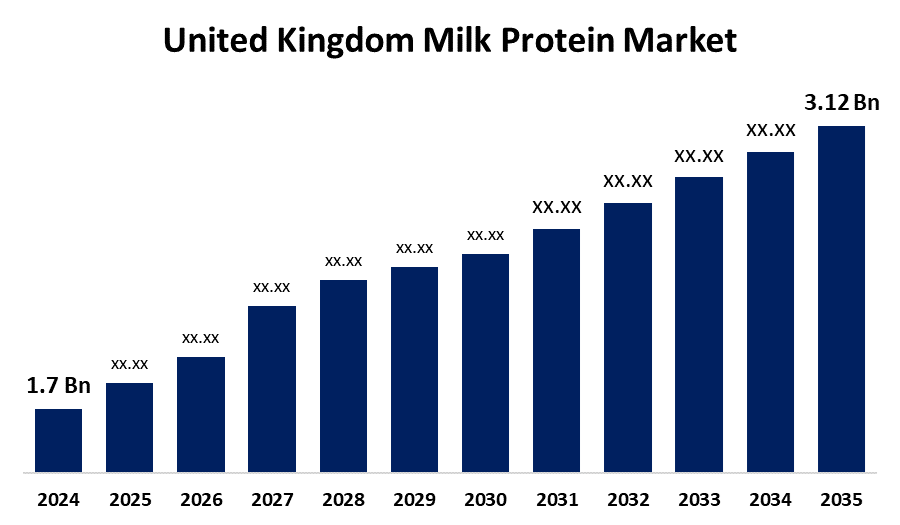

- The United Kingdom Milk Protein Market Size Was Estimated at USD 1.7 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.68% from 2025 to 2035

- The United Kingdom Milk Protein Market Size is Expected to Reach USD 3.12 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Milk Protein Market is anticipated to reach USD 3.12 billion by 2035, growing at a CAGR of 5.68% from 2025 to 2035. The increased health consciousness, expanding consumer demand for high-protein meals, and the growing acceptance of dairy products with additional protein. The market is growing as the consequence of the growing sports nutrition industry.

Market Overview

The UK milk protein market refers to the industry involved in the manufacturing, processing, and distribution of milk-based proteins, including whey and casein. Dairy products, baby formula, sports nutrition, and functional foods are just a few of the products that use these proteins. The market has grown as a consequence of consumers' growing health consciousness, the need for high-protein diets, and the growing acceptance of nutritional supplements made from dairy. Both exports to foreign markets and domestic consumption drive the market. Increasing demand for products with protein, such as functional foods, sports nutrition, and weight management. There is room for innovation in dairy-based protein products as customers grow more health-conscious. Dairy proteins can also accommodate hybrid eating habits due to the growing popularity of plant-based diets. The development of sophisticated filtering methods for ready-to-drink protein beverages, fortified dairy products with extra physiological advantages, and purer protein isolates. In order to comply with consumer demands for convenience, health, and environmental responsibility, businesses are also investing in sustainable production techniques and packaging.

Report Coverage

This research report categorizes the market for the UK milk protein market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK milk protein market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK milk protein market.

United Kingdom Milk Protein Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1.7 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 5.68% |

| 2035 Value Projection: | USD 3.12 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 206 |

| Tables, Charts & Figures: | 117 |

| Segments covered: | By Product Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | Arla Foods Group, Fonterra Co-operative Group Limited, Glanbia PLC, Kerry Group PLC, Lactoprot Deutschland GmbH, Royal FrieslandCampina N.V, Lactalis Group, Others. and others key plsyers. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand for high-protein diets among consumers that are concerned regarding their fitness and health. Consumption of milk-derived proteins like casein and whey has increased due to growth in the sports nutrition and functional food industries. Additionally, producers are being encouraged to incorporate milk proteins by the growing demand of natural and clean-label components in food items. The increased demand for protein-enriched dairy and nutritional goods is also an indication of the aging population's need for benefits related to muscle maintenance and recovery.

Restraining Factors

The dairy allergies, lactose intolerance, and animal farming-related environmental issues. Consistent demand and long-term market stability are further hampered by shifting consumer preferences toward plant-based proteins and volatile dairy prices.

Market Segmentation

The UK milk protein market share is classified into product type and application.

- The whey protein segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK milk protein market is segmented by product type into whey protein and casein & caseinates. Among these, the whey protein segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing demand for baby formulae, nutritional supplements, and high-protein dairy products. They are an attractive choice for producers aiming to appeal to consumers who consider themselves health-conscious due to their adaptability in functional beverages and health-focused calculations.

- The pharmaceuticals & nutraceuticals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK milk protein market is segmented by application into food & beverages, pharmaceuticals & nutraceuticals, and sports & clinical nutrition. Among these, the pharmaceuticals & nutraceuticals segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because increasing demand for protein supplements, growing interest in fitness, and expanding application in medical nutrition. Milk protein-based products are used by consumers to improve performance, aid in muscle repair, and provide nutritional support.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK milk protein market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Arla Foods Group

- Fonterra Co-operative Group Limited

- Glanbia PLC

- Kerry Group PLC

- Lactoprot Deutschland GmbH

- Royal FrieslandCampina N.V

- Lactalis Group

- Others.

Recent Developments:

- In March 2025, Cathedral City launched a new range of cheddar cheeses boasting 30g of protein per 100g and 50% less fat than standard cheddar. Available in block, sliced, grated, and mini formats, this innovation targets health-conscious consumers desiring high-protein options without compromising on taste.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the UK Milk Protein Market based on the below-mentioned segments:

UK Milk Protein Market, By Product Type

- Whey Protein

- Casein & Caseinates

UK Milk Protein Market, By Application

- Food & Beverages

- Pharmaceuticals & Nutraceuticals

- Sports & Clinical Nutritio

Need help to buy this report?