United Kingdom Micro Mobility Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (Electric Kick Scooters, Electric Skateboards, and Electric Bicycles), By Battery (Sealed Lead Acid, NiMH, and Li-Ion), and United Kingdom Micro Mobility Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited Kingdom Micro Mobility Market Size Insights Forecasts to 2035

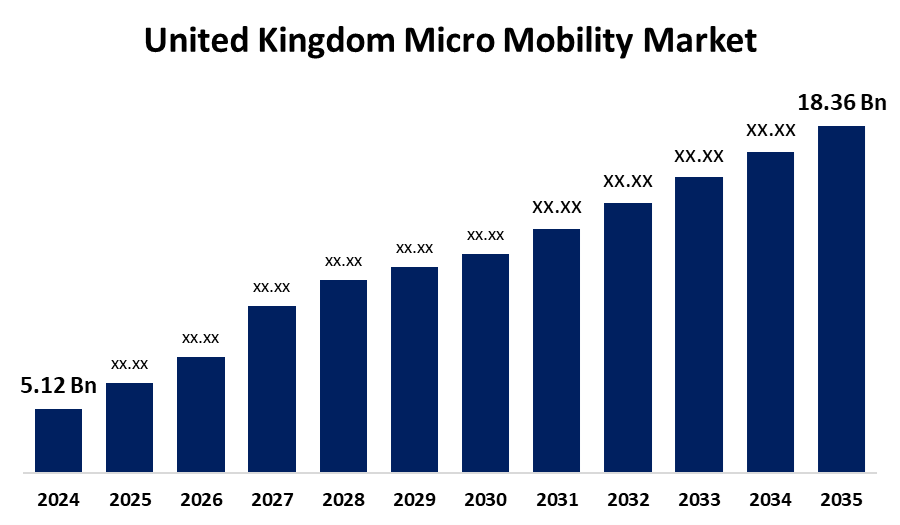

- The United Kingdom Micro Mobility Market Size Was Estimated at USD 5.12 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.31% from 2025 to 2035

- The UK Micro Mobility Market Size is Expected to Reach USD 18.36 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the United Kingdom Micro Mobility Market is anticipated to reach USD 18.36 billion by 2035, growing at a CAGR of 12.31% from 2025 to 2035. Micro-mobility is a fast-growing segment of the transportation market that includes travel via a number of low-energy vehicles, such as electric bicycles, electric skateboards, and electric kick scooters.

Market Overview

The United Kingdom micro mobility market offers low-speed, lightweight transportation options like e-scooters, e-bikes, and bikes. It is driven by growing traffic congestion, higher fuel prices, and a shift toward more sustainable travel solutions. The UK micro mobility Market is evolving quickly due to rising demand for convenient, sustainable urban transportation. Increased awareness of environmental concerns and traffic congestion has led consumers and local governments to seek alternatives to traditional vehicles. Public interest in electric bikes and scooters continues to grow as municipalities provide pilot programs and funding for dedicated infrastructure. Cities such as London and Manchester are improving accessible and safe transportation with more bike lanes and new parking zones. Advances in technology, especially in lithium battery technology, have made e-bikes and e-scooters more efficient and inexpensive. The flexible and affordable options provided by subscription and rental models are encouraging commuters to use them more. The user experience is improved by integration with mobile apps for payments and access. Partnerships between private companies and local governments are growing fleets of shared vehicles. With sustained governmental backing and a focus on environmentally friendly transport, the UK micro mobility market is expected to experience significant long-term expansion.

Report Coverage

This research report categorizes the market for the United Kingdom micro mobility market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom micro mobility market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom micro mobility market.

United Kingdom Micro Mobility Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 5.12 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 12.31% |

| 2035 Value Projection: | USD 18.36 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 148 |

| Tables, Charts & Figures: | 128 |

| Segments covered: | By Vehicle Type, By Battery and COVID-19 Impact Analysis |

| Companies covered:: | Circ, Dott, Beryl, Superpedestrian, Ofo, Fretlink, Tier Mobility, Spin, Lime, Mobike, Gocycle, Voi Technology, Bird, Zapp, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact,Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The flow of urbanization and traffic congestion across the UK along with an increased demand for sustainable transport solutions has driven the UK Micro Mobility Market. It is further supported by Government initiatives to reduce carbon emissions, including funding for cycling infrastructure and e-scooter trials. As e-scooters and e-bikes become more popular in urban environments, advances in electric vehicle technologies pertaining to batteries and mobile apps have improved user experiences and convenience.

Restraining Factors

The UK micro mobility market limits from long-delayed legislation and the ambiguity of regulatory legislation and frameworks regarding the e-scooter legality, which provides major barriers. This uncertainty inhibits investment, limits integration with public transport, and restricts the clarity between private use and rental schemes.

Market Segmentation

The United Kingdom micro mobility market share is classified into vehicle type and battery.

- The electric bicycles segment held the largest market share in 2024 and is expected to grow at a remarkable CAGR during the forecast period.

The United Kingdom micro mobility market is segmented by vehicle type into electric kick scooters, electric skateboards, and electric bicycles. Among these, the electric bicycles segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In comparison to other options for micro-mobility, electric bicycles offer comfort, versatility, and range. An electric bicycle enables riders to traverse a wider variety of terrain comfortably. Electric bicycles are great for short commutes or long weekend rides. With better battery technology and their capacity to reduce carbon footprints, electric bicycles are quickly becoming a popular alternative for getting around urban and suburban environments.

- The sealed lead acid segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period.

United Kingdom micro mobility market is segmented by battery into sealed lead acid, NiMH, and Li-Ion. Among these, the sealed lead acid segment held the highest revenue share in 2024 and is expected to grow at a significant CAGR during the forecast period. Sealed lead acid batteries (SLA) are ideal solutions for urban transportation because they are durable and maintain consistent performance across a wide range of temperatures. Durability is guaranteed through SLA's durable design, and their endurance comes from their ability to perform in a range of environmental conditions. In addition, the consumer and producer viable solution that SLA batteries provide comes from easy availability and recycling.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom micro mobility market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Circ

- Dott

- Beryl

- Superpedestrian

- Ofo

- Fretlink

- Tier Mobility

- Spin

- Lime

- Mobike

- Gocycle

- Voi Technology

- Bird

- Zapp

- Others

Recent Development

- In July 2024, Nissan struck a cooperation with industry leader Silence to supply consumers with clean, compact, and agile nanocars, easing the transition of urban drivers to electric mobility. Nissan will be the UK distributor for the Silence Nano S04 and e-motorcycles starting in October 2024, after they were introduced in France, Italy, and Germany. The strategy for UK distribution agreements is currently being reviewed.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at the United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom micro mobility market based on the following segments:

United Kingdom Micro Mobility Market, By Vehicle Type

- Electric Kick Scooters

- Electric Skateboards

- Electric Bicycles

United Kingdom Micro Mobility Market, By Battery

- Sealed Lead Acid

- NiMH

- Li-Ion

Need help to buy this report?