United Kingdom Micro Mobility Charging Infrastructure Market Size, Share, and COVID-19 Impact Analysis, By Vehicle Type (E-Scooters, E-Bikes, E-Unicycles, E-Skateboards), By Source (Battery Powered, Solar Powered), By End Use (Residential, Commercial), and United Kingdom Micro Mobility Charging Infrastructure Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUnited Kingdom Micro Mobility Charging Infrastructure Market Insights Forecasts to 2035

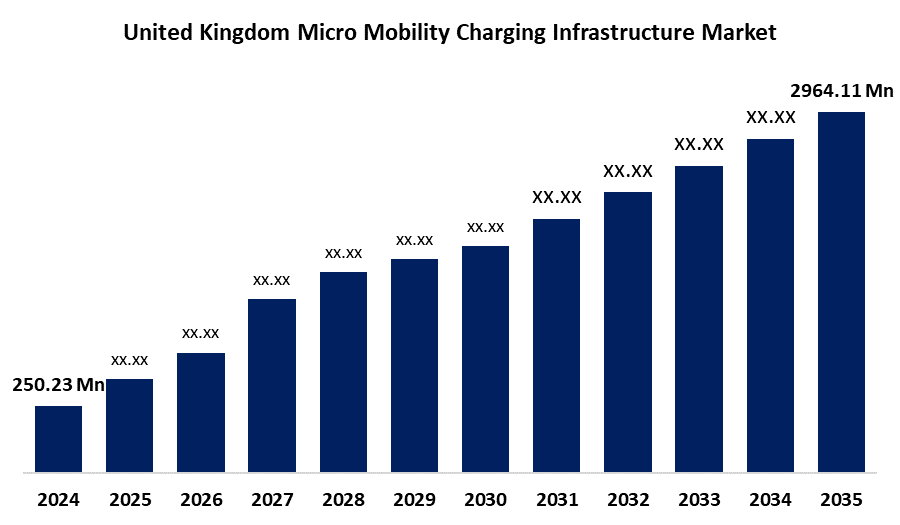

- The United Kingdom Micro Mobility Charging Infrastructure Market Size was Estimated at USD 250.23 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 25.20% from 2025 to 2035

- The United Kingdom Micro Mobility Charging Infrastructure Market Size is Expected to Reach USD 2964.11 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Micro Mobility Charging Infrastructure Market Size is anticipated to reach USD 2964.11 Million by 2035, growing at a CAGR of 25.20% from 2025 to 2035. The market for this is rising due to rapid growth in the automobile sector, with technology interference, green energy, and sustainability being given top priority in the country. Steady expansion is facilitated by innovative urban planning and robust government initiatives that encourage e-mobility.

Market Overview

The United Kingdom micro mobility charging infrastructure market refers to the industry focused on the production and application of charging solutions for compact, light-weight electric cars that are driven short distances. The major function of the charging infrastructure is to provide these micro-mobility cars' batteries with electrical energy so they may continue to function and be used by users. These charging station infrastructures are set up in public spaces, business complexes, and homes. Micromobility and infrastructure are necessary due to the car industry's growing electrification, which creates alternate transit options for everyday use. This charging infrastructure must be developed and expanded to support sustainable mobility. Concurrently, the government encourages steps to boost the market development, such as the initiative, titled "Unlocking the Value Chain of EVs and Micromobility in India," which was led by Connected Places Catapult and featured eight UK-based companies. They are specializing in battery technology, charging infrastructure, fleet management, and AI-powered mobility solutions, and this has been done with a UK and India partnership across the years.

Report Coverage

This research report categorizes the market for the United Kingdom micro mobility charging infrastructure market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom micro mobility charging infrastructure market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom micro mobility charging infrastructure market.

United Kingdom Micro Mobility Charging Infrastructure Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 250.23 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 25.20% |

| 2035 Value Projection: | USD 2964.11 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 266 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Vehicle Type, By Source and By End Use |

| Companies covered:: | GRIDSERVE, InstaVolt, ZPN Energy, ChargePoint UK, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for the United Kingdom micro mobility charging infrastructure is driven by the rapid expansion of the nation's EV market and the large expenditures made by leading automakers on next-generation lithium-ion and solid-state batteries. Government and business cooperation intensifies the research and implementation of charging solutions, resulting in dynamic market growth. The micro-mobility charging infrastructure sector is growing as a result of the rise in personal discretionary cash is increasing their requirement, particularly for young adults who are embracing this movement regularly. AI helps with key problems in the micro-mobility space, such as price plans, fleet rebalancing, damage detection, and parking control. Artificial intelligence (AI) systems began to optimize charging schedules based on grid capacity, energy use, and consumer preferences.

Restraining Factors

The market growth is restricted by several obstacles, including the expensive upfront costs, a lack of timely regulatory approval for parking spaces, and competition from other forms of transportation.

Market Segmentation

The United Kingdom Micro Mobility Charging Infrastructure Market share is classified into vehicle type, source, and end use.

- The e-scooters segment held the highest significant share in 2024 and is anticipated to grow at a significant CAGR over the forecast period.

The United Kingdom micro mobility charging infrastructure market is segmented by vehicle type into e-scooters, e-bikes, e-unicycles, and e-skateboards. Among these, the e-scooters segment held a significant share in 2024 and is anticipated to grow at a significant CAGR over the forecast period. This is due to parking and recharging are convenient; their popularity has rapidly increased. Moreover, e-scooters help to improve air quality and reduce traffic, which is why there will be more charging infrastructure locations. Additionally, the use of e-scooters for first-, last-, and communal travel is growing, outpacing the segment increase.

- The battery powered segment dominated the market in 2024 and is estimated to grow at a substantial CAGR over the forecast period.

The United Kingdom micro mobility charging infrastructure market is divided by source into battery powered and solar powered. Among these, the battery powered segment dominated the market in 2024 and is estimated to grow at a substantial CAGR over the forecast period. This is due to the growing popularity of battery-swapping technology for e-scooters is driving up demand for battery-powered charging stations. Users can simply replace an uncharged battery with a charged one at battery switching stations and resume riding. Battery-swapping facilities have been installed in public areas by numerous businesses.

- The commercial segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The United Kingdom micro mobility charging infrastructure market is classified by end use into residential, and commercial. Among these, the commercial segment held a significant share in 2024 and is expected to grow at a substantial CAGR during the forecast period. This is because of its convenience and adaptability, which affect a variety of clients, including leisure travelers, vacationers, and adventurers. In addition, several businesses have installed charging stations at hotels, offices, and other tourist destinations so that customers or staff may efficiently charge their vehicles. Additionally, this charging infrastructure helps to alleviate heavy traffic congestion at major charging stations by being installed in business complexes and small retail outlets with enough parking.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom micro mobility charging infrastructure market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- GRIDSERVE

- InstaVolt

- ZPN Energy

- ChargePoint UK

- Others

Recent Developments:

- In March 2025, A UK delegation visited India to showcase electric and micromobility innovations, aiming to accelerate the adoption of sustainable transport solutions in cities like Kolkata and Chennai.

- In July 2024, Nissan partnered with Acciona to bring Silence Nanocars and e-motorcycles to UK streets, expanding its electric micro-mobility offerings. These vehicles feature quick charging options, including battery swapping stations and removable battery packs for home or office charging. Nissan’s new business plan, The Arc, emphasizes strategic partnerships to accelerate the EV transition and expand clean mobility solutions.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom micro mobility charging infrastructure market based on the below-mentioned segments:

United Kingdom Micro Mobility Charging Infrastructure Market, By Vehicle Type

- E-Scooters

- E-Bikes

- E-Unicycles

- E-Skateboards

United Kingdom Micro Mobility Charging Infrastructure Market, By Source

- Battery Powered

- Solar Powered

United Kingdom Micro Mobility Charging Infrastructure Market, By End Use

- Residential

- Commercial

Need help to buy this report?