United Kingdom Medical Device Market Size, Share, and COVID-19 Impact Analysis, By Device Type (Drug Delivery System, Diagnostic Devices, Invasive Devices, Respiratory Therapeutic Devices, Electronic Medical Device, and Others), By Application (Cardiovascular Diseases, Diagnostic Imaging, Orthopedics, Oncology, Ophthalmology, General Surgery, Respiratory, Dental, Ear, Nose, and Throat (ENT), Neurology, Nephrology Urology, and Others), By End User (Hospitals and Clinics, Ambulatory Surgical Centers, Homecare Settings, and Others), and UK Medical Device Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Medical Device Market Forecasts to 2035

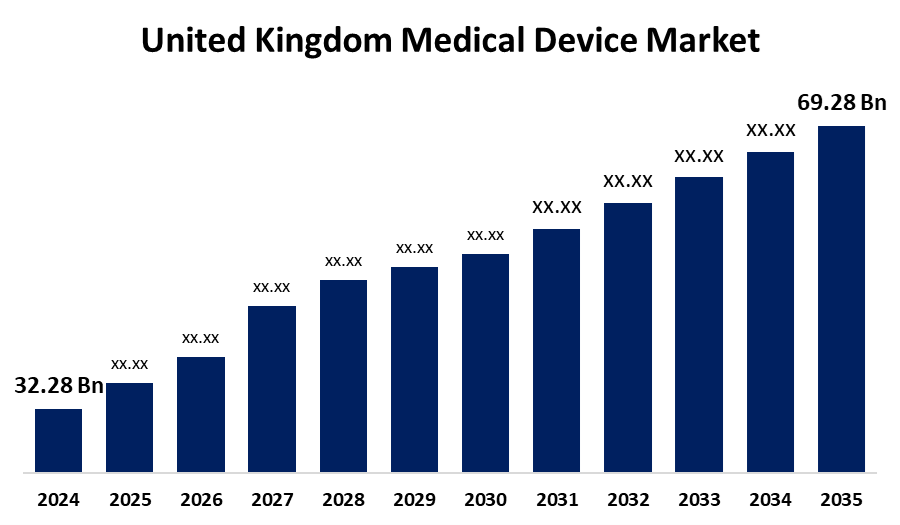

- The United Kingdom Medical Device Market Size Was Estimated at USD 32.28 Billion in 2024

- The UK Medical Device Market Size is Expected to Grow at a CAGR of around 7.19% from 2025 to 2035

- The UK Medical Device Market Size is Expected to Reach USD 69.28 Billion by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The UK Medical Device Market Size is anticipated to reach USD 69.28 billion by 2035, growing at a CAGR of 7.19% from 2025 to 2035. Ongoing advancements in healthcare technology, an aging population, rising adoption of digital health technologies, increasing healthcare expenditure, and growing focus on personalized treatment drive the market.

Market Overview

The Medical Device Market Size in the United Kingdom includes the manufacture, creation, and marketing of instruments, apparatus, and machinery used in disease prevention, diagnosis, and treatment. This market is further divided into submarkets depending on medical specialties or applications, such as cardiology, diagnostic imaging, and orthopaedics. With a significant percentage of medical devices licensed and sold in the UK, the industry is mostly driven by imports. Due mostly to technology breakthroughs and the continuous search for new healthcare solutions, the UK medical device industry is going through a major transition. The COVID-19 pandemic has expedited the shift towards telemedicine and remote monitoring, increasing the usage of wearable devices and mobile health applications. This transition not only improves patient care, but it also aligns with the UK government's goals to digitally reform the healthcare system. Furthermore, there is an increasing emphasis on personalised treatment, which necessitates devices that are adapted to particular patient needs, driving even more innovation. An ageing population in the UK is driving up the prevalence of chronic diseases, increasing demand for medical gadgets. The National Health Service (NHS) of the United Kingdom has boosted its investment in cutting-edge medical technologies to improve patient outcomes and healthcare efficiency. Furthermore, the government is promoting local manufacturing and the use of digital health technology to keep the country competitive in the global healthcare market. This industry offers opportunities for the integration of artificial intelligence and machine learning in medical devices, which can improve diagnostic capabilities and treatment regimens. There is significant possibility for expansion in the orthopaedic and cardiovascular device markets, reflecting the UK's growing health concerns in these areas. Recent trends indicate that manufacturers are increasingly focusing on sustainable processes and eco-friendly products, in line with rising environmental consciousness among customers and regulatory organisations. The possibility for collaboration across the healthcare ecosystem also opens up opportunities for producing cutting-edge medical devices that address the changing demands of UK patients.

Report Coverage

This research report categorizes the market size for the UK medical device market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom medical device market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom medical device market.

United Kingdom Medical Device Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 32.28 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 7.19% |

| 2035 Value Projection: | USD 69.28 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Device Type, By Application, By End User |

| Companies covered:: | Baxter International, Medtronic, Smith and Nephew, Johnson and Johnson, Philips, Boston Scientific, Siemens Healthineers, Cardinal Health, Thermo Fisher Scientific, Zimmer Biomet, Becton Dickinson, GE Healthcare, Fresenius Medical Care, Abbott, Stryker, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The UK’s aging population is driving growth in the medical device market. Increased demand for homecare technologies and chronic disease management tools is supported by NHS investments. Technological advances, including AI, telemedicine, and wearable devices, are enhancing patient care and system efficiency. Government initiatives like the Accelerated Access Collaborative and streamlined MHRA regulatory processes are accelerating innovation and market access. With nearly 40% of devices approved through MHRA pathways, the UK’s supportive environment is fostering rapid development in medical technologies to meet rising healthcare demands.

Restraining Factors

Regulatory difficulties, potential trade protectionism, market saturation in developed nations, unpredictable raw material costs, and the necessity for post-market surveillance are all barriers to growth in the UK medical device industry. These challenges can impact the growth and competitiveness of the UK medical device industry.

Market Segmentation

The United Kingdom medical device market share is classified into device type, application and end user.

- The diagnostic devices segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom medical device market is segmented by device type into drug delivery systems, diagnostic devices, invasive devices, respiratory therapeutic devices, electronic medical devices, and others. Among these, the diagnostic devices segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Diagnostic devices play an important role in preventive healthcare since they allow for the early detection and diagnosis of medical disorders. This is especially significant in the United Kingdom, where public health policies are centred on lowering the illness burden by timely intervention. Furthermore, invasive devices account for a considerable share of the industry, emphasising the need for surgical and non-surgical alternatives that improve patient outcomes.

- The cardiovascular diseases segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom medical device market is segmented by application into cardiovascular diseases, diagnostic imaging, orthopaedics, oncology, ophthalmology, general surgery, respiratory, dental, ear, nose, and throat (ENT), neurology, nephrology, urology, and others. Among these, the cardiovascular diseases segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Cardiovascular illnesses continue to be a prominent cause of death, resulting in substantial developments in medical equipment targeted at early detection and treatment. Diagnostic imaging is critical in improving patient care by allowing for more accurate assessments and treatment plans.

- The hospitals and clinics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom medical device market is segmented by end user into hospitals and clinics, ambulatory surgical centers, homecare settings, and others. Among these, the hospitals and clinics segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Hospitals and clinics play an important role in the adoption of medical devices because they require innovative equipment to improve patient care and operating efficiency.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom medical device market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Baxter International

- Medtronic

- Smith and Nephew

- Johnson and Johnson

- Philips

- Boston Scientific

- Siemens Healthineers

- Cardinal Health

- Thermo Fisher Scientific

- Zimmer Biomet

- Becton Dickinson

- GE Healthcare

- Fresenius Medical Care

- Abbott

- Stryker

- Others

Recent Developments:

- In January 2024, Abbott announced the UK launch of Lingo, a pioneering biowearable gadget and software meant to help people enhance their overall health and well-being. Lingo monitors glucose spikes and decreases in real time, providing personalised insights and coaching to help people adopt healthier habits and achieve better sleep, mood, concentration, energy, and less impulsive cravings.

- In January 2023, the UK Focused Ultrasound Foundation (UK FUSF), which is dedicated to fostering the research and deployment of focused ultrasound in the UK, announced its official debut. Focused ultrasound is a breakthrough platform technology that employs ultrasound energy directed by real-time imaging to treat tissue deep in the body, without incisions or radiation.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom medical device market based on the below-mentioned segments:

United Kingdom Medical Device Market, By Device Type

- Drug Delivery System

- Diagnostic Devices

- Invasive Devices

- Respiratory Therapeutic Devices

- Electronic Medical Device

- Others

United Kingdom Medical Device Market, By Application

- Cardiovascular Diseases

- Diagnostic Imaging

- Orthopedics

- Oncology

- Ophthalmology

- General Surgery

- Respiratory

- Dental

- Ear

- Nose

- Throat (ENT)

- Neurology

- Nephrology

- Urology

- Others

United Kingdom Medical Device Market, By End User

- Hospitals and Clinics

- Ambulatory Surgical Centers

- Homecare Settings

- Others

Need help to buy this report?