United Kingdom Medical Device Contract Manufacturing Market Size, Share, and COVID-19 Impact Analysis, By Class (Class I, Class II, and Class III), By Services (Accessories Manufacturing, Assembly Manufacturing, Component Manufacturing, Device Manufacturing, Packaging and Labelling, and Others), and United Kingdom Medical Device Contract Manufacturing Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Medical Device Contract Manufacturing Market Insights Forecasts to 2035

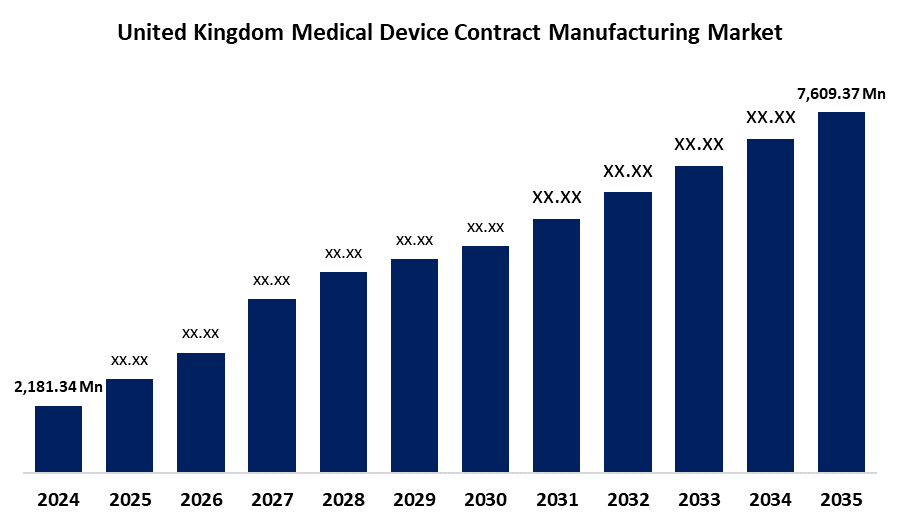

- The United Kingdom Medical Device Contract Manufacturing Market Size was Estimated at USD 2,181.34 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.03% from 2025 to 2035

- The United Kingdom Medical Device Contract Manufacturing Market Size is Expected to Reach USD 7,609.37 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Medical Device Contract Manufacturing Market Size is anticipated to reach USD 7,609.37 Million by 2035, growing at a CAGR of 12.03% from 2025 to 2035. The increasing chronic disease costs, aging populations, technology improvements, and outsourcing trends among OEMs striving to reduce costs while guaranteeing rapid time-to-market and regulatory compliance, in addition to the growing need for cost-effective production.

Market Overview

The United Kingdom medical device contract manufacturing market refers to the industry involves collaborating with external producers to create medical devices. From product design and development to component production, assembly, packaging, and regulatory support, these contract manufacturers offer a wide range of services. This market ensures high-quality and compliant production of devices used in diagnostics, treatment, monitoring, and surgical operations across various healthcare sectors while assisting original equipment manufacturers (OEMs) in reducing expenses, increasing efficiency, and speeding time-to-market. The rising incidences of chronic diseases, an aging population, and an increasing demand for cutting-edge healthcare solutions. OEMs are encouraged to outsource production by a growing emphasis on cost effectiveness and quicker product development cycles. Innovations in wearable technologies, diagnostic instruments, and minimally invasive gadgets also open up new business opportunities. Support from regulations and advancements in manufacturing processes and materials further increase prospects for cooperation and market expansion. The integrating innovative methods including robotic-assisted manufacturing, AI-driven design, and 3D printing. Businesses are implementing smart manufacturing techniques, utilizing automation and the Internet of Things to improve accuracy, shorten lead times, and facilitate the creation of intricate, personalized, and minimally invasive medical equipment.

Report Coverage

This research report categorizes the market for the United Kingdom medical device contract manufacturing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom medical device contract manufacturing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom medical device contract manufacturing market.

United Kingdom Medical Device Contract Manufacturing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,181.34 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 12.03% |

| 2035 Value Projection: | USD 7,609.37 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 288 |

| Tables, Charts & Figures: | 102 |

| Segments covered: | By Class and By Services |

| Companies covered:: | Guerbet, Renishaw, Consort Medical, Synnovia, Vygon, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The increasing prevalence of chronic conditions requiring innovative medical technologies, the growing need for sophisticated and affordable healthcare solutions, and the increased outsourcing of production by OEMs to cut costs. In addition, the UK's aging population increases demand for orthopedic implants and diagnostic tools, along with other medical gadgets. Contract manufacturing is also encouraged by regulatory support for increased product approval times and quality standards. Additionally, advances in manufacturing technologies like automation, digital health integration, and additive manufacturing allow for mass customization and rapid prototyping, which drives growth in this market that is growing more and more innovative and competitive.

Restraining Factors

The concerns regarding intellectual property protection, stringent regulatory compliance requirements, and high setup and validation costs. Delays in the supply chain and reliance on outside manufacturers can also have an impact on product schedules, quality assurance, and adaptability to unexpected shifts in the market.

Market Segmentation

The United Kingdom Medical Device Contract Manufacturing Market share is classified into class and services.

- The class II segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom medical device contract manufacturing market is segmented by class into class I, class II, and class III. Among these, the class II segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to the need for advanced medical equipment has increased due to an aging population and the rising incidence of chronic diseases. As healthcare professionals search for innovative methods to improve patient outcomes, this demand drives the industry.

- The device manufacturing segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom medical device contract manufacturing market is segmented by services into accessories manufacturing, assembly manufacturing, component manufacturing, device manufacturing, packaging & labelling, and others. Among these, the device manufacturing segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the increasing demand for scalable manufacturing solutions and innovative medical technologies. technological developments that improve device production efficiency and accuracy, including as automation, robotics, and the incorporation of Internet of Things (IoT) capabilities in manufacturing processes.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom medical device contract manufacturing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Guerbet

- Renishaw

- Consort Medical

- Synnovia

- Vygon

- Others.

Recent Developments:

- In May 2024, Abingdon Health launched SaliStick, the world's first saliva-based pregnancy test, in partnership with Salignostics. This non-invasive test offers an alternative to traditional methods, enhancing user convenience.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom medical device contract manufacturing market based on the below-mentioned segments:

United Kingdom Medical Device Contract Manufacturing Market, By Class

- Class I

- Class II

- Class III

United Kingdom Medical Device Contract Manufacturing Market, By Services

- Accessories Manufacturing

- Assembly Manufacturing

- Component Manufacturing

- Device Manufacturing

- Packaging and Labelling

- Others

Need help to buy this report?