United Kingdom Mayonnaise Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Flavoured and Unflavoured), By Distribution Channel (Supermarkets and Hypermarkets, Convenience stores, Online Retailers, and Others), and UK Mayonnaise Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Mayonnaise Market Forecasts to 2035

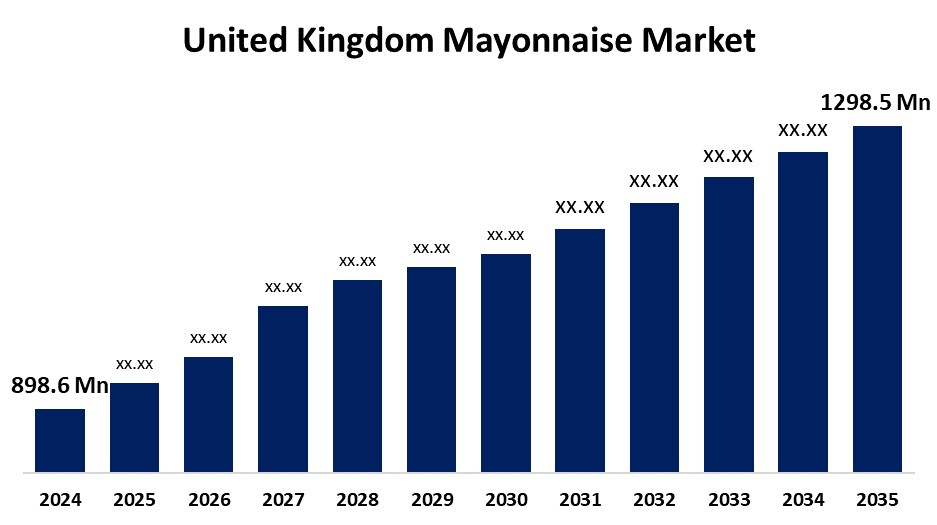

- The United Kingdom Mayonnaise Market Size Was Estimated at USD 898.6 Million in 2024

- The UK Mayonnaise Market Size is Expected to Grow at a CAGR of around 3.4% from 2025 to 2035

- The UK Mayonnaise Market Size is Expected to Reach USD 1298.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Mayonnaise Market is anticipated to reach USD 1298.5 million by 2035, growing at a CAGR of 3.4% from 2025 to 2035. The UK mayonnaise market is driving as a result of rising demand for convenience meals, health-conscious product innovations, increased retail availability, home cooking, and consumer desire in bold, customisable flavour combinations.

Market Overview

The UK mayonnaise market refers to a creamy blend of oil, egg yolk, and vinegar or lemon juice, which is widely used in salads, dips, and sandwiches, driving market demand. The growing food service sector and the growing desire for quick meal options, including salads, sandwiches, and wraps, are the main drivers of the UK mayonnaise market's robust expansion. With growing interest in low-fat, vegan, organic, gluten-free, and eggless mayonnaise, health-conscious customers are having an impact on the industry. Consumer choices are also being influenced by transparency in food labelling and a preference for natural, additive-free foods. Brands are being pushed by eco-conscious consumers to use premium, sustainable ingredients. The industry is also growing due to shifting lifestyles and a rising preference for strong flavours like truffle, sriracha, and garlic. By providing specialised goods, artisanal and regional manufacturers are becoming more popular and strengthening local economies. The convenience of buying mayonnaise from supermarkets, online retailers, and food delivery platforms is also supporting growth. The rise of online shopping and food delivery has led to increased consumption of mayonnaise due to its use in ready-to-eat meals. In summary, changing consumer preferences and lifestyle trends keep opening doors in the UK mayonnaise market.

Report Coverage

This research report categorizes the market for the UK mayonnaise market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom mayonnaise market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom mayonnaise market.

United Kingdom Mayonnaise Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 898.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 3.4% |

| 2035 Value Projection: | USD 1298.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 220 |

| Tables, Charts & Figures: | 112 |

| Segments covered: | By Product Type, By Distribution and COVID-19 Impact Analysis |

| Companies covered:: | Stokes, Del Monte, Hain Celestial, Miracle Whip, Best Foods, Kraft Heinz, Tesco, Hellmanns, Sainsburys, Wilkin and Sons, Unilever, Zafron Foods Ltd., Hiltfields Ltd., Sasco Sauces Ltd., Piquant Ltd., Freshpak Chilled Foods, Olympic Oils Ltd., Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The trend of convenience and demand for easy meals is influencing the UK mayonnaise market. The increase of mayonnaise in sandwiches, burgers, and recipes has grown due to post-COVID everyday life and home cooking. There is a large amount of low-fat and organic choices due to health consciousness and food trends, which were supported by Public Health England. Mayonnaise is becoming an increasingly versatile staple because of the trend of people cooking DIY and personalizing their foods as well. Companies such as Heinz and Unilever are adding their distribution to meet customer demand, which will further enhance the market growth.

Restraining Factors

The market for mayonnaise in the UK is largely constrained by consumers' desire for better options due to health concerns about the product's high fat and calorie content. More transparency is also required by stringent food rules and labelling requirements. Brands are under pressure to innovate while upholding changing food safety regulations since non-compliance puts them at risk of fines and recalls. These factors hamper the mayonnaise market during the forecast period.

Market Segmentation

The United Kingdom mayonnaise market share is classified into product type and distribution channel.

- The unflavoured segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom mayonnaise market is segmented by product type into flavoured and unflavoured. Among these, the unflavoured segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rise of fast-food restaurants and eateries in the UK is the reason for this expansion. Because of its thick, creamy consistency and mild flavour, unflavoured mayonnaise can be used as a spread, dip, or sauce. Which is driving up demand for mayonnaise in the UK.

- The supermarkets and hypermarkets segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom mayonnaise market is segmented by distribution channel into supermarkets and hypermarkets, convenience stores, online retailers, and others. Among these, the supermarkets and hypermarkets segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The supermarket and hypermarket sector are growing at a significant rate. Supermarkets and hypermarkets sell mayonnaise in various brands, flavours, and packaging types and sizes. These dairy-free mayonnaise businesses usually have a company commitment to stocking a large assortment of products. Given the breadth of items available, consumers have multiple options to address their dietary needs, personal choice, or financial restrictions. These companies also provide consumers, whether commercial/institutional or retail, the ability to purchase mayonnaise in bulk.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom mayonnaise market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Stokes

- Del Monte

- Hain Celestial

- Miracle Whip

- Best Foods

- Kraft Heinz

- Tesco

- Hellmanns

- Sainsburys

- Wilkin and Sons

- Unilever

- Zafron Foods Ltd.

- Hiltfields Ltd.

- Sasco Sauces Ltd.

- Piquant Ltd.

- Freshpak Chilled Foods

- Olympic Oils Ltd.

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom mayonnaise market based on the below-mentioned segments:

United Kingdom Mayonnaise Market, By Product Type

- Flavoured

- Unflavoured

United Kingdom Mayonnaise Market, By Distribution Channel

- Supermarkets and Hypermarkets

- Convenience stores

- Online Retailers

- Others

Need help to buy this report?