United Kingdom Luxury Bedding Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Blankets & Quilts, Bed Linen, Down Covers, Duvets, Mattresses, Pillowcases & Shams, Protectors, Others), By Distribution Channel (Online Stores, Specialty Bedding Stores, Home Decor Stores, Hypermarkets and Supermarkets, Others), By End-User (Residential, Commercial), and UK Luxury Bedding Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Luxury Bedding Market Forecasts to 2035

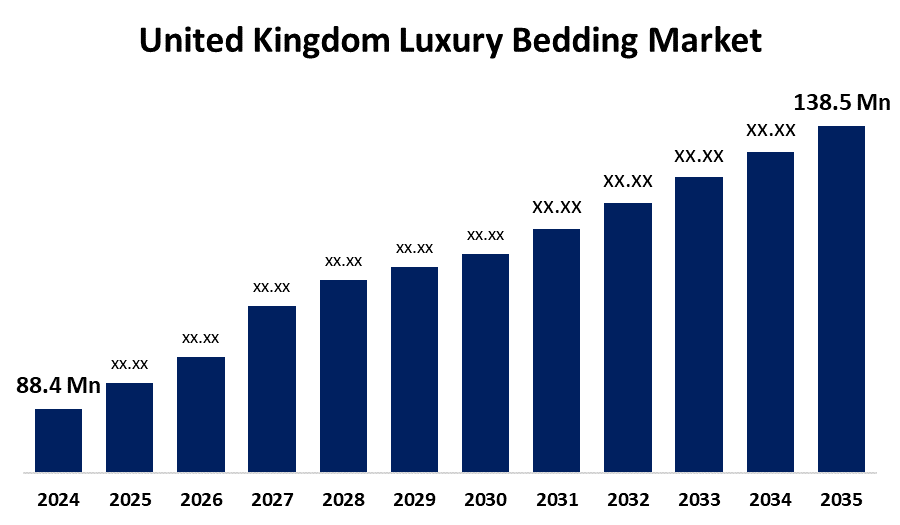

- The United Kingdom Luxury Bedding Market Size Was Estimated at USD 88.4 Million in 2024

- The UK Luxury Bedding Market Size is Expected to Grow at a CAGR of around 4.17% from 2025 to 2035

- The UK Luxury Bedding Market Size is Expected to Reach USD 138.5 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The UK Luxury Bedding Market Size is anticipated to reach USD 138.5 Million by 2035, growing at a CAGR of 4.17% from 2025 to 2035. The luxury bedding market in the UK has been steadily expanding. Consumers are spending more on upscale home furnishings and opulent sleep accessories as a result of rising income levels and increasing disposable income. Additionally, the demand for luxury bed linens made of premium materials like cashmere, silk, and cotton has increased due to the growing influence of international home décor trends on UK customers

Market Overview

The UK luxury bedding market refers to the manufacturing, marketing, and distribution of luxury bedding goods aimed at wealthy customers and lodging facilities. Product innovation, a broad range of customisations, and brand positioning that prioritises quality, exclusivity, and premium appeal are its defining characteristics. One important aspect of creating opportunities for the luxury bedding market is the growing popularity of internet purchasing. Discounts provided by online channels aid in customer retention, which may boost market expansion. Startups in the textile and mattress sectors can purchase goods straight from producers and resell them online, which reduces transportation expenses and makes it possible to drastically cut the price of luxury goods. Because online shopping is becoming more and more popular, the market for luxury bedding is growing. The rising discretionary incomes of customers present an opportunity for the luxury bedding sector. As consumers' discretionary income increases, they are more likely to purchase luxurious and high-end bedding products. Over the coming years, there will likely be a strong demand for high-end home furnishings and accessories as disposable incomes continue to rise, helped by a steady job market and stable inflation. The demand for high-end bedding solutions will be driven by the need for self-care, the importance of getting a good night's sleep, and the desire to live in luxury at home even during stressful times. To draw in wealthy customers, top luxury bedding companies are experimenting with innovative fabric technologies, eco-friendly materials, and ergonomic designs.

Report Coverage

This research report categorizes the market for the UK luxury bedding market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom luxury bedding market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom luxury bedding market.

United Kingdom Luxury Bedding Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 88.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.17% |

| 2035 Value Projection: | USD 138.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 271 |

| Tables, Charts & Figures: | 101 |

| Segments covered: | By Product Type, By Distribution Channel and By End-User |

| Companies covered:: | White Company, Savoir Beds, Frette, Vispring, John Lewis & Partners, Hastens, Harrods, Soak &Sleep, WestPoint Home LLC, Hollander Sleep Products LLC, Crane & Canopy Inc., John Cotton Group Ltd., and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

Premium and customised items are in high demand in the UK luxury bedding market. Customers are becoming more interested in custom alternatives from luxury brands as they look for bedding that matches their bedroom decor and expresses their choice. Furthermore, soft and organic materials like sateen, velvet, flax linen, and organic cotton are becoming more and more popular due to their eco-friendliness and comfort. There are no harsh chemicals or pesticides in these materials. Initiatives like India's NPOP, which encourages organic production and certification standards, assist the movement. This change is a reflection of consumers' increased emphasis on quality, sustainability, and customised comfort in bedding.

Restraining Factors

The UK luxury bedding market has been impacted by economic slowdown and rising inflation, reducing consumer spending on premium products. Brexit-related uncertainty further weakened consumer confidence. Additionally, the high cost of silk due to labour intensive production and limited availability adds to challenges for luxury bedding markets, making it harder to maintain affordability and demand amid economic pressures. These factors can hamper the UK Luxury Bedding market during the forecast period.

Market Segmentation

The United Kingdom Luxury Bedding Market Share is classified into product type, distribution channel, and end user.

- The bed linen segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom luxury bedding market is segmented by product type into blankets & quilts, bed linen, down covers, duvets, mattresses, pillowcases & shams, protectors, and others. Among these, the bed linen segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The need for bed linen, which comprises fitted sheets, pillowcases, and high-thread-count sheets, stems from the fact that it is crucial for improving comfort, appearance, and general sleep quality. A major factor in this segment's growth is consumers' growing desire for high-end fabrics like linen, silk, and Egyptian cotton. The popularity of bed linens among luxury buyers is further increased by the rising knowledge of the health advantages linked to good sleep and hypoallergenic fabric possibilities.

- The online stores segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom luxury bedding market is segmented by distribution channel into online stores, specialty bedding stores, home decor stores, hypermarkets and supermarkets, and others. Among these, the online stores segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Online buying is becoming more and more popular due to the accessibility, variety, and ease that e-commerce platforms provide. Before making a purchase, consumers can quickly compare brands, materials, and costs, which is especially appealing when purchasing high-end bedding.

- The residential segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom luxury bedding market is segmented by end user into residential, commercial. Among these, the residential segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. This impressive success is a result of consumers' growing interest in home comfort, wellness, and aesthetics, as more people see fine bedding as a necessary part of an opulent lifestyle. Because customers are spending more time at home and prioritising bedroom modifications for improved sleep quality, the rise of remote work has also been crucial. Further supporting the residential segment's market leadership is the fact that rising disposable incomes, especially in urban areas, have allowed more consumers to invest in high-end bedding products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom luxury bedding market and a with comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- White Company

- Savoir Beds

- Frette

- Vispring

- John Lewis & Partners

- Hastens

- Harrods

- Soak &Sleep

- WestPoint Home LLC

- Hollander Sleep Products LLC

- Crane & Canopy Inc.

- John Cotton Group Ltd.

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom luxury bedding market based on the below-mentioned segments:

United Kingdom Luxury Bedding Market, By Product Type

- Blankets & Quilts

- Bed Linen

- Down Covers

- Duvets

- Mattresses

- Pillowcases & Shams

- Protectors

- Others

United Kingdom Luxury Bedding Market, By Distribution Channel

- Online Stores

- Specialty Bedding Stores

- Home Decor Stores

- Hypermarkets and Supermarkets

- Others

United Kingdom Luxury Bedding Market, By End-User

- Residential

- Commercial

Need help to buy this report?