United Kingdom Lottery Market Size, Share, and COVID-19 Impact Analysis, By Category (Draw-based lottery, Instant games, Sports game), By Format (Online Lottery, Offline Lottery), and United Kingdom Lottery Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Lottery Market Insights Forecasts to 2035

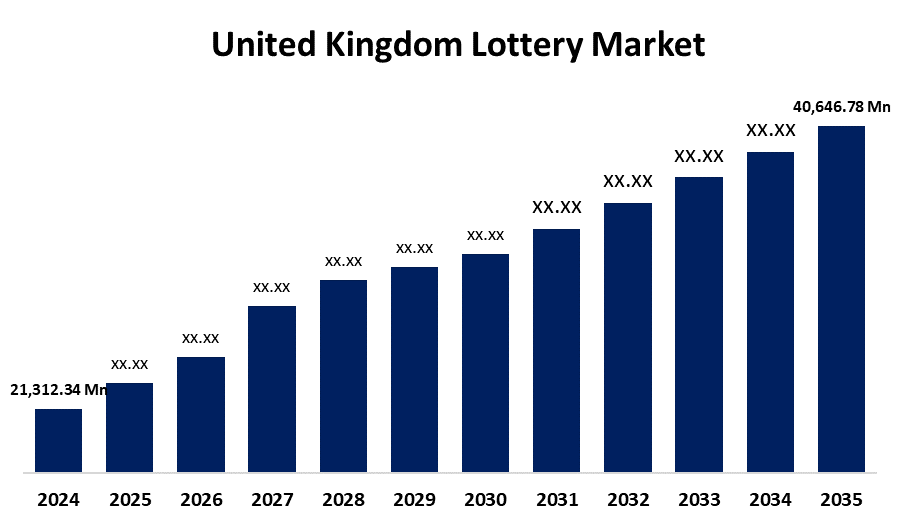

- The United Kingdom Lottery Market Size was Estimated at USD 21,312.34 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.05% from 2025 to 2035

- The United Kingdom Lottery Market Size is Expected to Reach USD 40,646.78 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Lottery Market Size is anticipated to reach USD 40,646.78 Million by 2035, growing at a CAGR of 6.05% from 2025 to 2035. The growing number of Gen Z and minimal, the expansion of gambling laws, the growing recognition of lottery applications and platforms, and the increased accessibility.

Market Overview

The United Kingdom lottery market is described to the marketplace, focused on the distribution and encouraging the type of gambling business for local consumers as a form of entertainment. A lottery is a form of gambling where participants purchase tickets and select numbers in hopes of winning a prize. The winning numbers are usually drawn at random, and the prize amounts can vary widely, ranging from small amounts to large jackpots. Lotteries are often run by governments or authorized organizations, and the proceeds may be used to fund public programs or other causes. The industry is being revolutionized in large part by innovative technologies. Customers' interactions with lottery games are changing as a cinsequence of blockchain-based solutions, AI-powered predictive analytics, and mobile-friendly apps. Additionally, consumers' convenience and security are being improved by the integration of digital payment alternatives, such as cryptocurrency transactions, opening the door to a more modern and efficient lottery experience. Further, development news across the country highlights the progress of the market. For instance, in June 2021, The National Lottery achieved a record-breaking year, surpassing £8 billion in sales for the first time. This milestone has resulted in £1.2 billion in funding being awarded to support COVID-19 response efforts and other Good Causes, with players contributing over £5 million per day to charitable initiatives.

Report Coverage

This research report categorizes the market for the United Kingdom lottery market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom lottery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom lottery market.

United Kingdom Lottery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 21,312.34 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 6.05% |

| 2035 Value Projection: | USD 40,646.78 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 269 |

| Tables, Charts & Figures: | 96 |

| Segments covered: | By Category and By Format |

| Companies covered:: | Camelot Group, Allwyn UK, The Health Lottery, Postcode Lottery, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for the United Kingdom lottery is driven by the notable growth of e-commerce and digital services across this country. The digital expansion creates new opportunities for industry growth and makes cutting-edge gaming experiences that open up to a wider audience. Further driving market expansion are regional governments' legalization and regulation of online lotteries to raise money. Using blockchain technology increases consumer trust by ensuring fairness and transparency, also boosting market expansion. The market's development is further enhanced by the incorporation of cutting-edge game formats and marketing techniques.

Restraining Factors

The market growth suffers from some obstacles, including illegal gambling activities, risky gaming experiences, and a lack of safeguards or permits. Illegal activities not only give permitted businesses unfair competition, but they also lower tax collections and raise the possibility of fraud and money laundering.

Market Segmentation

The United Kingdom Lottery Market Share is classified into category and format.

- The sports game segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period.

The United Kingdom lottery market is segmented by category into draw-based lottery, instant games, and sports game. Among these, the sports game segment held a significant share in 2024 and is expected to grow at a rapid pace during the forecast period. This is due to the thrill of sporting events, which adds to the allure of sports lotteries. When international competitions like the Olympics or the World Cup happen, fans get really excited and involved, which frequently results in additional individuals playing the lottery. One of the main reasons consumers buy lottery tickets is the possibility of winning big prizes during these well-known occasions.

- The online lottery segment held the highest share in 2024 and is estimated to grow at a substantial over during the forecast period.

The United Kingdom lottery market is divided by format into online lottery, and offline lottery. Among these, the online lottery segment held the highest share in 2024 and is estimated to grow at a substantial CAGR over the forecast period. This is because of growing internet penetration and the widespread use of smartphones. Lottery games can be played at any time and from almost anywhere, owing to high-speed internet connectivity, eliminating the need to purchase actual tickets or go to conventional retail locations. A larger audience can now interact with lottery products thanks to the democratization of lottery participation brought about by this move to digital platforms.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom lottery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Camelot Group

- Allwyn UK

- The Health Lottery

- Postcode Lottery

- Others

Recent Developments:

- In February 2025, the UK National Lottery operator, Allwyn, had partnered with McLaren Racing, marking its second Formula One-focused sponsorship in a week. This deal followed Allwyn’s recent agreement with Formula 1 itself, as the company had sought to expand its brand visibility across European and global markets.

- In February 2024, Allwyn UK had become the official operator of The National Lottery, taking over from Camelot Group. The company had focused on digital innovation, responsible gaming, and community engagement, ensuring that lottery proceeds had continued to support charitable causes across the UK.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom lottery market based on the below-mentioned segments:

United Kingdom Lottery Market, By Category

- Draw-based lottery

- Instant games

- Sports game

United Kingdom Lottery Market, By Format

- Online Lottery

- Offline Lottery

Need help to buy this report?