United Kingdom Logistics Market Size, Share, and COVID-19 Impact Analysis, By Service (Transportation Services, Warehousing and Distribution Services, Freight Forwarding Services, Inventory Management Services, Value-Added Logistics Services, and Integration & Consulting Services), By Model (3PL/Contract Logistics, 4PL/Lead Logistics, and Others), By Mode of Transportation (Roadways, Seaways, Railways, and Airways), and United Kingdom Logistics Market Insights, Industry Trend, Forecasts to 2035

Industry: Automotive & TransportationUK Logistics Market Insights Forecasts to 2035

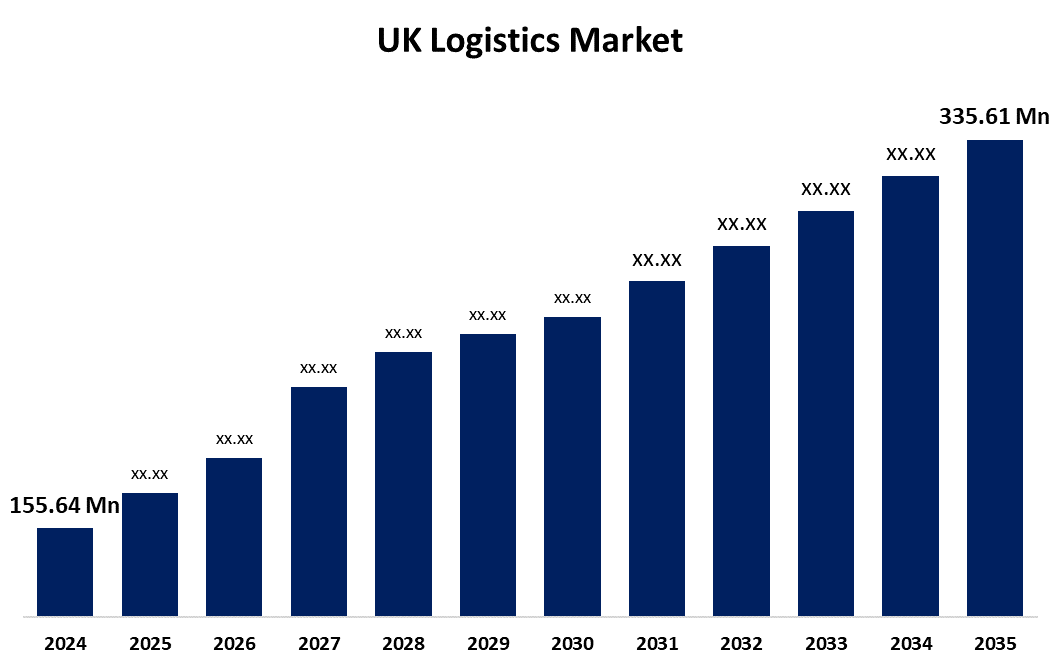

- The United Kingdom Logistics Market Size was Estimated at USD 155.64 Million in 2024

- The United Kingdom Logistics Market Size is Expected to Grow at a CAGR of around 7.24% from 2025 to 2035

- The United Kingdom Logistics Market Size is Expected to Reach USD 335.61 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Logistics Market Size is anticipated to reach USD 335.61 Million by 2035, Growing at a CAGR of 7.24% from 2025 to 2035. The increasing need for efficient transportation, the rapid growth of trade deals and international company ties, and increasing last-mile delivery services are some of the major drivers propelling the market's rise.

Market Overview

The United Kingdom logistics market refers to the industry focused on organizing, planning, and carrying out intricate processes that involve moving individuals, information, or merchandise. They combine with distribution, warehousing, transportation, and procurement to guarantee prompt and economical delivery. Manufacturing, retail, and e-commerce are key industry verticals where logistics is vital. The objective is to efficiently and dependably deliver the appropriate goods at the appropriate time to the appropriate location. A more efficient and responsive supply chain is the outcome of modern logistics' integration of technology to improve automation, tracking, and visibility. Further, a strong government support, such as in December 2023, the government partnered with several logistics companies, significantly boosting the UK economy by enhancing supply chain efficiency, trade, and sustainability. Recent discussions among UK logistics leaders emphasized the sector’s £163 billion contribution to the economy and urged the government to implement strategic policies to support growth.

Report Coverage

This research report categorizes the market for the United Kingdom logistics market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom logistics market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom logistics market.

United Kingdom Logistics Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 155.64 Million |

| Forecast Period: | 2025 - 2035 |

| Forecast Period CAGR 2025 - 2035 : | 7.24% |

| 2035 Value Projection: | USD 335.61 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 178 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Service, By Model, By Mode of Transportation and COVID-19 Impact Analysis |

| Companies covered:: | Royal Mail, UK Mail, UPS, Kuehne + Nagel, and Others. |

| Pitfalls & Challenges: | Covid-19 Empact, Challenges, Growth, Analysis. |

Get more details on this report -

Driving Factors

The market for United Kingdom logistics is driven by sophisticated infrastructure and advantageous geographic location, which enable effective supply chain and transportation operations. The need for more reliable logistics solutions has been fueled by the growing demand for online shopping. The market expansion has also been significantly driven by sustainability programs that aim to lower carbon footprints. The growth of e-commerce and the growing need for dependable, quick delivery services have greatly expanded the logistics industry. Furthermore, automation and technological breakthroughs are improving operational effectiveness and propelling industry expansion.

Restraining Factors

The United Kingdom market for logistics is being challenged by the high upfront expenses. Additionally, geopolitical unpredictability and regulatory barriers could impede market expansion.

Market Segmentation

The United Kingdom logistics market share is classified into service, model, and mode of transportation.

- The warehousing and distribution services segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period.

The United Kingdom logistics market is divided by service into transportation services, warehousing and distribution services, freight forwarding services, inventory management services, value-added logistics services, and integration & consulting services. Among these, the warehousing and distribution services segment held a significant share in 2024 and is expected to grow at a rapid pace over the forecast period. The segment growth is propelled by the growing complexity of supply chains and the expansion of e-commerce businesses. Further, companies are making substantial investments in cutting-edge distribution and warehousing technology, like automation and robotics, which drive the segment growth.

- The 3PL/contract logistics segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period.

The United Kingdom logistics market is segmented by model into 3PL/contract logistics, 4PL/lead logistics, and others. Among these, the 3PL/contract logistics segment held the largest share in 2024 and is anticipated to grow at a significant CAGR during the forecast period. This is because of the growth in e-commerce and shifting consumer demands for prompt and effective delivery, the 3PL model is a key competitor. Consolidated shipments and better route planning are two ways that businesses are using 3PL solutions to improve sustainability practices in the face of increased environmental concerns. The 3PL framework's incorporation of AI-driven analytics and IoT-based tracking enhances visibility and control as the industry experiences technological breakthroughs.

- The roadways segment held the highest share in 2024 and is expected to grow at a substantial CAGR over the forecast period.

The United Kingdom logistics market is segmented by mode of transportation into roadways, seaways, railways, and airways. Among these, the roadways segment held the highest share in 2024 and is expected to grow at a substantial CAGR over the forecast period. This is because of a vast network of roads. The importance of roads has increased in tandem with the drastic expansion of e-commerce, consumers' increased demands for speedy deliveries, and the growing last-mile delivery marketplace. Furthermore, the factors highlight the importance of road transportation in shaping the logistics environment of the United Kingdom, such as versatility, dependability, and the critical role in meeting the needs of the country's supply chain with precision.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom logistics market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Royal Mail

- UK Mail

- UPS

- Kuehne + Nagel

- Others

Recent Developments:

- In May 2024, Mountain Warehouse extended its partnership with Metapack, a leader in e-commerce delivery technology, to enhance shipping services across the UK. Already utilizing Metapack’s Delivery Manager, Mountain Warehouse integrated Metapack’s Delivery Options and Intelligence solutions to optimize its fulfillment operations.

- In December 2023, CEVA Logistics was selected as the exclusive UK supply chain partner for Flying Tiger Copenhagen. This strategic partnership focused on road freight logistics, ensuring efficient and sustainable product distribution across the UK.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom logistics market based on the below-mentioned segments:

UK Logistics Market, By Service

- Transportation Services

- Warehousing and Distribution Services

- Freight Forwarding Services

- Inventory Management Services

- Value-Added Logistics Services

- Integration & Consulting Services

UK Logistics Market, By Model

- 3PL/Contract Logistics

- 4PL/Lead Logistics

- Others

UK Logistics Market, By Mode of Transportation

- Roadways

- Seaways

- Railways

- Airways

Need help to buy this report?