United Kingdom Last Mile Delivery Market Size, Share, and COVID-19 Impact Analysis, By Service Type (B2C, B2B, C2C), By Application (Retail & E-Commerce, Healthcare, Food & Beverages, and Others), and United Kingdom Last Mile Delivery Market Insights, Industry Trend, Forecasts to 2035.

Industry: Automotive & TransportationUnited Kingdom Last Mile Delivery Market Insights Forecasts to 2035

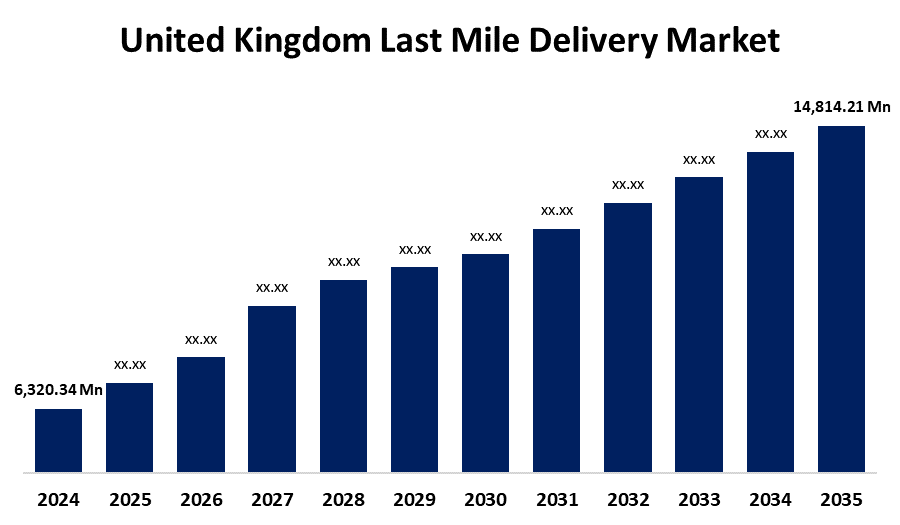

- The United Kingdom Last Mile Delivery Market Size was estimated at USD 6,320.34 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 8.05% from 2025 to 2035

- The United Kingdom Last Mile Delivery Market Size is Expected to Reach USD 14,814.21 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Last Mile Delivery Market Size is Anticipated to reach USD 14,814.21 Million By 2035, Growing at a CAGR of 8.05% from 2025 to 2035. Technological advancements, quick e-commerce evaluation, dynamic shifts in the industry, and evolving and developing consumer preferences are all contributing factors to market expansion.

Market Overview

The United Kingdom last mile delivery market refers to the business focused on the last mile logistics to cover the short distance, at the highest point of the delivery chain. It represents the flow of products or anything that can be transported from the storage facility or transportation hub to the endpoint. Its main objective is to transport the products to their designated locations as quickly, precisely, effectively, and sustainably as possible. Businesses often require assistance with last-mile delivery due to supply chain inefficiencies, consumer expectations for free and speedy shipping, and the need to balance cost-effectiveness and service quality. Further, accessibility and a wide range of products, online shopping has become more and more popular among customers, which shows the significant importance of the last mile delivery market expansion. Besides, the increasing business of on demand delivery could heighten the market position across the country. Further, companies teamed up to find new solutions and new market strategies to boost the wide market adoption. Also, they emphasize that supplying excellent consumer service can obtain an edge in the marketplace, build loyal clients, and eventually achieve sustained growth.

Report Coverage

This research report categorizes the market for the United Kingdom last mile delivery market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom last mile delivery market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom last mile delivery market.

United Kingdom Last Mile Delivery Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 6,320.34 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 8.05% |

| 2035 Value Projection: | USD 14,814.21 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 175 |

| Tables, Charts & Figures: | 90 |

| Segments covered: | By Service Type, By Application and COVID-19 Impact Analysis |

| Companies covered:: | AMZ Prep, Zendbox, Royal Mail, DPD, Preston Courier Co. Ltd, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The market for the United Kingdom last mile delivery is driven by the country's trade transactions in the international marketplace and the rising demand for merchandise due to changing consumer needs. Further, the rising consumer goods sector, which fuels the market opportunities. The last-mile delivery sector is changing as a consequence of the introduction of alternative delivery techniques, including drone and autonomous vehicle delivery. In places with a high population density, these technologies lower labor costs and expedite delivery, which fulfills the market expansion. Continued developments in automation, such as Unmanned Aerial Vehicles (UAVs), hold the potential to completely transform the last mile delivery process and satisfy the changing needs of both businesses and consumers.

Restraining Factors

However, factors including staff safety and health worries, a higher cost of sophisticated technology specifically for small and medium-sized enterprises that results in problems with transportation, and shortages of workers slow down the market's growth.

Market Segmentation

The United Kingdom last mile delivery market share is classified into service type and application.

- The B2C segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom last mile delivery market is segmented by service type into B2C, B2B, and C2C. Among these, the B2C segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is due to the growing adoption of e-commerce portals and a notable increase in consumer preferences for online shopping. This trend will continue as long as businesses recognize how crucial it is to offer smooth, responsive, and customer-focused services.

- The retail & e-commerce segment dominated the market in 2024 and is expected to grow at a substantial CAGR during the forecast period.

The United Kingdom last mile delivery market is segmented by application into retail & e-commerce, healthcare, food & beverages, and others. Among these, the retail & e-commerce segment dominated the market in 2024 and is expected to grow at a substantial CAGR during the forecast period. This is because of the constant necessity to remain viable, and the continued expansion of online shopping is the primary reason for the dominance of both the retail and e-commerce industries. The market is also growing since it helps move goods from distribution warehouses quickly and efficiently to the customer's delight at the door during delivery.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom last mile delivery market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- AMZ Prep

- Zendbox

- Royal Mail

- DPD

- Preston Courier Co. Ltd

- Others

Recent Developments:

- In February 2025, Pricewatch Group became the first retailer to adopt NearSt’s last-mile delivery solution in the UK. This technology automatically connected EPoS systems and in-store inventory to major delivery platforms like Uber Eats, Deliveroo, and Just Eat, making last-mile operations more efficient.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom last mile delivery market based on the below-mentioned segments

United Kingdom Last Mile Delivery Market, By Service Type

- B2C

- B2B

- C2C

United Kingdom Last Mile Delivery Market, By Application

- Retail & E-Commerce

- Healthcare

- Food & Beverages

- Others

Need help to buy this report?