United Kingdom Internet Data Center (IDC) Market Size, Share, and COVID-19 Impact Analysis, By Services (Colocation, Hosting, CDN, and Others), By Deployment (Public, Private, and Hybrid), and United Kingdom Internet Data Center (IDC) Market Insights, Industry Trend, Forecasts to 2035

Industry: Information & TechnologyUnited Kingdom Internet Data Center (IDC) Market Insights Forecasts to 2035

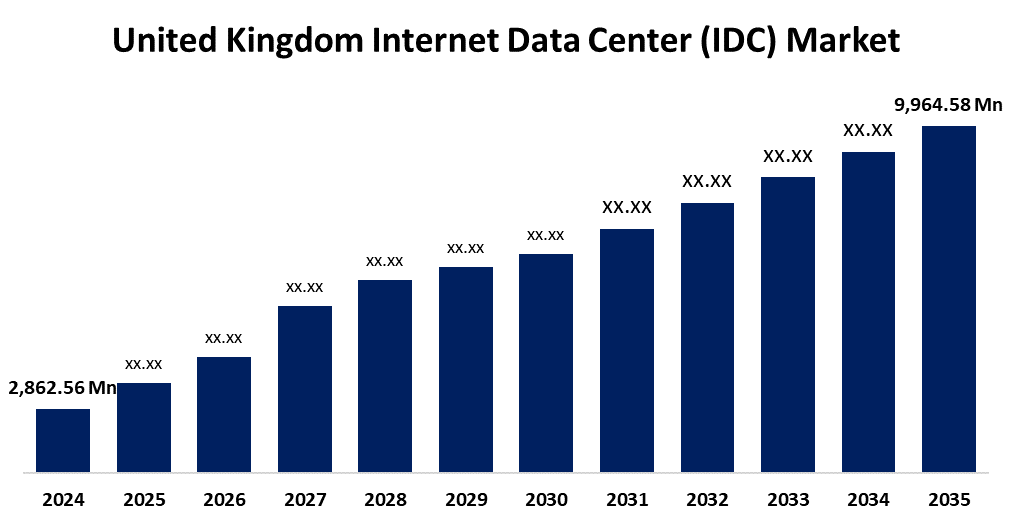

- The United Kingdom Internet Data Center (IDC) Market Size Was Estimated at USD 2,862.56 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 12.01% from 2025 to 2035

- The United Kingdom Internet Data Center (IDC) Market Size is Expected to Reach USD 9,964.58 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Internet Data Center (IDC) Market Size is anticipated to reach USD 9,964.58 Million by 2035, growing at a CAGR of 12.01% from 2025 to 2035. The increased data traffic from digital transformation, growing investments in hyperscale data center infrastructure and green energy solutions, growing demand for cloud services, and growing usage of IoT and AI technologies.

Market Overview

The United Kingdom internet data center (IDC) market refers to the industry includes buildings that contain vital IT components including networking hardware, servers, and storage systems. These facilities facilitate the processing, storing, and sharing of data for companies and web-based services. IDCs assistance a variety of industries, including finance, healthcare, retail, and telecommunications, by guaranteeing the high availability, security, and scalability of online services in the context of increasing digitalization, cloud adoption, and big data usage. The growing demand for computing at the edge, the growing trend toward cloud computing, and the emergence of AI and IoT applications. The need for sophisticated data center infrastructure is also fueled by the growth of e-commerce, the adoption of remote work, and digital services across industries. Furthermore, new opportunities for environmentally friendly and energy-efficient IDC solutions in the UK are provided by government programs that foster sustainability and digital transformation. The integration of modular data centers, AI-driven infrastructure management, and liquid cooling solutions. These developments serve the changing demands of cloud computing, IoT, and big data analytics across businesses through enhanced energy efficiency, optimizing performance, and lowering operating costs.

Report Coverage

This research report categorizes the market for the United Kingdom internet data center (IDC) market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom internet data center (IDC) market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom internet data center (IDC) market.

United Kingdom Internet Data Center (IDC) Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2,862.56 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 12.01% |

| 2035 Value Projection: | USD 9,964.58 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 259 |

| Tables, Charts & Figures: | 108 |

| Segments covered: | By Services and By Deployment |

| Companies covered:: | Telehouse, Interxion, Stonegate, Virtus Data Centres, Giganet, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The rapid increase of data produced by IoT, AI, and big data applications, the quick digital transformation of entire industries, and the growing use of cloud computing are all significant factors. The growth of IDCs is driven by rising demands for processing power, data storage, and low-latency communication. Government programs promoting the adoption of 5G and digital infrastructure also accelerate industry expansion. Furthermore, the demand for reliable, scalable, and secure data center solutions has increased due to the growth of online services, e-commerce, and remote work. Innovation in energy-efficient and sustainable IDC technologies is also influenced by environmental concerns.

Restraining Factors

The high expenses of capital investments, difficult regulatory compliance, and privacy issues with data. Environmental and operational challenges are also presented by rising energy usage and cooling needs. Data center implementation and growth can also be slowed down by infrastructure limitations and a shortage of competent workers.

Market Segmentation

The United Kingdom internet data center (IDC) market share is classified into service and deployment.

- The colocation segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom internet data center (IDC) market is segmented by service into colocation, hosting, CDN, and others. Among these, the colocation segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to businesses have been searching for scalable, secure, and reasonably priced infrastructure solutions. Businesses choose colocation over owning physical assets due to growing digital transformation, cloud usage, and the need for dependable data storage, which accelerates market growth in the UK.

- The public segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period

The United Kingdom internet data center (IDC) market is segmented by deployment into public, private, and hybrid. Among these, the public segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by growing use of the cloud by businesses and governments in search of reasonable, scalable solutions. Demand is additionally supported by improved remote work, digital services, and flexible resource allocation, and public clouds are becoming more appealing to UK industries due to security enhancements.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom internet data center (IDC) market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Telehouse

- Interxion

- Stonegate

- Virtus Data Centres

- Giganet

- Others.

Recent Developments:

- In December 2024, Blackstone announced a 10 Billion pound investment to develop Europe's largest AI data center in Northumberland, marking a significant commitment to the UK's digital infrastructure.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom internet data center (IDC) market based on the below-mentioned segments:

United Kingdom Internet Data Center (IDC) Market, By Service

- Colocation

- Hosting

- CDN

- Others

United Kingdom Internet Data Center (IDC) Market, By Deployment

- Public

- Private

- Hybrid

Need help to buy this report?