United Kingdom Innerduct Market Size, Share, and COVID-19 Impact Analysis, By Type (Corrugated Innerduct, Smooth Innerduct, and Microduct), By Material (High-density Polyethylene (HDPE), Polyvinyl Chloride (PVC), Polyethylene Terephthalate (PET), and Others), and UK Innerduct Market Insights, Industry Trend, Forecasts to 2035

Industry: Semiconductors & ElectronicsUnited Kingdom Innerduct Market Size Forecasts to 2035

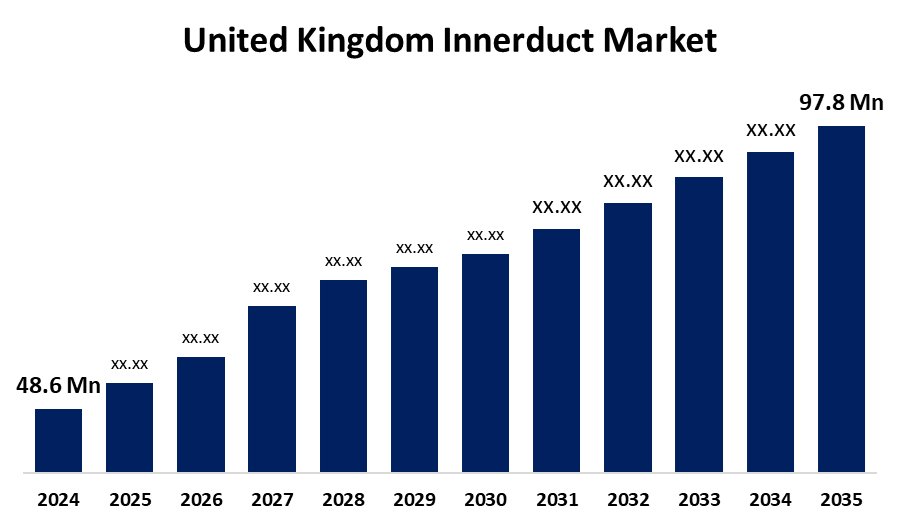

- The United Kingdom Innerduct Market Size Was Estimated at USD 48.6 Million in 2024

- The UK Innerduct Market Size is Expected to Grow at a CAGR of around 6.56% from 2025 to 2035

- The UK Innerduct Market Size is Expected to Reach USD 97.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Innerduct Market Size is anticipated to reach USD 97.8 million by 2035, growing at a CAGR of 6.56% from 2025 to 2035. The market's expansion is mostly due to the growing use of fibre optic cables for 5G networks, broadband internet, and other high-speed communication services. It is also projected that the substantial expansion of smart cities in the UK will fuel market expansion during the forecast period.

Market Overview

The UK innerduct market refers to a strong conduit, typically composed of polyethylene or PVC, that is used to protect and organise cables in fibre optic and telecom networks. It provides an organised cabling pathway, which protects against damage, lowers interference, and simplifies upgrades and maintenance. Innovation in innerduct technology focuses on making them more durable, flexible, and effective by using materials that are more resistant to tensile forces and other external environmental factors, including moisture, UV radiation, and temperature fluctuation. The purpose of these advancements is to prolong the lifespan of innerducts and the long-term reliability of the fiber optics that innerducts protect. The increasing growth of telecommunications and power transmission networks, especially supporting renewable energy projects, has already increased demand for cable protection alternatives such as innerducts. Demand is also increasing through awareness of environmental influences on cables, like weather, rodent invasions, physical impacts on buried cables, and more. With the ongoing rollout of 5G and the UK fiber network expansions, securing the safety of fiber optic assets is becoming a priority. Innerducts are an important layer of protection for the wires that collectively provide internet connectivity.

To improve connectivity and speeds, the UK's innerduct market has heavily invested in modernizing broadband networks, notably with fiber optic installations and even advancements in cables. Additionally, there are a number of telecom companies, such as Virgin Media, BT, and Openreach, promoting fiber optic installation and growth. With improvements of interior devices, it will expand the gigabit-capable coverage across the state, while improving internet speed, resilience, and reliability for UK homes and businesses.

Report Coverage

This research report categorizes the market for the UK innerduct market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom innerduct market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom innerduct market.

United Kingdom Innerduct Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 48.6 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.56% |

| 2035 Value Projection: | USD 97.8 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 159 |

| Tables, Charts & Figures: | 122 |

| Segments covered: | By Type, By Material and COVID-19 Impact Analysis |

| Companies covered:: | Roxtec, Radius CTS, Emtelle, Goodwin Plastics Ltd, Marshall-Tufflex, Tech Tube Ltd, Flexicon Ltd, Openreach, BT, Virgin Media, TalkTalk Business Direct, Prysmian Group, Nexans, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis. |

Get more details on this report -

Driving Factors

The UK telecommunications industry is rapidly expanding, with high-speed internet, 5G, FTTH, and data centre development driving considerable growth in the innerduct sector. Innerducts protect and organise sensitive fibre optic cables, resulting in dependable performance and easy upgrades. The growing demand for cloud services, big data, and IoT increases this requirement. Government investment and fast-tracked projects to invest in areas of key aspects of broadband infrastructure also propel demand into the industry. Furthermore, emerging technologies and increasing concern for the environment increase the desire for sustainable and recyclable materials like polyethylene in duct systems. This also aligns with environmentally friendly solutions and green infrastructure project work to support innerducts and duct systems that are scalable, modern, and sustainable network extensions.

Restraining Factors

The high initial installation costs, the requirement for specialty labour, and expensive equipment. Fast-paced technological change can create compatibility issues and force frequent upgrades. Environmental concerns regarding traditional materials like PVC are also forcing companies to move to newer and more costly sustainable products. Long-term market growth and wider acceptance are still hampered by the need to balance sustainability, cost, and performance. These factors hamper the innerduct market during the forecast period.

Market Segmentation

The United Kingdom innerduct market share is classified into type and material.

- The corrugated innerduct segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom innerduct market is segmented by type into corrugated innerduct, smooth innerduct, and microduct. Among these, the corrugated innerduct segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Corrugated innerduct has outstanding all-weather flexibility. Providing maximum flexibility in a lightweight innerduct, which can be installed in very confined spaces. For added flexibility, corrugated innerducts have a corrugated or ribbed exterior.

- The high-density polyethylene (HDPE) segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom Innerduct market is segmented by material into high-density polyethylene (HDPE), polyvinyl chloride (PVC), polyethylene terephthalate (PET), and others. Among these, the high-density polyethylene (HDPE) segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. In applications like innerducts, where cost savings and moisture barriers are important, HDPE's molecular structure excels. HDPE innerducts are a necessary alternative for outdoor innerducts because of their superior resistance to ultraviolet (UV) radiation. This environmental barrier minimizes the delivery of UV radiation to the innerducts while guaranteeing their performance.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom innerduct market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Roxtec

- Radius CTS

- Emtelle

- Goodwin Plastics Ltd

- Marshall-Tufflex

- Tech Tube Ltd

- Flexicon Ltd

- Openreach

- BT

- Virgin Media

- TalkTalk Business Direct

- Prysmian Group

- Nexans

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom innerduct market based on the below-mentioned segments:

United Kingdom Innerduct Market, By Type

- Corrugated Innerduct

- Smooth Innerduct

- Microduct

United Kingdom Innerduct Market, By Material

- High-density Polyethylene (HDPE)

- Polyvinyl Chloride (PVC)

- Polyethylene Terephthalate (PET)

- Others

Need help to buy this report?