United Kingdom Industrial Solvents Market Size, Share, and COVID-19 Impact Analysis, By Type (Alcohols, Ketones, Esters, Glycols, and Others), By Application (Paints & Coatings, Pharmaceuticals, Printing Inks, Adhesives & Sealants, and Others), and United Kingdom Industrial Solvents Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Kingdom Industrial Solvents Market Insights Forecasts to 2035

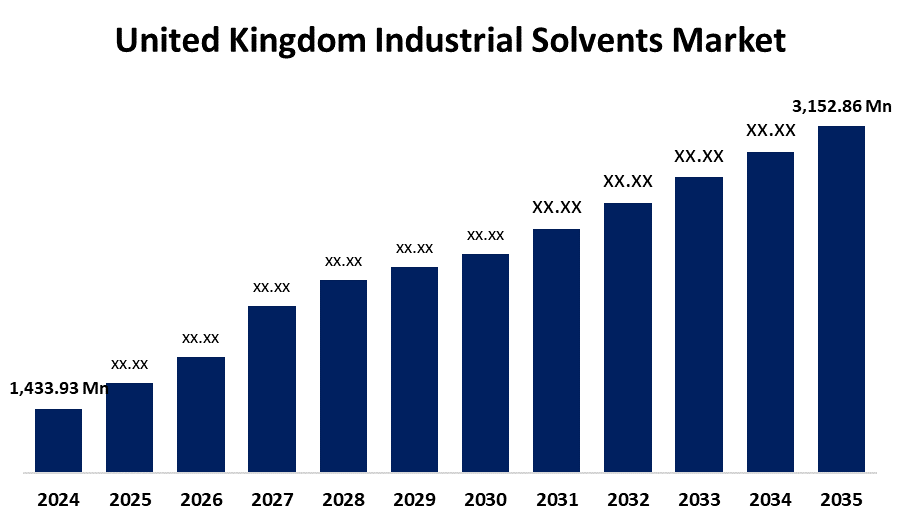

- The United Kingdom Industrial Solvents Market Size Was Estimated at USD 1,433.93 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 7.43% from 2025 to 2035

- The United Kingdom Industrial Solvents Market Size is Expected to Reach USD 3,152.86 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Industrial Solvents Market Size is anticipated to reach USD 3,152.86 Million by 2035, growing at a CAGR of 7.43% from 2025 to 2035. The increasing industrialization, technical improvements, and a growing emphasis on environmentally friendly and sustainable solvent solutions, in addition to a rise in the need for cleaning agents, paints & coatings, adhesives, and pharmaceuticals.

Market Overview

The United Kingdom industrial solvents market refers to the industry involves the manufacture, use, and distribution of chemicals termed solvents that dissolve, extract, or suspend other materials without changing their chemical makeup. The pharmaceutical, paint & coating, adhesive, and cleaning product industries all make extensive use of these solvents. The market, which is driven by improvements in sustainable manufacturing techniques, regulatory changes, and industrial growth, includes both conventional and environmentally friendly solvents. The increasing demand for bio-based and green solvents due to sustainability objectives and environmental restrictions. Potential is further increased by advancements in solvent technology and growing uses in cutting-edge industries like electronics and healthcare. Additionally, manufacturers now have more ways to satisfy changing consumer and industrial demands because to rising R&D investments and the trend toward high-performance, low-VOC (volatile organic compound) solvents. The development of low-VOC, bio-based solvents to satisfy environmental regulations. In industries including electronics, coatings, and medicines, developments in solvent recycling, green chemistry, and nanotechnology integration are improving performance, lowering toxicity, and promoting sustainable industrial practices.

Report Coverage

This research report categorizes the market for the United Kingdom industrial solvents market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom industrial solvents market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom industrial solvents market.

United Kingdom Industrial Solvents Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 1,433.93 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 7.43% |

| 2035 Value Projection: | USD 3,152.86 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 268 |

| Tables, Charts & Figures: | 104 |

| Segments covered: | By Type and By Application |

| Companies covered:: | BASF SE, Shell Chemicals, Solvay S.A., Arkema S.A., INEOS Group, Evonik Industries AG, Clariant AG, Synthomer plc, AkzoNobel N.V., Perstorp Holding AB, and Others. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing demand from important sectors including paints and coatings, adhesives, personal care products, and pharmaceuticals. The growth of the construction and automotive industries is also increasing the need for high-performance solvents. Furthermore, more effective and ecologically friendly applications are being made possible by developments in solvent formulations and technology. Stricter environmental regulations are driving the growing popularity of green and bio-based solvents. Additionally, companies are being encouraged to switch to sustainable alternatives by increased R&D efforts and growing awareness of the negative effects of conventional solvents, which will drive market expansion over the course of the projection period.

Restraining Factors

The regulations about the use of volatile organic compounds (VOCs) in terms of safety and the environment. In addition to impeding market expansion, health issues associated with extended solvent exposure, growing raw material costs, and problems implementing eco-friendly substitutes also present operational and regulatory obstacles.

Market Segmentation

The United Kingdom industrial solvents market share is classified into type and application.

- The alcohols segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom industrial solvents market is segmented by type into alcohols, ketones, esters, glycols, and others. Among these, the alcohols segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to increasing demand for low-toxicity, adaptable solvents like alcohols, growing use in coatings, cosmetics, and pharmaceuticals, and heightened attention to high-performing, environmentally friendly solutions in a variety of commercial and industrial domains.

- The paints & coatings segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom industrial solvents market is segmented by application into paints & coatings, pharmaceuticals, printing inks, adhesives & sealants, and others. Among these, the paints & coatings segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of increasing demand for ornamental and protective coatings, an increase in building and automotive movement, and the use of solvents to improve application qualities including durability, drying time, and viscosity.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom industrial solvents market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- BASF SE

- Shell Chemicals

- Solvay S.A.

- Arkema S.A.

- INEOS Group

- Evonik Industries AG

- Clariant AG

- Synthomer plc

- AkzoNobel N.V.

- Perstorp Holding AB

- Others.

Recent Developments:

- In January 2023, Clariter and TotalEnergies Fluids launched a sustainable ultra-pure solvent derived from plastic waste in January 2023. This initiative showcases the feasibility of producing high-quality solvents from recycled materials, aligning with the industry's shift towards environmentally friendly and sustainable production methods.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom industrial solvents market based on the below-mentioned segments:

United Kingdom Industrial Solvents Market, By Type

- Alcohols

- Ketones

- Esters

- Glycols

- Others

United Kingdom Industrial Solvents Market, By Application

- Paints & Coatings

- Pharmaceuticals

- Printing Inks

- Adhesives & Sealants

- Others

Need help to buy this report?