United Kingdom Industrial Coating Market Size, Share, and COVID-19 Impact Analysis, By Resin (Acrylic, Alkyd, Polyurethane, Epoxy, Polyester, and Others), By Technology (Solvent-borne, Water-borne, Powder, and Others), By End-use (General Industrial, Powder, Automotive OEM, Automotive Refinish, Protective, Wood, Marine, Coil, Packaging, and Others), and United Kingdom Industrial Coating Market Insights, Industry Trend, Forecasts to 2035.

Industry: Specialty & Fine ChemicalsUnited Kingdom Industrial Coating Market Insights Forecasts to 2035

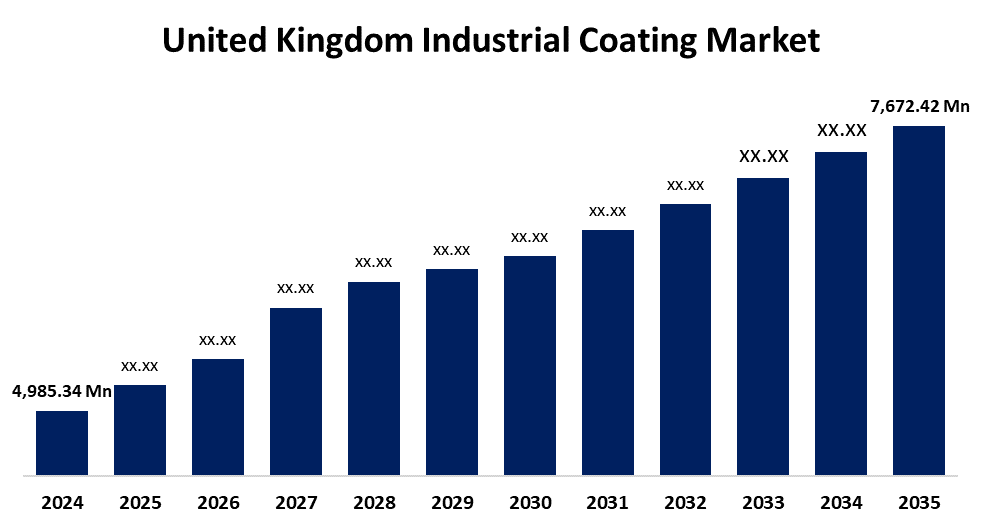

- The United Kingdom Industrial Coating Market Size was estimated at USD 4,985.34 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.00% from 2025 to 2035

- The United Kingdom Industrial Coating Market Size is Expected to Reach USD 7,672.42 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom Industrial Coating Market Size is Anticipated to reach USD 7,672.42 Million By 2035, Growing at a CAGR of 4.00% from 2025 to 2035. The need for industrial paints is anticipated to be driven by the increasing popularity of restorative cosmetics for automobile upkeep, repairs, and market painting to improve resistance to corrosion, surface security, and appearance.

Market Overview

The United Kingdom industrial coating market refers to the industry focused on the production and application of coatings used for protective coatings for a variety of industries, such as the automotive, construction, aerospace, and manufacturing sectors. These are important benefits that result from providing corrosion protection, durability, and aesthetic enhancements to ensure longevity and performance. Industrial coatings can be categorized as powder coatings, liquid coatings, or specialized coatings based on the substrate and end-use application. Further, regional regulatory authorities support the overall market size, such as the British Coatings Federation (BCF) released a report emphasizing the critical role of coatings in the UK economy. The report highlighted that the coatings sector contributed £4 billion annually and exported £1 billion worth of products each year. According to the BCF, coatings were essential across industries such as aerospace, automotive, green energy, and life sciences, enabling these sectors to achieve their full potential. The report also underscored that downstream companies worth £300 billion relied on coatings products, making them a fundamental part of UK manufacturing. Also, key development news related to country market opportunities, in February 2021, HMG Paints Ltd announced a new distribution partnership with Breakwells Paints Ltd, a West Midlands-based company. This collaboration allows Breakwells to distribute some of HMG’s most popular products, including industrial coatings, narrowboat coatings, and specialist UPVC coatings.

Report Coverage

This research report categorizes the market for the United Kingdom industrial coating market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom industrial coating market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom industrial coating market.

United Kingdom Industrial Coating Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 4,985.34 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.00% |

| 2035 Value Projection: | USD 7,672.42 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 210 |

| Tables, Charts & Figures: | 100 |

| Segments covered: | By Resin, By Technology, By End-use and COVID-19 Impact Analysis |

| Companies covered:: | Akzo Nobel Industrial Coatings, Industrial Coatings Ltd, PPG Coatings Services, Marcote UK Ltd., Universal Coatings UK Ltd., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The significant demand for durability, corrosion protection, and aesthetic value in important industries, including automotive, construction, and aerospace, is propelling the industrial coatings market across the UK. High-performance, eco-friendly coatings made possible by technological developments are boosting sustainability trends, which propel the market opportunities and growth. The development of water-based and low-VOC coatings is aided by ongoing research and government laws, which support environmental safety and emission reduction. Further, novel resins and pigments that enhance the energy consumption during the automotive coatings process are anticipated to boost the market growth.

Restraining Factors

The price volatility of raw materials, the rising costs of production, and new environmental laws that force producers to spend more on development, research, and sustainability norms could impede market expansion, especially for smaller and medium-sized businesses.

Market Segmentation

The United Kingdom industrial coating market share is classified into resin, technology, and end use.

- The epoxy segment held a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period.

The United Kingdom industrial coating market is segmented by resin into acrylic, alkyd, polyurethane, epoxy, polyester, and others. Among these, the epoxy segment held a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period. The segment growth is driven by its exceptional qualities, which include resistance to stains, cracking, severe temperatures, and blistering. Epoxy industrial coatings are extensively utilized in shipbuilding, wastewater treatment facilities, and construction. The solution also protects home appliances like washing machines and refrigerators against corrosive gases with prolongs their lifespan and enhancing their appearance.

- The waterborne segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom industrial coating market is segmented by technology into solvent-borne, water-borne, powder, and others. Among these, the waterborne segment held the highest share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because water quickly evaporates from the coating layer, industrial coatings based on water dry faster than those based on solvents. Their high resistance to heat and corrosion makes them outstanding primers. Additionally, because they emit fewer harmful air pollutants and have low volatile organic compounds (VOC), they are low in toxicity and flame-resistant.

- The automotive OEM segment held a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period.

The United Kingdom industrial coating market is segmented by end use into general industrial, powder, automotive OEM, automotive refinish, protective, wood, marine, coil, packaging, and others. Among these, the automotive OEM segment held a significant share in 2024 and is anticipated to grow at a rapid pace during the forecast period. This is because they are frequently used to protect and improve a variety of parts, including wheels, body panels, chrome plating, etc, which are focused on visually appealing color finishes, including pearl, metallic, high-gloss, and matte. Further, they are designed to cure at room temperature or through low-temperature baking, repair facilities can complete repairs more quickly.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom industrial coating market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Akzo Nobel Industrial Coatings

- Industrial Coatings Ltd

- PPG Coatings Services

- Marcote UK Ltd.

- Universal Coatings UK Ltd.

- Others

Recent Developments:

- In March 2025, Peerless Plastics & Coatings officially announced a strategic partnership with Bowles & Walker Ltd, a specialist in precision injection moulding. This collaboration was designed to enhance injection moulding solutions, offering a comprehensive, end-to-end service for industries such as aerospace, automotive, medical, and security.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom industrial coating market based on the below-mentioned segments

United Kingdom Industrial Coating Market, By Resin

- Acrylic

- Alkyd

- Polyurethane

- Epoxy

- Polyester

- Others

United Kingdom Industrial Coating Market, By Technology

- Solvent-borne

- Water-borne

- Powder

- Others

United Kingdom Industrial Coating Market, By End Use

- General Industrial

- Powder

- Automotive OEM

- Automotive Refinish

- Protective

- Wood

- Marine

- Coil

- Packaging

- Others

Need help to buy this report?