United Kingdom Immunoassay Market Size, Share, and COVID-19 Impact Analysis, By Technology (Radioimmunoassay, Enzyme Immunoassays, Rapid Test, and Others), By Application (Therapeutic Drug Monitoring, Oncology, Cardiology, Endocrinology, Infectious Disease Testing, Autoimmune Diseases, and Others), and UK Immunoassay Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Immunoassay Market Forecasts to 2035

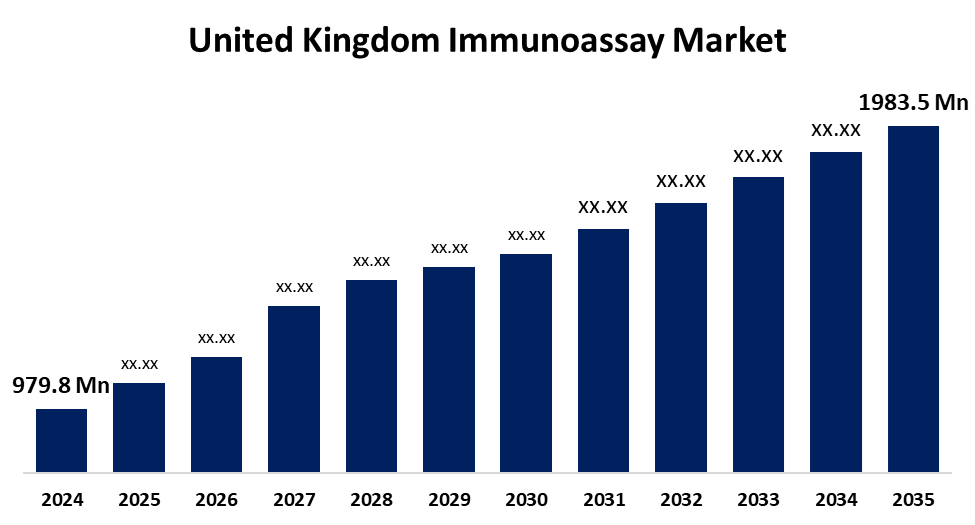

- The United Kingdom Immunoassay Market Size Was Estimated at USD 979.8 Million in 2024

- The UK Immunoassay Market Size is Expected to Grow at a CAGR of around 6.62% from 2025 to 2035

- The UK Immunoassay Market Size is Expected to Reach USD 1983.5 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, The UK Immunoassay Market Size is anticipated to Reach USD 1983.5 Million by 2035, Growing at a CAGR of 6.62% from 2025 to 2035. The prevalence of chronic diseases is on the rise, technology advancements are enhancing diagnostics, healthcare spending is rising, and the government is strongly supporting the immunoassay industry in the UK. These elements increase early disease identification and individualised treatment options by driving demand for precise, effective immunoassay tests.

Market Overview

The UK Immunoassay Market Size refers to a selective bioanalytical technique that detects or measures analytes using antibodies or antigens. It gives excellent specificity and sensitivity for a variety of clinical or research applications by utilizing antibody-antigen interactions with signal amplification. The increase in chronic diseases is driving the immunoassay market in the UK. This effect of the disease is being actively mitigated by government programmes like the NHS Diabetes Prevention Programme (DPP), created together with Public Health England and Diabetes UK. Companies leading the healthcare diagnostics industry are also moving the needle forward through immunoassay diagnostics. As an example, LumiraDx is working towards larger-scale commercialisation of its Rapid Microfluidic Immunoassay HbA1c Test to enhance diabetes diagnostics and manage diabetes in a variety of healthcare settings. Given the importance of immunoassay technologies in combating the prevalence of diabetes and addressing early diagnosis, treatment, and disease monitoring, we expect that the immunoassay market overall will rise.

Advancements in diagnostic tools like ELISAs, radioimmunoassays, and lateral flow devices are driving market growth by enhancing biomarker detection speed and accuracy. AI and machine learning improve data interpretation, supporting personalized treatment. Increasing adoption of digital immunoassays and point-of-care testing, integrated with mobile and cloud platforms, expands use in emergency, outpatient, and home care. Rising chronic diseases, emerging infections, and demand for personalized therapies fuel innovation and investments in affordable, high-quality immunoassay solutions by companies like Diamond Diagnostics.

Report Coverage

This research report categorizes the market for the UK immunoassay market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom immunoassay market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom immunoassay market.

United Kingdom Immunoassay Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 979.8 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR of 6.62% |

| 2035 Value Projection: | USD 1983.5 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 212 |

| Tables, Charts & Figures: | 97 |

| Segments covered: | By Technology, By Application |

| Companies covered:: | Abbott Laboratories, Roche Diagnostics, Siemens Healthineers, Bio-Rad Laboratories, Oxford Immunotec, Thermo Fisher Scientific, Becton, Dickinson and Company (BD), Danaher Corporation (Beckman Coulter), bioMerieux, Beckman Coulter, Quidel, PerkinElmer, Eisai, Ortho Clinical Diagnostics, Fujirebio, Agilent Technologies, and Other Key Companies. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing prevalence of chronic diseases and the growing demand for accurate, rapid diagnostics are stimulating growth in the immunoassay market in the UK. Industry sectors are advancing technologies such as chemiluminescent and fluorescent immunoassays, with larger companies like Roche, Abbott, Siemens, and DiaSorin developing products. Future advancements are also supported by government funding and help from organizations like the Wellcome Trust. The healthcare delivery model is being disrupted by the move toward point-of-care testing, and easy-to-use, portable, and rapidly available immunoassays are becoming increasingly adopted, which is likely to affect future trends within this market.

Restraining Factors

The high prices of advanced immunoassay instruments and reagents restrict access for smaller healthcare centres. Lately, strict regulatory approvals and complicated test standardization can slow product launch readiness and limit market impacts, especially for early-stage diagnostics companies. These factors hamper the immunoassay market during the forecast period.

Market Segmentation

The United Kingdom immunoassay market share is classified into technology and application.

- The enzyme immunoassay segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom immunoassay market is segmented by technology into radioimmunoassay, enzyme immunoassay, rapid test, and others. Among these, the enzyme immunoassay segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Enzyme Immunoassays are widely used in research, environmental testing, and clinical diagnostics due to their high sensitivity and specificity. New technologies like lab-on-a-chip systems and microarray-based immunoassays are developing and allow for rapid, multiplex and small test approaches. For example, iTACT from Fujirebio is an innovative test format approach that simultaneously reduces the interference of autoantibodies with antigen detection for superior test sensitivity and accuracy towards reliable diagnostic results.

- The infectious disease testing segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom immunoassay market is segmented by application into therapeutic drug monitoring, oncology, cardiology, endocrinology, infectious disease testing, autoimmune diseases, and others. Among these, the infectious disease testing segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The increase in infectious diseases and the growing attention toward early detection and personalised treatment plans. For infectious diseases, an immunoassay aims to optimally manage risk variables and maximise drug selection options. The advances in the therapeutic area of targeted medicines and biomarker detection, enable clinicians to adapt their treatments to the individual profile of patients for improved outcomes and decreased adverse events. As technology advances, immunoassays will expand their role in point-of-care testing, early detection, and personalised treatment.

Competitive Analysis:

The report offers the appropriate analysis of the key organisations/companies involved within the United Kingdom immunoassay market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Abbott Laboratories

- Roche Diagnostics

- Siemens Healthineers

- Bio-Rad Laboratories

- Oxford Immunotec

- Thermo Fisher Scientific

- Becton, Dickinson and Company (BD)

- Danaher Corporation (Beckman Coulter)

- bioMerieux

- Beckman Coulter

- Quidel

- PerkinElmer

- Eisai

- Ortho Clinical Diagnostics

- Fujirebio

- Agilent Technologies

- Others

Recent Developments:

- In August 2024, Abingdon Health, a UK-based manufacturer of lateral flow assay diagnostic tests, announced the acquisition of regulatory and quality assurance businesses, CS LifeSciences and IVDeology, into the Abingdon Health Group.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom immunoassay market based on the below-mentioned segments:

United Kingdom Immunoassay Market, By Technology

- Radioimmunoassay

- Enzyme Immunoassays

- Rapid Test

- Others

United Kingdom Immunoassay Market, By Application

- Therapeutic Drug Monitoring

- Oncology

- Cardiology

- Endocrinology

- Infectious Disease Testing

- Autoimmune Diseases

- Others

Need help to buy this report?