United Kingdom Imaging Services Market Size, Share, and COVID-19 Impact Analysis, By Modality (Ultrasound, X-ray, MRI Scans, CT-Scans, Nuclear Medicine Scans), By End-Use (Diagnostic Imaging Centers, Hospitals, and Others), and United Kingdom Imaging Services Market Insights Forecasts 2023 – 2033

Industry: HealthcareUnited Kingdom Imaging Services Market Insights Forecasts to 2033

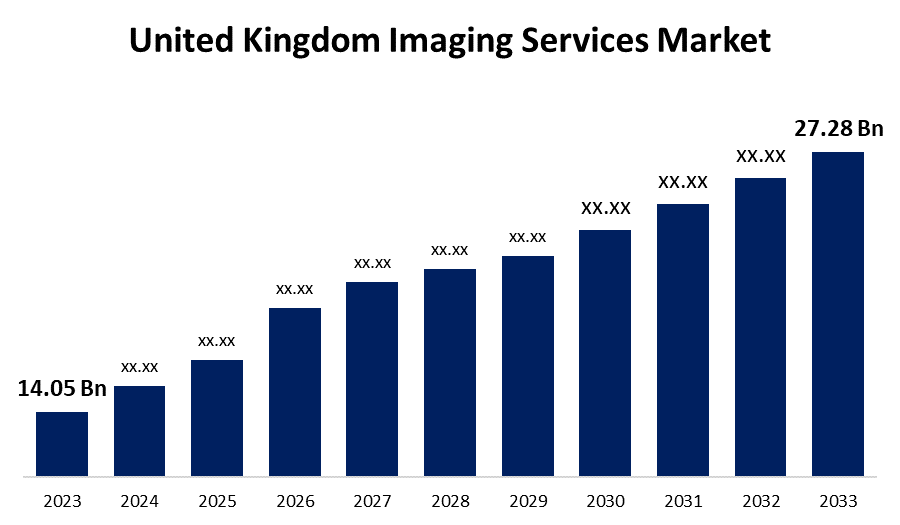

- The United Kingdom Imaging Services Market Size was valued at USD 14.05 Billion in 2023

- The Market Size is Growing at a CAGR of 6.86% from 2023 to 2033.

- The United Kingdom Imaging Services Market Size is Expected to Reach USD 27.28 Billion by 2033.

Get more details on this report -

The United Kingdom Imaging Services Market Size is Expected to Reach USD 27.28 Billion by 2033, at a CAGR of 6.86% during the forecast period 2023 to 2033.

Market Overview

The rapid, safe, and precise delivery of critical information through medical imaging has revolutionized healthcare. Non-invasive imaging techniques including nuclear medicine scans, CTs, MRIs, and X-rays are examples of imaging services. These techniques are used to diagnose a range of illnesses. These imaging services also help with early disease detection, which helps with efficient treatment. The prevalence of several illnesses and medical disorders is rising significantly in the United Kingdom. The United Kingdom imaging services market is expanding due to this increase in disease rates, which is also a public health problem. Like many industrialized countries, the UK is dealing with an aging population and lifestyle changes that have significantly raised the prevalence of disease. Additionally, GE Healthcare and Alliance Medical inked a contract in May 2022 to work together on a digital solution that will use data analytics and Al to boost productivity in hospital radiology departments in the United Kingdom. In addition, more consumers are paying for private medical insurance as a result of longer wait times at the NHS and referrals to the private sector, which is projected to support market expansion.

Report Coverage

This research report categorizes the market for the United Kingdom imaging services market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom imaging services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom imaging services market.

United Kingdom Imaging Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Market Size in 2023: | USD 14.05 Billion |

| Forecast Period: | 2023 - 2033 |

| Forecast Period CAGR 2023 - 2033 : | 6.86% |

| 2033 Value Projection: | USD 27.28 Billion |

| Historical Data for: | 2019 - 2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Modality, By End-Use. |

| Companies covered:: | InHealth Group, Alliance Medical Ltd, Medica Group PLC, Rutherford Health Plc, Unilab Corp, Affidea Group BV, Vista Health, Medical Imaging Partnership Ltd, TIC International Corp, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The necessity for early detection and diagnosis is one of the main factors driving the growth of the imaging services market, along with growing disease prevalence. Early detection greatly improves the prognosis for many diseases, such as cancer and heart disease. Early diagnosis and characterization of these disorders are crucial for treatment, and medical imaging techniques such as computed tomography (CT), ultrasonography, and magnetic resonance imaging (MRI) play a key role in this regard. The field of personalized or precision medicine is becoming increasingly important as our understanding of disease biology increases. Customized treatment regimens for each patient need comprehensive diagnostic data, which is frequently acquired using cutting-edge imaging methods.

Restraining Factors

The imaging services market in the United Kingdom is being negatively impacted by high initial and ongoing expenditures. Furthermore, the UK is experiencing a radiology deficit, which is causing a rise in workload and lengthier wait times for image interpretation. This might impair patient care and delay the delivery of imaging reports.

Market Segment

- In 2023, the MRI scans segment accounted for the largest revenue share over the forecast period.

Based on modality, the United Kingdom imaging services market is segmented into ultrasound, X-ray, MRI scans, CT scans, and nuclear medicine scans. Among these, the MRI scans segment has the largest revenue share over the forecast period. Compared to alternative imaging techniques, MRI scan service is exceptional in producing crisp images of soft tissues. It is an important diagnostic tool for a variety of illnesses and ailments, and it helps arrange surgical treatments efficiently. It is also anticipated that the demand for MRI services will rise due to anticipated technical developments.

- In 2023, the diagnostic imaging centers segment is witnessing significant growth over the forecast period.

Based on end-use, the United Kingdom imaging services market is segmented into diagnostic imaging centers, hospitals, and others. Among these, the diagnostic imaging centers segment is witnessing significant growth over the forecast period. This is because diagnostic imaging facilities and other healthcare organizations are increasingly collaborating and taking over one another. For instance, in March 2021, Fortius Clinic the biggest orthopedic group in the United Kingdom was purchased by Affidea Group, a well-known European supplier of outpatient, cancer treatment, and diagnostic imaging services.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom imaging services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- InHealth Group

- Alliance Medical Ltd

- Medica Group PLC

- Rutherford Health Plc

- Unilab Corp

- Affidea Group BV

- Vista Health

- Medical Imaging Partnership Ltd

- TIC International Corp

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Developments

- In May 2022, InHealth Services is the first Radiographer-led Reporting service to be approved by the Quality Standard for Imaging (QSI).

Market Segment

This study forecasts revenue at regional, and country levels from 2022 to 2033. Spherical Insights has segmented the United Kingdom Imaging Services Market based on the below-mentioned segments:

United Kingdom Imaging Services Market, By Modality

- Ultrasound

- X-ray

- MRI Scans

- CT-Scans

- Nuclear Medicine Scans

United Kingdom Imaging Services Market, By End-Use

- Diagnostic Imaging Centers

- Hospitals

- Others

Need help to buy this report?