United Kingdom Home Services Market Size, Share, and COVID-19 Impact Analysis, Home Improvement Type (Interior Design and Construction), By Deployment (Offline and Online), and United Kingdom Home Services Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Home Services Market Insights Forecasts to 2035

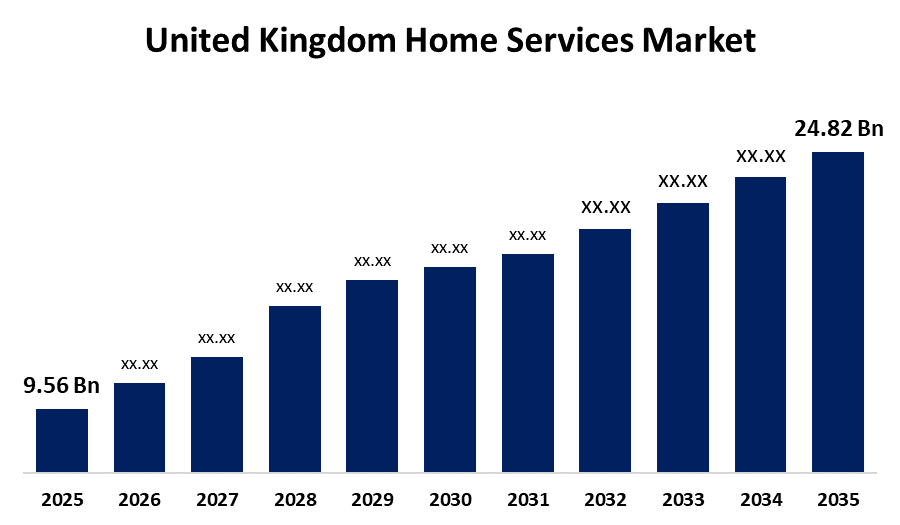

- The United Kingdom Home Services Market Size Was Estimated at USD 9.56 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 9.06% from 2025 to 2035

- The United Kingdom Home Services Market Size is Expected to Reach USD 24.82 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the United Kingdom Home Services Market is anticipated to reach USD 24.82 billion by 2035, growing at a CAGR of 9.06% from 2025 to 2035. The increasing utilization of internet booking platforms, urbanization, more disposable incomes, and the need for easy, competent home maintenance. Personalized service offerings and technological advancements further boost market growth and consumer utilization.

Market Overview

The United Kingdom home services market refers to the industry includes a broad range of services offered to homeowners for the maintenance, management, repair, and enhancement of residential properties. Cleaning, plumbing, electricity, landscaping, pest control, appliance repair, house remodeling, and smart home installation are all included in this market. The industry is bolstered by digital platforms that link customers and service providers, and it is driven by the growing need for professional expertise, time-saving solutions, and convenience. In the UK, urbanization, growing disposable incomes, and changing lifestyle preferences all contribute to growth. Increasing homeownership, a growing desire to outsource household duties, and a growing need for tech-enabled, on-demand solutions. Businesses now have more ways to reach time-pressed, convenience-seeking customers seeking dependable, effective, and adaptable home service experiences because to the growth of online booking platforms, aging housing infrastructure, and eco-friendly service offerings. The combination of AI-powered platforms, eco-friendly solutions, and smart home technology. Businesses are supplying subscription-based models for routine home maintenance, deploying predictive maintenance through IoT devices, and embracing mobile apps for convenient service booking.

Report Coverage

This research report categorizes the market for the United Kingdom home services market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom home services market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom home services market.

United Kingdom Home Services Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 9.56 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 9.06% |

| 2035 Value Projection: | USD 24.82 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 224 |

| Tables, Charts & Figures: | 98 |

| Segments covered: | Home Improvement Type, By Deployment and COVID-19 Impact Analysis. |

| Companies covered:: | B&Q (Kingfisher plc), Local Heroes, Checkatrade, Rated People, Housekeep, Handy, MyBuilder, com, HomeTeam, Green Homes Network, The Home Service Company, Appliance, Speedy Services, Angie’s List, Aico, and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The demand for expert house maintenance and repair services is increased by growing urbanization and rising disposable incomes. Household duties are increasingly being outsourced to professionals due to busy lifestyles and a growing need for ease. Advances in technology, such online platforms and smartphone apps, enable it to be simple to book and connect with reliable service providers. Demand for environmentally friendly house upgrades is driven by growing knowledge of sustainability and energy efficiency. All of these elements collaborate to support consistent market expansion and growth in a number of home service categories.

Restraining Factors

The lack of workers, increased operating expenses, and rigorous adherence to regulations. Further impeding market expansion and lowering consumer confidence in unknown or under-known service providers include uneven service quality, a shortage of qualified personnel, and a lack of digital adoption among older service providers.

Market Segmentation

The United Kingdom home services market share is classified into home improvement type and deployment.

- The interior design segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom home services market is segmented by home improvement type into interior design and construction. Among these, the interior design segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed increasing demand, driven by hybrid working trends, for individualized, practical living spaces. Consumer interest in expert, easily accessible interior design services is further enhanced by virtual consultations, rising property investments, and changing lifestyle preferences.

- The offline segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom home services market is segmented by deployment into offline and online. Among these, the offline segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of long-standing service networks, word-of-mouth recommendations, and high levels of local trust. The need for honest, in-person home service solutions remains high due to the continuous importance placed on in-person experience and the enhancement of traditional offerings by innovations like smart home diagnostics by key companies.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom home services market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- B&Q (Kingfisher plc)

- Local Heroes

- Checkatrade

- Rated People

- Housekeep

- Handy

- MyBuilder

- com

- HomeTeam

- Green Homes Network

- The Home Service Company

- Appliance

- Speedy Services

- Angies List

- Aico

- Others

Recent Developments:

- In May 2025, Brilliant has launched its second generation of smart home control panels, designed to replace traditional light switches. These panels feature higher-resolution screens, dual-band Wi-Fi, and improved processors, enhancing responsiveness and integration with popular smart home devices like Philips Hue lights and Sonos speakers.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom home services market based on the below-mentioned segments:

United Kingdom Home Services Market, By Home Improvement Type

- Interior Design

- Construction

United Kingdom Home Services Market, By Deployment

- Offline

- Online

Need help to buy this report?