United Kingdom Home Decor Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Furniture, Home Textiles, Lighting, Wall Decor, Floor Coverings, and Decorative Accessories), By Price Point (Luxury, Premium, Mid-Range, and Budget), and United Kingdom Home Decor Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Home Decor Market Insights Forecasts to 2035

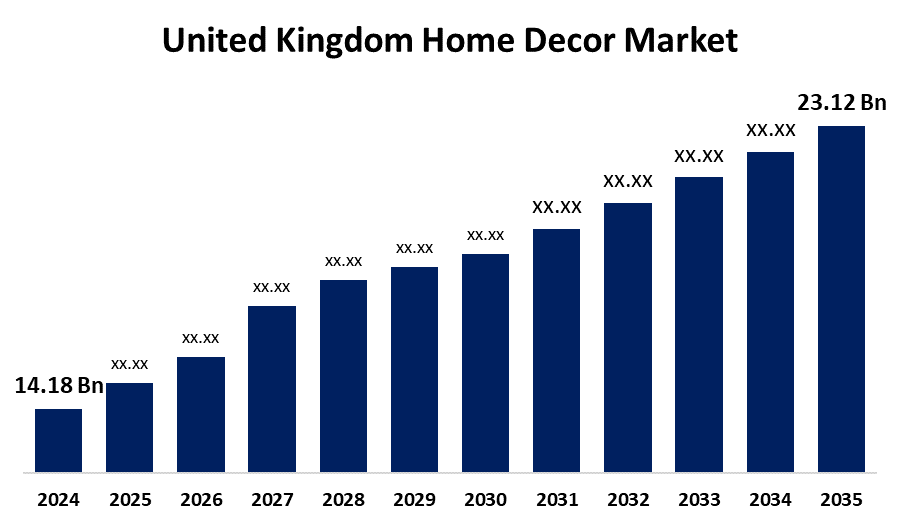

- The United Kingdom Home Decor Market Size was estimated at USD 14.18 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 4.54% from 2025 to 2035

- The United Kingdom Home Decor Market Size is Expected to Reach USD 23.12 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Home Decor Market Size is anticipated to reach USD 23.12 Billion by 2035, the growing at a CAGR of 4.54% from 2025 to 2035. The demand for individualized and attractive living environments, growing urbanization, rising disposable income, and the effects of interior design trends spread via digital and social media platforms have all increased consumer interest in home styling products.

Market Overview

The United Kingdom home decor market refers to the industry that includes an extensive assortment of goods and services designed to improve the comfort, usefulness, and visual attractiveness of homes. It consists of accessories, wall décor, flooring, furniture, textiles, and lighting. The market shows the growing significance of individualized and attractive living spaces, which are driven by changing consumer lifestyles, design preferences, and interior trends. It also gains from the rise of internet retail in the UK and an increase in refurbishment operations. The expansion of e-commerce platforms makes it simple for customers to access a wide range of goods and creative ideas. Furthermore, the increasing demand for eco-friendly and sustainable home decor solutions creates opportunities for innovation, allowing companies to stand out in a crowded market and appeal to consumers who are concerned about the environment. The integration of smart technology into furniture, including automated blinds and app-controlled lighting. Furthermore, modular furniture, eco-friendly materials, 3D-printed decor, and adjustable design options are revolutionizing how individuals add sustainability, style, and usefulness to their living spaces.

Report Coverage

This research report categorizes the market for the United Kingdom Home Decor Market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom Home Decor Market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom Home Decor Market.

United Kingdom Home Decor Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 14.18 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 4.54% |

| 2035 Value Projection: | USD 23.12 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 266 |

| Tables, Charts & Figures: | 121 |

| Segments covered: | By Product Type and By Price Point |

| Companies covered:: | IKEA Group, Dunelm Group plc, John Lewis & Partners, Marks and Spencer Group Plc, Next Plc, Homesense, The Range, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The consumer demand for interior design is rising, driven by social media, home remodeling programs, and internet platforms. Multipurpose and space-saving design solutions are in high demand due to growing urbanization and smaller living areas. The industry is growing as consumers invest more in aesthetically pleasing house improvements due to rising disposable income and lifestyle improvements. Creating visually appealing and functional home surroundings has become more important as a consequence of the trend toward remote work. Also, producers are being pushed to innovate by the growing demand for eco-friendly and sustainable products. Home décor products are becoming more accessible because of the growth of e-commerce, which has increased market penetration.

Restraining Factors

The high product prices, particularly for high-end and environmentally conscious products, make them inaccessible to some customers. Furthermore, shifting customer tastes, unstable economies, and supply chain interruptions can impede steady product availability and market expansion in a number of home furnishings sectors.

Market Segmentation

The United Kingdom Home Decor Market share is classified into product type and price point.

- The furniture segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom home decor market is segmented by product type into furniture, home textiles, lighting, wall decor, floor coverings, and decorative accessories. Among these, the furniture segment accounted for the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed to its vital significance in both practicality and aesthetics. Growth is driven by rising urbanization, home ownership, and the need for multipurpose, space-saving designs in addition to customer interest in attractive, long-lasting, and environmentally friendly furniture alternatives.

- The mid-range segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom home decor market is segmented by price point into luxury, premium, mid-range, and budget. Among these, the mid-range segment accounted for the largest revenue in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because of the growing demand from consumers for high-quality yet inexpensive home décor. Due to urbanization, growing middle-class wages, and an emphasis on value-driven shopping, it caters to a wide range of consumers searching for popular, long-lasting goods at reasonable costs.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom home decor market, along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- IKEA Group

- Dunelm Group plc

- John Lewis & Partners

- Marks and Spencer Group Plc

- Next Plc

- Homesense

- The Range

- Others

Recent Developments:

- In January 2025, IKEA introduced the SPETSBOJ table lamp, priced at £8, featuring a retro-inspired cylindrical design and available in trendy colors like butter yellow. Its affordability and stylish appeal have made it a viral sensation on platforms like TikTok and Instagram.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom home decor market based on the below-mentioned segments:

United Kingdom Home Decor Market, By Product Type

- Furniture

- Home Textile

- Lighting

- Wall Décor

- Floor Coverings

- Decorative Accessories

United Kingdom Home Decor Market, By Price Point

- Luxury

- Premium

- Mid-Range

- Budget

Need help to buy this report?