United Kingdom High Performance Computing Market Size, Share, and COVID-19 Impact Analysis, By Component (Servers, Storage, and Networking Devices) By End-user (Media & entertainment, Retail, Transportation, Government & Defense, and Education & Research), and United Kingdom High Performance Computing Market Insights, Industry Trend, Forecasts to 2035.

Industry: Information & TechnologyUnited Kingdom High Performance Computing Market Insights Forecasts to 2035

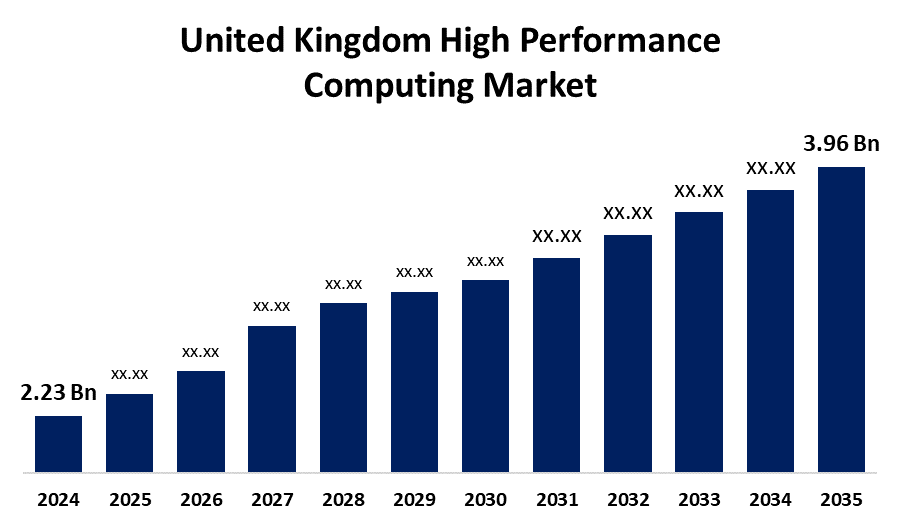

- The United Kingdom High Performance Computing Market Size was estimated at USD 2.23 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 5.36% from 2025 to 2035

- The United Kingdom High Performance Computing Market Size is Expected to Reach USD 3.96 Billion by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, The United Kingdom High Performance Computing Market is Anticipated to reach USD 3.96 Billion By 2035, Growing at a CAGR of 5.36% from 2025 to 2035. The growing interest in scientific research, big data analytics, and artificial intelligence. The main drivers of this market's growth include government investments, cloud-based HPC accessibility, and industry use in the disciplines of engineering, healthcare, and finance.

Market Overview

The U.K. high performance computing market refers to the industry focused on offering innovative computer systems that are capable of handling huge amounts of data. Complex processes like data processing, modeling, and simulations in industry like healthcare, finance, and science depend on these systems. Supercomputers, cloud-based HPC systems, and associated infrastructure comprise each a component of the market. Technological developments, the creation of more data, and an increasing demand for innovation rapid decision-making are the primary drivers supporting this market's growth. Encouraging scientific research, financial modeling, healthcare innovation, and artificial intelligence. Innovation, competitiveness, and efficiency are supported by the growing demand for scalable cloud HPC solutions and real-time data processing in both public and private sector businesses. The UK government is increasing its HPC capabilities with programmes such as £5,000 HPC innovation vouchers, plans to expand its AI infrastructure, and a £7.8 million EuroHPC investment. Enhancing research, industrial innovation, and AI development across several sectors is the primary objective of these initiatives.

Report Coverage

This research report categorizes the market for the U.K. high performance computing market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the U.K. high performance computing market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the U.K. high performance computing market.

United Kingdom High Performance Computing Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 2.23 Billion |

| Forecast Period: | 2025-2035 |

| 2035 Value Projection: | USD 3.96 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 230 |

| Tables, Charts & Figures: | 92 |

| Segments covered: | By Component, By End-user and COVID-19 Impact Analysis |

| Companies covered:: | Fujitsu, Hewlett Packard Enterprise Development LP, Huawei Technologies Co., Ltd., Intel Corporation, IBM, Microsoft, Numerical Algorithms Group Ltd, Oracle, Red Hat, Inc., Teradata corporation, Amazon Web Services, Inc., Cisco Systems, Inc., and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The Increased demand from industries such as finance, healthcare, automotive, and artificial intelligence. Further encouraging growth are government initiatives including the £7.8 million EuroHPC promise and efforts to improve AI infrastructure. Academic-industry partnerships, including the Hartree Centre, additionally promote the growth of the market. The overall goal of these endeavors is to enhance the technological prowess and worldwide competitiveness of the United Kingdom.

Restraining Factors

The deployment can be hampered by high upfront capital expenditures and continuing maintenance expenses, especially for small and medium-sized businesses. Additionally, efficient use of HPC systems is hampered by a lack of qualified personnel.

Market Segmentation

The U.K. high Performance Computing Market share is classified into component and end-user.

- The servers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.K. high performance computing market is segmented by component into servers, storage, and networking devices. Among these, the servers segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth can be attributed because enhanced simulations and data processing are made possible by the combination of AI and ML capabilities. Rapid data retrieval is made achievable with high-capacity storage devices including parallel file systems and SSDs. Additionally, by enabling several jobs to perform simultaneously, virtualization and containerization technologies improve efficiency and enhance HPC workloads.

- The government & defense segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The U.K. high performance computing market is segmented by end-user into media & entertainment, retail, transportation, government & defense, and education & research. Among these, the government & defense segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven because advanced simulations, scenario modeling, and data analysis are becoming increasingly essential to improve strategic planning and decision-making. The rise of HPC in defense applications is driven by its ability to facilitate effective resource allocation, enhance military capabilities through AI and machine learning, and support intricate activities include threat assessments and war simulations.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the U.K. high performance computing market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Fujitsu

- Hewlett Packard Enterprise Development LP

- Huawei Technologies Co., Ltd.

- Intel Corporation

- IBM

- Microsoft

- Numerical Algorithms Group Ltd

- Oracle

- Red Hat, Inc.

- Teradata corporation

- Amazon Web Services, Inc.

- Cisco Systems, Inc.

- Others

Recent Developments:

- In May 2025, SAS introduced new tools within its Viya platform, including AI agents, improved digital twin simulations, and the Viya Workbench for developers. These enhancements aim to simplify model building and accelerate decision-making processes.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the U.K. high performance computing market based on the below-mentioned segments

U.K. High Performance Computing Market, By Component

- Servers

- Storage

- Networking Devices

U.K. High Performance Computing Market, By End- user

- Media & entertainment

- Retail

- Transportation

- Government & Defense

- Education & Research

Need help to buy this report?