United Kingdom Health Insurance Market Size, Share, and COVID-19 Impact Analysis, By Type (Public, Private), By Demographics (Minor, Adult, Senior), and United Kingdom Health Insurance Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Health Insurance Market Insights Forecasts to 2035

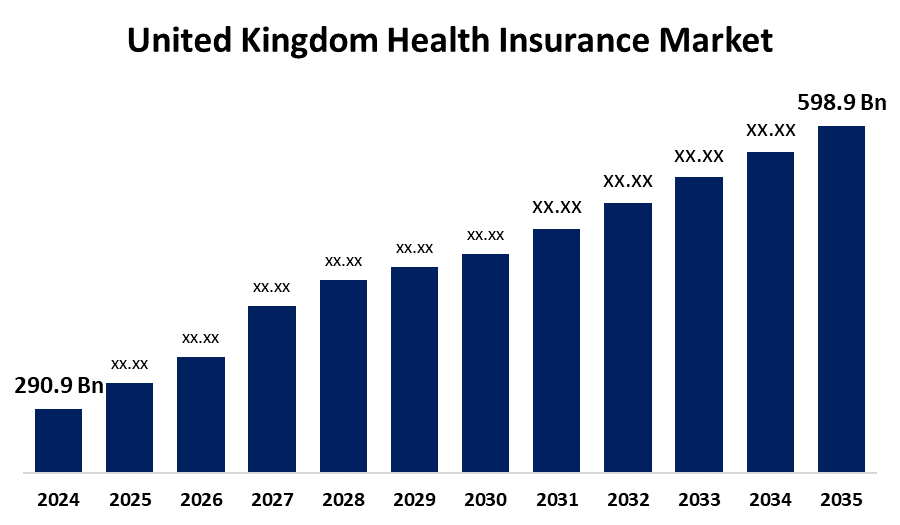

- The United Kingdom Health Insurance Market Size Was Estimated at USD 290.9 Billion in 2024

- The Market Size is Expected to Grow at a CAGR of around 6.78% from 2025 to 2035

- The United Kingdom Health Insurance Market Size is Expected to Reach USD 598.9 Billion by 2035

Get more details on this report -

The United Kingdom Health Insurance Market Size is Anticipated to reach USD 598.9 Billion by 2035, Growing at a CAGR of 6.78% from 2025 to 2035. Factors such as growing incidences of chronic illness, rising cost of healthcare treatments, technological advancements, and various government policies like the NHS help to drive the United Kingdom health insurance market growth in the forecasted period.

Market Overview

The health insurance market is a fiscal setting in which individuals and businesses purchase policies from insurers to help cover the cost of medical expenses. The policies cover a range of healthcare services such as hospitalization, prescription medication, and visits to physicians. The market comprises both publicly funded and private health insurance plans. Heightened awareness of the benefits of health insurance and rising medical expenditures are two major drivers powering market growth. Heightened incidence of various lifestyle and chronic conditions, such as diabetes, cancer, neurodegenerative diseases, cardiovascular disease, and more, is another driver powering the demand for health insurance. Rising healthcare expenditures are another driver, as people try to mitigate the probable financial burden that is associated with medical costs. The need for complete health coverage is also fueled by the growing population and the rise of chronic illness. Technological advances are also affecting the market, with insurers using greater numbers of telehealth features and digital platforms to improve client satisfaction and efficiency. The National Health Service (NHS) provides medical care to all residents of the UK, but one may also acquire private health insurance. Private health insurance can be made available to employees by their employers, or they may even buy it themselves. An evolutionary drive towards customized and individualized health coverage plans with complete coverage and benefits is now occurring in the market.

Government policy, including the National Health Service (NHS), offers a wide range of public health services, including medical, psychiatric, and hospital treatments. This is primarily paid through general taxation, although income tax does make a contribution to healthcare, and Private Health Insurance (PHI), offering supplementary cover to the NHS, provides faster access to elective procedures and treatments. PHI is usually bought by employers or individuals to pay for expenses over and above the NHS standard benefits.

Report Coverage

This research report categorizes the market for United Kingdom health insurance market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom health insurance market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom health insurance market.

United Kingdom Health Insurance Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 290.9 Billion |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 6.78% |

| 2035 Value Projection: | USD 598.9 Billion |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Type, By Demographics and COVID-19 Impact Analysis |

| Companies covered:: | Cigna, Freedom Health Insurance, Bupa, AXA Health, Vitality Health, Western Provident Association, Aviva plc, Discovery Limited, Now Health International, Howden Employee Benefits & Wellbeing Ltd and others key players. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenges, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

One of the primary drivers fuelling the growth of the UK health insurance sector is the increasing cost of healthcare services. The cost burden to the individual seeking medical treatment is increasing as the NHS struggles financially and the demand for specialist procedures increases. The growing population is following this trend to take out private health insurance to offset potentially excessive out-of-pocket costs. Employers are increasingly finding the benefits of providing health insurance as a way to attract and retain staff because it shows they care about their health and offers protection against unforeseen medical bills. One of the strongest impulses for growth in the UK private health insurance market is increased knowledge of the financial danger posed by rising healthcare expenditure. Additionally, another factor for growth in the health insurance sector in the UK is its progressively older population. Prevalence of chronic diseases brought about by this population trend necessitates repeated treatment and prolonged care, whose costs balloon. The need for private healthcare insurance policies designed to fulfill the unique requirements of ageing citizens has increased exponentially, driving the market growth. For a solution to their specific healthcare needs, insurance companies are innovating by offering customized packages guaranteeing protection for long-term care, rehabilitation, and specialty treatments. As a result of increasing numbers of chronic occurrences, people and families alike are increasingly learning the importance of quality health insurance coverage as a way of reducing financial burdens from these chronic occurrences and availing timely, quality medical care.

Restraining Factors

The UK health insurance market is greatly hindered by regulatory developments. Because of the constantly evolving healthcare regulatory context, consumers and insurers are both unsure. Changes to tax rules, data protection laws, and healthcare standards can greatly influence insurance product cost and design. These regulatory amendments impose adjustments on insurers, which often involve modifying policy terms, adjusting premiums, and investing in emerging technology, which tend to hinder market growth. The stability and growth of the UK health insurance industry are greatly threatened by the need to navigate the regulatory complexities. In addition to this, another of the largest challenges confronting the UK healthcare insurance industry is data privacy and data security concerns. Since it handles very sensitive personal health information, the sector is highly exposed to data breaches and cyberattacks. To reduce these risks, insurers have to incorporate sound encryption, access controls, and frequent security audits. For the integrity and privacy of patient information, critical to long-term UK health insurance industry growth, this challenge demands continuing investment and scrutiny.

Market Segmentation

The United Kingdom health insurance market share is classified into type and demographics.

- The public segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom health insurance market is segmented by type into public and private. Among these, the public segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. In the United Kingdom the health care is publicly funded and usually financed with taxes. NHS's extensive history of being a comprehensive, taxpayer-supported system, its immense public trust, and the universal healthcare values are some of the reasons driving its fast expansion. Because the majority of health insurance plans are provided by the National Health Service (NHS) and have relatively low out-of-pocket costs, there has traditionally been less demand of the population to take up private health insurance in large numbers, which efficiently drives the segmental growth in the forecasted period.

- The adult segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom health insurance market is segmented by demographics into minor, adult, and senior. Among these, the adult segment held the largest share in 2024 and is expected to grow at a significant CAGR during the forecast period. since the majority of individuals possess health insurance, either private or public, typically through employer-based private coverage. This group of people is also particularly susceptible to numerous lifestyle diseases that must be addressed immediately, including diabetes, cancer, hypertension, and many others. Thus, the above factors are adding to the growth of this segment of the market.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom health insurance market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Cigna

- Freedom Health Insurance

- Bupa

- AXA Health

- Vitality Health

- Western Provident Association

- Aviva plc

- Discovery Limited

- Now Health International

- Howden Employee Benefits & Wellbeing Ltd

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at global, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom Health Insurance Market based on the below-mentioned segments:

United Kingdom Health Insurance Market, By Type

- Public

- Private

United Kingdom Health Insurance Market, By Demographics

- Minor

- Adult

- Senior

Need help to buy this report?