United Kingdom Gummy Market Size, Share, and COVID-19 Impact Analysis, By Product (Vitamins, Minerals, Carbohydrates, Omega Fatty Acids, Proteins & Amino Acids, Probiotics & Prebiotics, Dietary Fibers, CBD/CBN, Psylocybin Psychedelic Mushroom, Melotonin, and Others), By Ingredients (Gelatin and Plant-based Gelatin Substitute), and UK Gummy Market Insights, Industry Trend, Forecasts to 2035

Industry: Food & BeveragesUnited Kingdom Gummy Market Forecasts to 2035

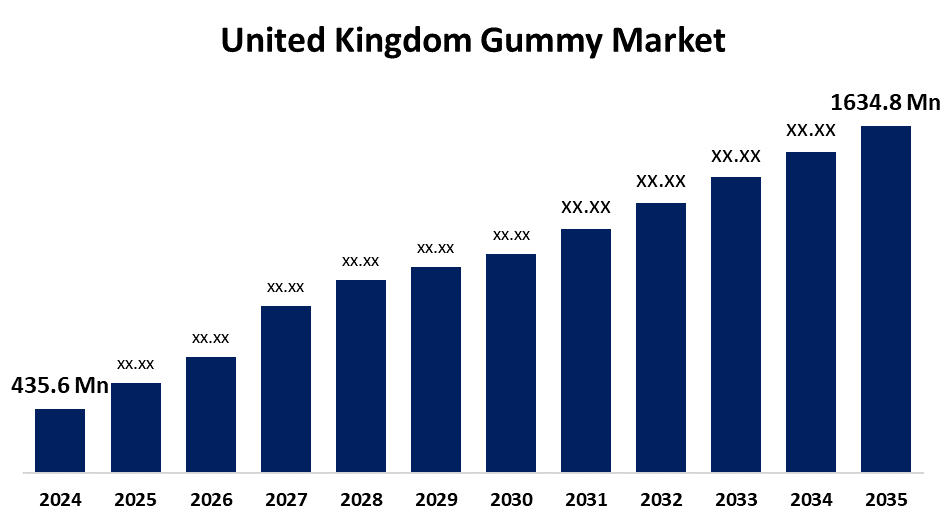

- The United Kingdom Gummy Market Size Was Estimated at USD 435.6 Million in 2024

- The UK Gummy Market Size is Expected to Grow at a CAGR of around 12.78% from 2025 to 2035

- The UK Gummy Market Size is Expected to Reach USD 1634.8 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Gummy Market is anticipated to reach USD 1634.8 million by 2035, growing at a CAGR of 12.78% from 2025 to 2035. The UK gummy market is rising as a result of rising consumer demand for convenient, pleasant supplement formats, personalised nutrition, creative flavour combinations, and the burgeoning health and wellness movement.

Market Overview

The UK gummy market refers to the gummy goods, both confections and nutraceuticals. Market can be ascribed to several factors, including the widespread popularity of gummy supplements in the UK, growing consumer awareness of ingredients used in processed foods, conscientious food and beverage consumption, changing trends that lead to a preference for nutraceuticals over pharmaceuticals, and the increasing incidence of health complications like diabetes and cardiovascular diseases, among others. Growing consumer preferences for healthier lifestyles, a greater acceptance of simple-to-consume foods and supplements, the increasing availability of a wide range of varieties, including vegan and plant-based options, growing consumer awareness of environmental responsibility, and innovation combined with a vast product portfolio are the main factors driving the growth of the gummy market in the UK. Consumers are continually adjusting lifestyle behaviours, spending long periods travelling after long days of work, and living in an increasingly urbanised landscape, which has created an environment where consumers are more aware of their diet and health. The use of vitamins, minerals, and melatonin in their everyday diets, caring more about animal cruelty, and meaningfully observing producer actions to clarify their commitment to sustainability made with cruelty-free products.

Report Coverage

This research report categorizes the market for the UK gummy market based on various segments and regions, and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom gummy market. Recent market developments and competitive strategies, such as expansion, product launch, development, partnership, merger, and acquisition, have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom gummy market.

Driving Factors

The gummy market in the UK is expanding quickly and is currently in a high-growth phase. With many well-known brands and a large number of small to medium-sized producers, it is extremely competitive and fragmented. The market is experiencing moderate innovation, propelled by consumer demand for customised goods, novel flavours, and changing tastes. More customers are being drawn in by manufacturers' experiments with novel flavour combinations and enhanced formulas. In the UK market, gummies are becoming more and more popular than other products as a result of this trend.

Restraining Factors

A significant restraining factor in the UK gummy market comes from the high levels of regulatory compliance and quality control. Manufacturers have to spend significant amounts of money to ensure that their products meet safety and efficacy standards, and these costs can be reflected in production costs. In turn, this regulatory activity can limit the entry of smaller firms as well as slow the rate of product development and innovation. These factors hamper the gummy market during the forecast period.

Market Segmentation

The United Kingdom gummy market share is classified into product and ingredients.

- The vitamins segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom gummy market is segmented by product into vitamins, minerals, carbohydrates, omega fatty acids, proteins & amino acids, probiotics & prebiotics, dietary fibers, CBD/CBN, psilocybin/psychedelic mushroom, melatonin, and others. Among these, the vitamins segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. One of the primary causes of the rising popularity of vitamin-based gummies in the UK is the rise in vitamin deficiency. Many people are having trouble with vitamins like D and B12 because of their changing lifestyles, lengthy workdays, and other health issues.

- The gelatin segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom gummy market is segmented by ingredients into gelatin and plant-based gelatin substitutes. Among these, the gelatin segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. These are among the most popular candies, and the companies that make them distribute them extensively. These candies' cost-effectiveness and smoothness offer an increased demand across a variety of markets and distribution methods. These gummies provide users with a chewy, firm texture because gelatin is their main constituent. This is one of the main causes of consumers' preference for gummies made of gelatin.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom gummy market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Amway Corp.

- Bayer AG

- Chruch & Dwight Co. Inc.

- Ernest Jackson & Co. Ltd.

- Ion Labs Inc.

- Pfizer Inc.

- Reckitt Benckiser Group Plc

- UK Gummy Company

- Natures Bounty Inc.

- Perrigo Co.

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom gummy market based on the below-mentioned segments:

United Kingdom Gummy Market, By Product

- Vitamins

- Minerals

- Carbohydrates

- Omega Fatty Acids

- Proteins & Amino Acids

- Probiotics & Prebiotics

- Dietary Fibers

- CBD/CBN

- Psylocybin/Psychedelic Mushroom

- Melatonin

- Others

United Kingdom Gummy Market, By Ingredients

- Gelatin

- Plant-based Gelatin Substitute

Need help to buy this report?