United Kingdom Guidewires Market Size, Share, and COVID-19 Impact Analysis, By Product (Coronary Guidewires, Peripheral Guidewires, Urology Guidewires, and Neurovascular Guidewires), By Material (Nitinol, Stainless Steel, and Hybrid), and UK Guidewires Market Insights, Industry Trend, Forecasts to 2035

Industry: HealthcareUnited Kingdom Guidewires Market Size Forecasts to 2035

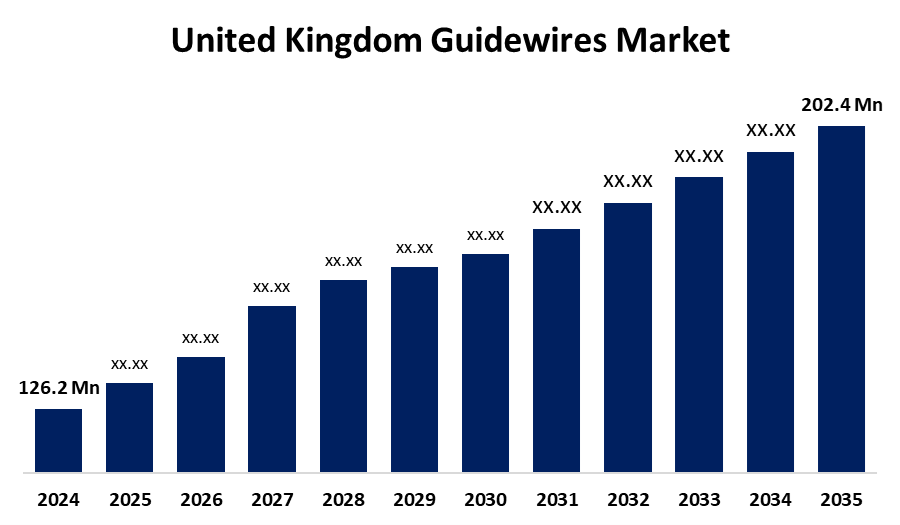

- The United Kingdom Guidewires Market Size Was Estimated at USD 126.2 Million in 2024

- The UK Guidewires Market Size is Expected to Grow at a CAGR of around 4.39% from 2025 to 2035

- The UK Guidewires Market Size is Expected to Reach USD 202.4 Million by 2035

Get more details on this report -

According to a Research Report Published by Spherical Insights & Consulting, the UK Guidewires Market Size is anticipated to reach USD 202.4 million by 2035, growing at a CAGR of 4.39% from 2025 to 2035. Increases in cardiovascular diseases (CVD), peripheral artery disease (PAD), and urological illnesses are the main causes of the guidewires industry's growth.

Market Overview

The UK guidewires market refers to the slender, flexible tools used in minimally invasive procedures across fields like cardiology, urology, and radiology. They help doctors navigate body pathways, such as vessels and ducts, enabling precise access without the need for open surgery. The guidewires market is seeing robust expansion, driven by rising demand for minimally invasive procedures, constant technical improvements, and increasing healthcare demands. Significant R&D investments, product advancements, and collaborations are influencing the sector, with an emphasis on developing flexible, user-friendly, and precise guidewire systems. Guidewire performance, longevity, and navigation are improved by innovations like steerable designs, sophisticated materials like stainless steel and nitinol, and specialty coatings. Guidewires are essential in many specialties as minimally invasive operations become more popular due to their shorter recovery periods and fewer risks.

The strict laws and regulations in the UK are driving the market for guidewires, which is expanding significantly. Future medical device laws in the UK, as described in the document issued by the UK government, will have a big impact on medical devices like guidewires. In the healthcare sector, the regulatory framework controlling medical devices is essential for guaranteeing patient safety, product quality, and innovation.

Report Coverage

This research report categorizes the market for the UK guidewires market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom guidewires market. Recent market developments and competitive strategies such as expansion, product launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom guidewires market.

United Kingdom Guidewires Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 126.2 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | 4.39% |

| 2035 Value Projection: | USD 202.4 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 169 |

| Tables, Charts & Figures: | 126 |

| Segments covered: | By Product, By Material and COVID-19 Impact Analysis |

| Companies covered:: | Invamed, Arrotek, Medtronic, Boston Scientific, Terumo, Abbott Laboratories, Philips, Asahi Intecc, Cook Medical, Cardinal Health, B. Braun, and Other key vendors |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increasing incidence of cardiovascular illness in the UK is driving an increase in demand for angioplasty and other minimally invasive procedures, which in turn is driving the usage of guidewires. Adoption of cutting-edge guidewire technologies is encouraged by the NHS's emphasis on interventional care, as well as by advantageous reimbursement schemes and strict medical device regulations. Product development and commercial expansion are further accelerated by close cooperation between UK biotech companies and academia.

Restraining Factors

The market for guidewires in the UK is subject to restrictive factors, including high costs of devices, lengthy regulatory approval processes, limited reimbursement for advanced technology, shortage of providers, operational risk in complex case scenarios. These factors hamper the guidewires market during the forecast period.

Market Segmentation

The United Kingdom guidewires market share is classified into product and material.

- The coronary guidewires segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom guidewires market is segmented by product into coronary guidewires, peripheral guidewires, urology guidewires, and neurovascular guidewires. Among these, the coronary guidewires segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. The rising incidence of cardiovascular illness and the growing need for minimally invasive coronary surgery are the main causes of this dominance.

- The nitinol segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom guidewires market is segmented by material into nitinol, stainless steel, and hybrid. Among these, the nitinol segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Nitinol guidewires have impressive functionalities that enhance the efficiency of minimally invasive procedures, resulting in an extraordinarily high demand for these devices. Nitinol, a nickel-titanium alloy, is significantly more elastic, flexible, and kink-resistant than traditional stainless steel. This allows nitinol guidewires to traverse complex arterial pathways more easily and more accurately, reducing the likelihood of procedural complications and arterial injury.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom guidewires market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Invamed

- Arrotek

- Medtronic

- Boston Scientific

- Terumo

- Abbott Laboratories

- Philips

- Asahi Intecc

- Cook Medical

- Cardinal Health

- B. Braun

- Others

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom guidewires market based on the below-mentioned segments:

United Kingdom Guidewires Market, By Product

- Coronary Guidewires

- Peripheral Guidewires

- Urology Guidewires

- Neurovascular Guidewires

United Kingdom Guidewires Market, By Material

- Nitinol

- Stainless Steel

- Hybrid

Need help to buy this report?