United Kingdom Gluten-Free Products Market Size, Share, and COVID-19 Impact Analysis, By Product Type (Confectionary, Bakery, Beverages, Condiments, Dairy Products, Seasonings, Meat, Substitutes), By Distribution Channel (Specialty Stores, Supermarkets, Online, Others), and United Kingdom Gluten-Free Products Market Insights, Industry Trend, Forecasts to 2033

Industry: Food & BeveragesUnited Kingdom Gluten-Free Products Market Insights Forecasts to 2033

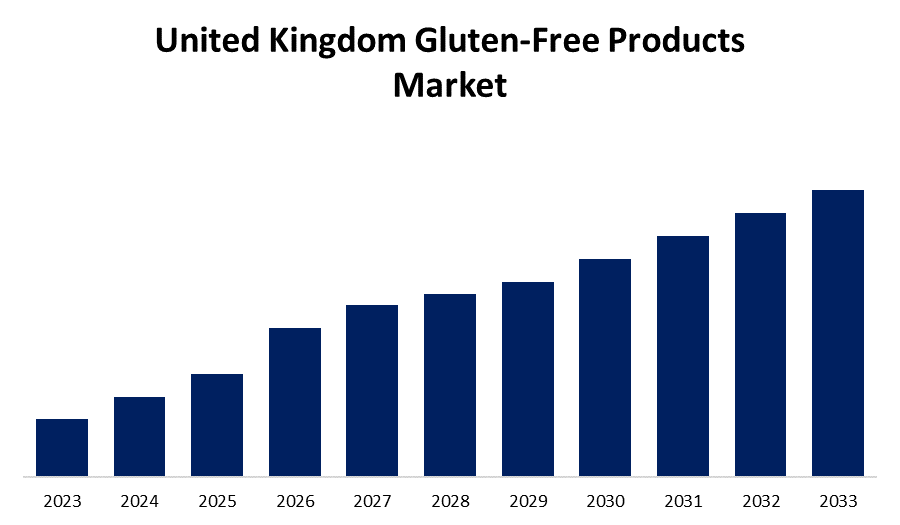

- The Market Size is Growing at a CAGR of 12.2% from 2023 to 2033.

- The United Kingdom Gluten-Free Products Market Size is Expected to Reach a Significant Share by 2033.

Get more details on this report -

The United Kingdom Gluten-Free Product Market Size is Expected to Reach a Significant Share by 2033, Growing at a Substantial CAGR of 12.2% from 2023 to 2033.

Market Overview

Gluten-free products are those that do not contain gluten, a mixture of proteins found in wheat, barley, rye, and triticale. For individuals with celiac disease, gluten sensitivity, or wheat allergy, consuming gluten can lead to adverse health effects ranging from gastrointestinal discomfort to severe autoimmune reactions. Therefore, gluten-free products are essential for individuals who need to avoid gluten in their diets. The growing number of people adopting better diets and the rising incidence of celiac disease are driving the United Kingdom market for gluten-free products. Proteins called gluten are mostly present in wheat, barley, rye, and hybrid triticale. Its primary function is to provide the dough elasticity, which gives it an extra chewy texture and allows for the manufacturing of a wide range of items while keeping the product's shape. Even yet, it is not appropriate for all users and can result in several health issues. People consequently have gluten intolerance and other health issues associated with gluten. Businesses currently produce and distribute a broad variety of gluten-free products globally in response to growing customer demand.

Report Coverage

This research report categorizes the market for the United Kingdom gluten-free products market based on various segments and regions forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom gluten-free products market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom gluten-free products market.

United Kingdom Gluten-Free Products Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2023 |

| Forecast Period: | 2023-2033 |

| Forecast Period CAGR 2023-2033 : | 12.2% |

| Historical Data for: | 2019-2022 |

| No. of Pages: | 200 |

| Tables, Charts & Figures: | 110 |

| Segments covered: | By Product Type, By Distribution Channel and COVID-19 Impact Analysis. |

| Companies covered:: | McCormick Foods Ltd, Amys Kitchen Inc, The Kraft Heinz Co., Co-Operative Group Ltd, Nestle S.A., Fria Brod A B, Genius Food Ltd, Nairns Oatcakes Ltd, Natures Path Foods, Nestle S.A., Prima Foods and other key vendors. |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The growing health consciousness of consumers is one of the primary factors driving changes in food and beverage consumption. The nation is seeing a substantial increase in the demand for gluten-free diet items and beverages as a result of numerous awareness-raising initiatives. To maintain their overall health, consumers are eating gluten-free products to avoid symptoms including gastrointestinal disturbances (bloating, cramping in the abdomen, and fatigue/tiredness); these factors taken together are driving growth in the United Kingdom gluten-free products market. The United Kingdom is a potent medium for information dissemination due to its vast internet infrastructure and well-educated populace who use social media. Furthermore, local consumers are becoming increasingly aware of other forms of advertising, such as television and billboards. People who are worried about their health frequently visit doctors, who advise them to follow a gluten-free diet if they have any allergies.

Restraining Factors

Cross-contamination, or the mingling of gluten-free and non-gluten-free goods, is one of the main obstacles to the expansion of the gluten-free food market in the United Kingdom. Cross-contamination occurs, for instance, when anyone use the same toaster for gluten-containing and gluten-free wheat bread. For those who have celiac disease, even minute levels of cross-contamination might result in adverse reactions like vomiting, indigestion, and diarrhea. Cross-contamination in restaurants is a serious issue. This is partly because fewer restaurants are offering gluten-free options due to waiters' and chefs' ignorance of gluten intolerance and celiac disease.

Market Segmentation

The United Kingdom gluten-free products market share is classified into product type and distribution channel.

- The bakery segment is expected to hold a significant share of the United Kingdom gluten-free products market during the forecast period.

Based on the product type, the United Kingdom gluten-free products market is segmented into confectionary, bakery, beverages, condiments, dairy products, seasonings, meat, and substitutes. Among these, the bakery segment is expected to hold a significant share of the United Kingdom gluten-free products market during the forecast period. The rising popularity and greater innovation of baked products that are nutritious as a result of the higher risk of chronic illnesses. The growing perception that baked goods free of gluten are healthier than traditional baked goods prepared with wheat flour is the source of the demand. Compared to regular baked foods, this provides greater energy and aids in weight loss and the prevention of obesity.

- The supermarkets segment is expected to hold the largest share of the United Kingdom gluten-free products market during the forecast period.

Based on the distribution channel, the United Kingdom gluten-free products market is divided into specialty stores, supermarkets, online, and others. Among these, the supermarkets segment is expected to hold the largest share of the United Kingdom gluten-free products market during the forecast period. Supermarkets offer wide accessibility to consumers across various regions. With a growing awareness of gluten intolerance and celiac disease, more consumers are seeking gluten-free alternatives. Supermarkets provide a convenient one-stop destination for consumers to access a variety of gluten-free products.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom gluten-free products market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- McCormick Foods Ltd

- Amys Kitchen Inc

- The Kraft Heinz Co.

- Co-Operative Group Ltd

- Nestle S.A.

- Fria Brod A B

- Genius Food Ltd

- Nairns Oatcakes Ltd

- Natures Path Foods

- Nestle S.A.

- Prima Foods

- Others

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting And Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Recent Development

- In March 2024, the Kraft Heinz Not Company LLC introduced KD NotMacandCheese, the inaugural plant-based KD option. This is the initial Canadian brand to release a product as part of the collaboration between Kraft Heinz and NotCo, which is focused on making delicious plant-based foods accessible to everyone. To provide fans with additional ways to enjoy KD, the famous mac n' cheese brand is introducing its first-ever gluten-free option.

Market Segment

This study forecasts revenue at German, regional, and country levels from 2020 to 2033. Spherical Insights has segmented the United Kingdom gluten-free products market based on the below-mentioned segments:

United Kingdom Gluten-Free Products Market, By Product Type

- Confectionary

- Bakery

- Beverages

- Condiments

- Dairy Products

- Seasonings

- Meat

- Substitutes

United Kingdom Gluten-Free Products Market, By Distribution Channel

- Specialty Stores

- Supermarkets

- Online

- Others

Need help to buy this report?