United Kingdom Glamping Market Size, Share, and COVID-19 Impact Analysis, By Accommodation Type (Cabins & Pods, Tents, Yurts, and Treehouses), By Age Group (18-32 Years, 33-50 Years, and 51-65 Years), and United Kingdom Glamping Market Insights, Industry Trend, Forecasts to 2035

Industry: Consumer GoodsUnited Kingdom Glamping Market Insights Forecasts to 2035

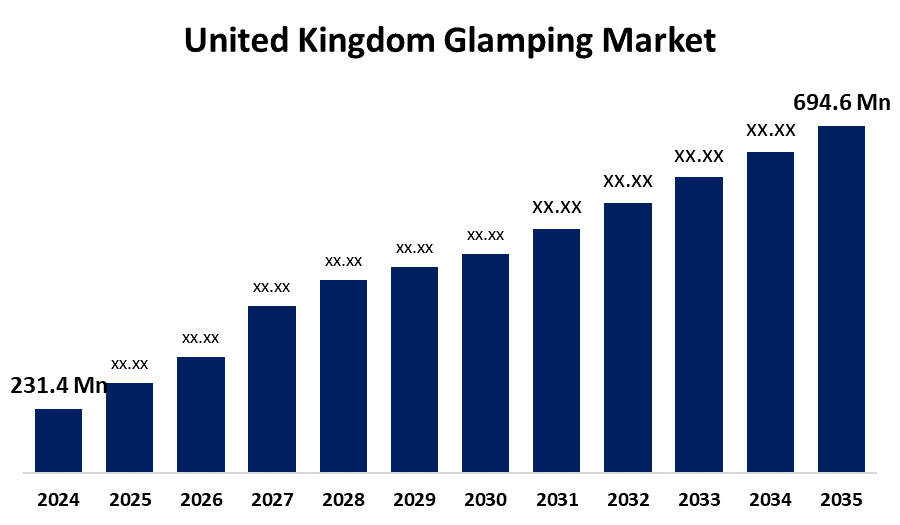

- The United Kingdom Glamping Market Size was estimated at USD 231.4 Million in 2024

- The Market Size is Expected to Grow at a CAGR of around 10.51% from 2025 to 2035

- The United Kingdom Glamping Market Size is Expected to Reach USD 694.6 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights and Consulting, The United Kingdom Glamping Market is anticipated to reach USD 694.6 Million by 2035, growing at a CAGR of 10.51% from 2025 to 2035. The increasing demand for sustainable tourism, increased disposable money, and the appeal of distinctive, upscale outdoor activities. Furthermore, glamping's appeal to a younger demographic who desire comfort and nature is driving market growth.

Market Overview

The UK glamping market refers to the industry focused on providing opulent camping experiences by fusing contemporary conveniences with outdoor pursuits. Combining the terms "glamorous" and "camping," glamping provides a more premium take on camping with distinctive lodging options such yurts, treehouses, safari tents, and pods. With extra amenities like comfortable mattresses, private bathrooms, and heaters, this market serves travelers eager to experience nature. It appeals to those seeking stress-free, environmentally responsible outdoor adventures without compromising comfort and luxury. premium outdoor experiences, ecotourism, and sustainable travel. Providers can benefit by targeting wealthy tourists, offering exclusive, themed glamping sites, and branching out into unknown regions with significant tourism potential as consumer demand for distinctive, nature-based vacations increases. The development of intelligent, solar-powered yurts, opulent treehouses with rapid connectivity, and adaptable tents with air conditioning and heating, among other sustainable and fully furnished options for accommodation. The experience for visitors is improved by these innovations while comfort and sustainability are preserved.

Report Coverage

This research report categorizes the market for the UK glamping market based on various segments and regions and forecasts revenue growth and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the UK glamping market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the UK glamping market.

United Kingdom Glamping Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 231.4 Million |

| Forecast Period: | 2025-2035 |

| Forecast Period CAGR 2025-2035 : | CAGR Of 10.51% |

| 2035 Value Projection: | USD 694.6 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 252 |

| Tables, Charts & Figures: | 119 |

| Segments covered: | By Accommodation Type and By Age Group |

| Companies covered:: | Bond Fabrications, The Glamping Orchard, Long Valley Yurts, Loose Reins, YURTCAMP DEVON, The Forge, Middle Lypiatt Glamping, Crafty Camping, Sawday’s Canopy & Stars Ltd., Wigwam Holidays Ltd, and Others |

| Pitfalls & Challenges: | COVID-19 Empact, Challenge, Future, Growth, & Analysis |

Get more details on this report -

Driving Factors

The increased consumer demand for eco-friendly and sustainable travel, an appreciation for uncommon and luxurious outdoor experiences, and a desire for socially distant vacations, particularly in the wake of the epidemic. Additionally, both younger and older groups have been drawn to glamping because to its growing popularity and advancements in technology, infrastructure, and lodging quality. The ability to blend luxury and nature appeals individuals who desire adventure, relaxation, and a respite from the city.

Restraining Factors

The high operating expenses, an abundance of suitable glamping locations, reliance on the weather, and competition from more conventional accommodations like hotels and resorts. Market expansion is further hampered by erratic restrictions and seasonal variations in demand.

Market Segmentation

The UK glamping market share is classified into accommodation type and age group.

- The cabins & pods segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK glamping market is segmented by accommodation type into cabins & pods, tents, yurts, and treehouses. Among these, the cabins & pods segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. The segment growth is driven by tourists who require private, roomy, secure accommodations with upscale amenities. Customers that concerned regarding the environment will be drawn to their eco-friendly construction, which uses natural and recyclable materials to improve comfort while promoting sustainability and weather protection in outdoor environments.

- The 18-32 years segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The UK glamping market is segmented by age group into 18-32 years, 33-50 years, and 51-65 years. Among these, the 18-32 years segment held a significant share in 2024 and is expected to grow at a significant CAGR during the forecast period. This is because they have a strong connection for adventurous, nature-based vacations, and unusual travel experiences. Demand in this group is further fueled by social media impact and growing interest in luxury camping and ecotourism.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the UK glamping market along with a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborative analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

List of Key Companies

- Bond Fabrications

- The Glamping Orchard

- Long Valley Yurts

- Loose Reins

- YURTCAMP DEVON

- The Forge

- Middle Lypiatt Glamping

- Crafty Camping

- Sawday’s Canopy & Stars Ltd.

- Wigwam Holidays Ltd

- Others

Recent Developments:

- In September 2024, in the Cotswolds, Treedwellers introduced a collection of luxury treehouse accommodations, offering guests a unique blend of modern amenities and immersive natural settings. These structures are designed to appeal to travelers seeking high-end, nature-centric retreats.

Key Target Audience

- Market Players

- Investors

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at UK, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the UK glamping market based on the below-mentioned segments:

UK Glamping Market, By Accommodation Type

- Cabins & Pods

- Tents

- Yurts

- Treehouses

UK Glamping Market, By Age Group

- 18-32 Years

- 33-50 Years

- 51-65 Years

Need help to buy this report?