United Kingdom Geopipes Market Size, Share, and COVID-19 Impact Analysis, By Product (High-Density Polyethylene (HDPE), Polyvinyl Chloride (PVC), Polypropylene (PP), and Others), By Application (Drainage & Sewer, Irrigation & Agriculture, Road & Highway Construction, Mining & Industrial, Oil & Gas Pipelines, and Others), and UK Geopipes Market Insights, Industry Trend, Forecasts to 2035

Industry: Chemicals & MaterialsUnited Kingdom Geopipes Market Forecasts to 2035

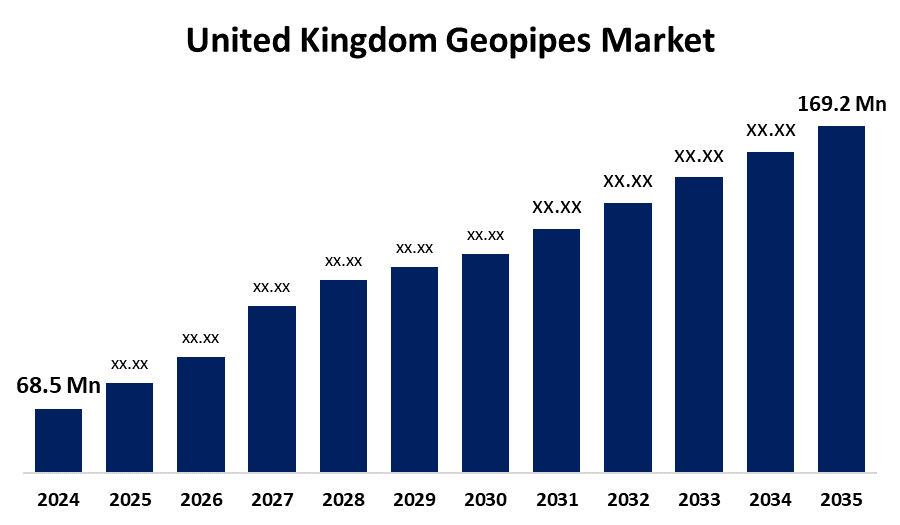

- The United Kingdom Geopipes Market Size Was Estimated at USD 68.5 Million in 2024

- The UK Geopipes Market Size is Expected to Grow at a CAGR of around 8.57% from 2025 to 2035

- The UK Geopipes Market Size is Expected to Reach USD 169.2 Million by 2035

Get more details on this report -

According to a research report published by Spherical Insights & Consulting, the UK Geopipes Market is anticipated to reach USD 169.2 million by 2035, growing at a CAGR of 8.57% from 2025 to 2035. Growing infrastructure development, increased need for corrosion-resistant piping solutions, and growing industrial and water management applications are the main factors propelling the market's expansion.

Market Overview

The UK geopipes market refers to, made from HDPE and PVC, which have become a preferred material for sustainable infrastructure due to their resistance to corrosion, flexibility, and affordability. Elements of polymer science have made these products suitable for drainage, sewage, and industrial use. Increasingly stringent environmental regulations and our desire to produce eco-friendly and reusable materials have contributed to the rise in the use of these products in mining, agriculture, and oil & gas.

The increasing need for environmentally friendly infrastructure, particularly in the fields of civil engineering and construction, is propelling the use of geopipes as a greener substitute for conventional piping systems. Due to its low maintenance requirements and long lifespan, geopipes are made of materials that are resistant to corrosion. Industries are employing geopipes more frequently to achieve operational and environmental objectives as a result of the UK's initiatives to lower carbon emissions and encourage green building practices. The popularity of geopipes has increased due to technological advancements in construction, especially trenchless installation techniques, which minimise disturbance and lower labour costs. These developments make them more appropriate for both new construction and infrastructure upgrades. As building methods and material science continue to advance, geopipes are becoming more affordable and adaptable, with adoption across various sectors, including municipal infrastructure, Irrigation & Agriculture facilities, and residential developments.

Report Coverage

This research report categorizes the market for the UK geopipes market based on various segments and regions and forecasts revenue growth and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the United Kingdom geopipes market. Recent market developments and competitive strategies such as expansion, product launch, and development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the United Kingdom geopipes market.

United Kingdom Geopipes Market Report Coverage

| Report Coverage | Details |

|---|---|

| Base Year: | 2024 |

| Market Size in 2024: | USD 68.5 Million |

| Forecast Period: | 2024-2035 |

| Forecast Period CAGR 2024-2035 : | 8.57% |

| 2035 Value Projection: | USD 169.2 Million |

| Historical Data for: | 2020-2023 |

| No. of Pages: | 160 |

| Tables, Charts & Figures: | 160 |

| Segments covered: | By Product, By Application and COVID-19 Impact Analysis. |

| Companies covered:: | Geosynthetics Limited, ABG Ltd., Terram, Rouden Pipetek, TenCate Geosynthetics, HUESKER, Officine Maccaferri, GSE Environmental, Thrace Group and Others |

| Pitfalls & Challenges: | Covid 19 Impact Challanges, Future, Growth and Analysis |

Get more details on this report -

Driving Factors

Infrastructure developments within the UK are one of the key drivers for the growth of the geopipes market. Several industries are using geopipes, including oil and gas, transportation, and water management. To develop solid pipeline networks to improve infrastructure for gas distribution, sewer runoff management, and delivery of water, governments from all over the UK are placing a significant amount of emphasis on development. Geopipes made of high-density polyethylene (HDPE) can be used for infrastructure development since they demonstrate high strength and chemical resistance to corrosion. This enhances ideals surrounding sustainable development projects. Sustainable development is well-regarded as geopipes are environmentally friendly. Geopipes will prove beneficial to sustainable development agendas, and energy efficiency and sustainability will also be instrumental in the market growth.

Restraining Factors

In many infrastructure projects, concrete and PVC pipes are preferred because of their lifespan and cost. They are durable. Metal or reinforced concrete pipes are suitable for many applications due to their high structural strength and residual pressure resistance. The main reasons for the popularity of reinforced concrete and concrete pipes are superior mechanical properties, including capabilities both in structural capacity and environmental resistance. These factors hamper the geopipes market during the forecast period.

Market Segmentation

The United Kingdom geopipes market share is classified into product and application.

- The high-density polyethylene (HDPE) segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom geopipes market is segmented by product into high-density polyethylene (HDPE), polyvinyl chloride (PVC), polypropylene (PP), and others. Among these, the high-density polyethylene (HDPE) segment held the largest market share in 2024 and is expected to grow at a significant CAGR during the forecast period. It's impressive durability, corrosion resistance, and low cost for a variety of applications. HDPE pipes are being used more and more because it is strong, flexible, and durable in a variety of industries, including construction, wastewater management, and agriculture. This makes it great for underground plumbing systems and infrastructure development.

- The drainage & sewer segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period.

The United Kingdom geopipes market is segmented by application into drainage & sewer, irrigation & agriculture, road & highway construction, mining & industrial, oil & gas pipelines, and others. Among these, the drainage & sewer segment held the highest revenue market share in 2024 and is expected to grow at a significant CAGR during the forecast period. Increased infrastructure growth, urbanisation, and the demand for effective wastewater treatment are increasing. The need for drainage and sewer piping systems that are durable, corrosion-resistant, and affordable increased as urban populations expanded. Geopipes are increasingly taking the overall longer life, better chemical resistance, and lightweight over traditional options such as metal and concrete.

Competitive Analysis:

The report offers the appropriate analysis of the key organizations/companies involved within the United Kingdom geopipes market and a comparative evaluation primarily based on their product offering, business overviews, geographic presence, enterprise strategies, segment market share, and SWOT analysis. The report also provides an elaborate analysis focusing on the current news and developments of the companies, which includes product development, innovations, joint ventures, partnerships, mergers & acquisitions, strategic alliances, and others. This allows for the evaluation of the overall competition within the market.

Recent Developments:

• In March 2025, REHAU introduced nevoPP, the UK’s first 100% climate-neutral plastic sewer system. Manufactured entirely from recycled high-quality polypropylene, nevoPP reduces Carbon Dioxide emissions by approximately 360 tonnes per 50 km installed equivalent to the annual emissions of about 75 average UK homes. This reduction has been independently verified by TÜV Rheinland.

Key Target Audience

- Investors

- Market players

- End-users

- Government Authorities

- Consulting and Research Firm

- Venture capitalists

- Value-Added Resellers (VARs)

Market Segment

This study forecasts revenue at United Kingdom, regional, and country levels from 2020 to 2035. Spherical Insights has segmented the United Kingdom geopipes market based on the below-mentioned segments:

United Kingdom Geopipes Market, By Product

- High-Density Polyethylene (HDPE)

- Polyvinyl Chloride (PVC)

- Polypropylene (PP)

- Others

United Kingdom Geopipes Market, By Application

- Drainage & Sewer

- Irrigation & Agriculture

- Road & Highway Construction

- Mining & Industrial

- Oil & Gas Pipelines

- Others

Need help to buy this report?